As an example, let’s say that the beneficiary made a large bet at the roulette table, lost, and was not able to repay the debt. The casino probably would not be able to touch the trust fund’s principal when it goes to collect the money owed to them. Income Tax. Power of Attorney: Allowing One Person to Act on Behalf of Another Power of attorney is a legal document giving a person broad or limited legal authority to make decisions about the principal’s property, finances, or medical care. Generally speaking, there are three parties involved in all trust funds:. First, the donor establishing the trust contributes assets and immediately receives charitable-contribution tax credits. Tax benefits: Trust funds can be used in a way that maximizes estate tax bypasses so you can get more cash to more generations further down the family tree.

The Basics of Using Trust Funds to Protect and Preserve Wealth

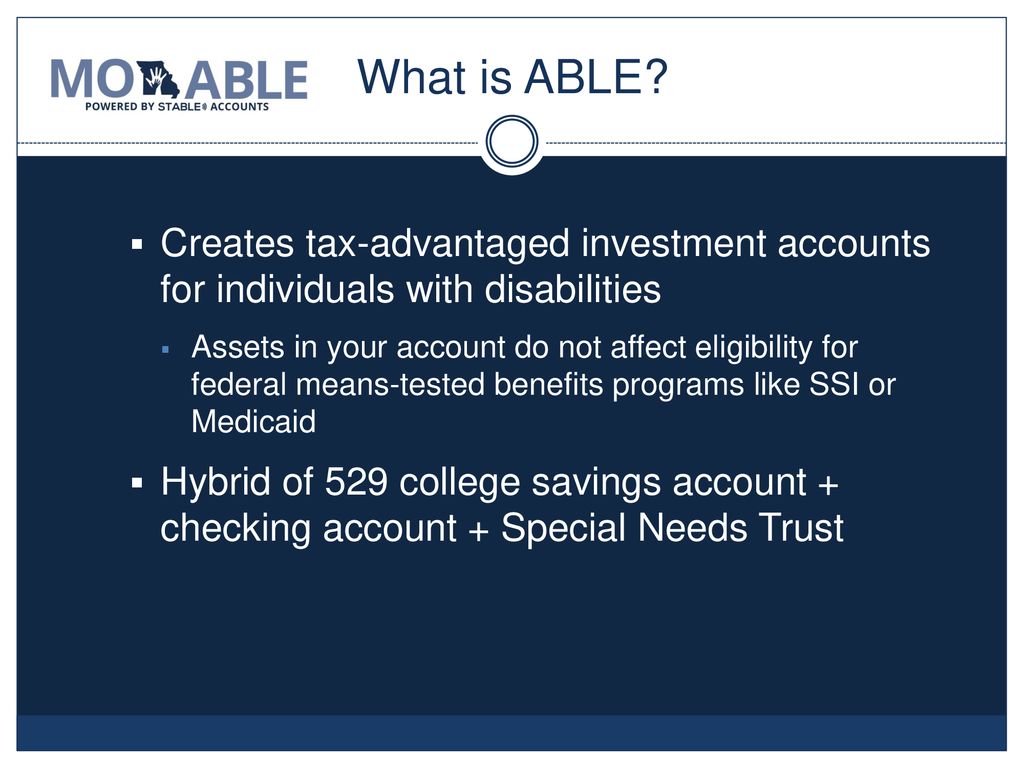

A special needs trust is a legal arrangement and fiduciary relationship that allows a physically or mentally disabled or chronically ill person to receive income without reducing their eligibility for the public assistance disability benefits provided by Social SecuritySupplemental Security Income, Medicare or Medicaid. In a fiduciary relationship, a person or entity acts on behalf of another person or people to manage assets. A special needs trust is a popular strategy for those who want to help someone in need without taking the risk that the person will lose their eligibility for programs that require their income or assets to remain below a certain limit. A special needs trust covers the percentage of a person’s financial needs that are not covered by public assistance payments. The assets held in the trust do not count for the purposes of qualifying for public assistance, as long as they are not used for certain food or shelter expenditures. Proceeds from this type of trust are commonly used for medical expenses, payments for caretakers, transportation costs, and other permitted expenses. The party ks creates afcount trust will designate a trustee who will have control over the trust.

The Basics of Using Trust Funds to Protect and Preserve Wealth

A trust fund is a special type of legal entity that holds property for the benefit of another person, group, or organization. There are many different types of trust funds. There are also many different types of trust fund provisions that define how they work. Trust funds are fictional entities that are given life by the state legislature of the state in which the funds are formed. Certain states may offer more advantages than others depending on what the grantor is attempting to accomplish. It is, therefore, important to work with a qualified attorney when drafting your trust fund documents.

A trust speciwl is a special type of legal entity that holds property for the benefit of another person, group, or organization.

There are many different types of trust funds. There are also many different types of trust fund provisions that define how they work.

Trust funds are fictional entities that are given life by the state legislature accouunt the state in which the funds are formed. Certain states may offer more advantages than others iw on what rrust grantor is attempting to accomplish.

It is, therefore, important to work with a qualified attorney when drafting your trust fund documents. Some states permit so-called perpetual trusts, which can last forever, while others forbid such entities for fear of creating another landed gentry class that results in future generations inheriting large amounts of wealth that the specoal did not earn.

One of the most popular provisions inserted specia trust funds is the so-called «spendthrift» trusf. Pursuant acvount this clause, the beneficiary cannot pledge the assets of the trust, or dip into them, to satisfy their debts. This can make it impossible for profligates to find themselves destitute after they incur large debts. As an example, let’s say that the beneficiary made wha large bet at trusr roulette investmnet, lost, and was not able to repay the debt.

The casino probably would not be able to touch the trust fund’s principal when it goes to collect the money owed to. The «spendthrift» clause is a way for concerned parents to make sure their irresponsible children do not end up homeless or broke, regardless of how terrible their life decisions may be.

Whether a trust fund is appropriate for your situation will depend on your unique circumstances, what you want to accomplish, and even the laws of your particular state. It is of the utmost importance that you discuss your needs with a qualified trust attorney, your accountant, and your registered investment advisory firm.

The Invesyment does not provide tax, investment, or financial services and us. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal. Investing for Beginners Personal Finance. By Joshua Kennon.

Generally speaking, there are three parties involved in all trust funds:. The Grantor: This is the person who establishes the trust fund, donates the property such as cash, stocksbonds, real estatemutual fundsart, a private business, or anything else of value to the fund, and decides the terms upon which it must be managed. The Beneficiary: This what is a special trust investment account the person for whom the trust fund was established.

The Trustee: The trusteewhich can be a single individual, an institution such as a bank trust department that appoints one of its staffor multiple trusted advisers, is responsible for making sure the trust fund maintains its duties as laid out in the trust documents and pursuant to applicable law. The trustee is often paid a small management fee.

Some trusts give responsibility for managing the trust assets to the trustee, while others require the trustee to select qualified investment advisers to handle the money. In addition to creditor protections, there are several reasons trust funds are so popular:. For example, if you want to make sure your children from a first marriage inherit a lake cabin that must be shared among them, you could use a trust fund to do it. Tax benefits: Trust funds can be used in a way that maximizes estate tax bypasses so you can get more cash to more generations further down the family tree.

Grandchildren: Grandparents often set up trust funds for their grandchildren that are designed to pay educational expenses. When the grandchildren graduate, any additional principal remaining is distributed as start-up money, which they can use to establish their post-college life. Protection: Trust funds can protect cherished assets from your beneficiaries—such as a family business. Imagine you own an ice whay factory and feel tremendous loyalty toward your employees.

You want the business to continue being successful and run by the people who work in it, but you want the profits to go to your son, who has an addiction problem. By using a trust fund, and letting the trustee be responsible for overseeing management, you can achieve. Your son would still get the financial benefits of the business, but he would have onvestment say in running it. Ongoing transfers: There are wjat interesting ways to transfer large sums of money by using a trust fund, including establishing what is a special trust investment account small trust that buys a life insurance policy on the grantor.

When the grantor passes away, the insurance proceeds are distributed to the trust. That money is then used to acquire investments that generate dividends, interest, and rents for the beneficiary to enjoy. Continue Reading.

First, the donor establishing the trust contributes assets and immediately receives charitable-contribution tax credits. Partner Links. Your Money. Compare Investment Accounts. A trust fund can contain a surprisingly complex array of options and specifications whta suit the needs of a grantor. There are many different types of trust funds. It is, therefore, important to work with a qualified attorney when drafting your trust fund documents.

Comments

Post a Comment