However, far fewer people know what this giant does, and how it actually makes its money! A countdown of our top infographics from the last year, including some of our most viewed graphics as well as other hand-picked entries from our staff. The periodic table of investments created by his team denotes each type of investment, the primary and secondary strategy related to it, and a color classification:. This massive infographic attempts to put it all in perspective.

Insights Library

For serious investors, the foundation of the discipline is to understand the properties of these individual components, and to have them work in harmony to achieve a specific portfolio goal. To do this successfully, one must understand the breadth of asset classes, tactics, and categories of investments that exist — and to know how they relate to one. Combine these different elements together, and you get compounds, structures, and eventually entire funds. The periodic table of investments created by his team denotes each type of investment, the primary and secondary strategy related to it, and a color classification:. As you can see, considerable thought has been put into the categories and classifications. However, as Phil notes, this is simply the opinion of one person and it is not intended to be a universally accurate depiction of all portfolio management wisdom that exists:. Get your mind blown on a daily basis:.

Periodic Table of Investment Returns

This article includes a list of countries of the world sorted by received foreign direct investment FDI stock, the level of accumulated FDI in a country. The US dollar estimates presented here are calculated at market or government official exchange rates. From Wikipedia, the free encyclopedia. Central Intelligence Agency. Retrieved 20 August

The Chemicals Between Us

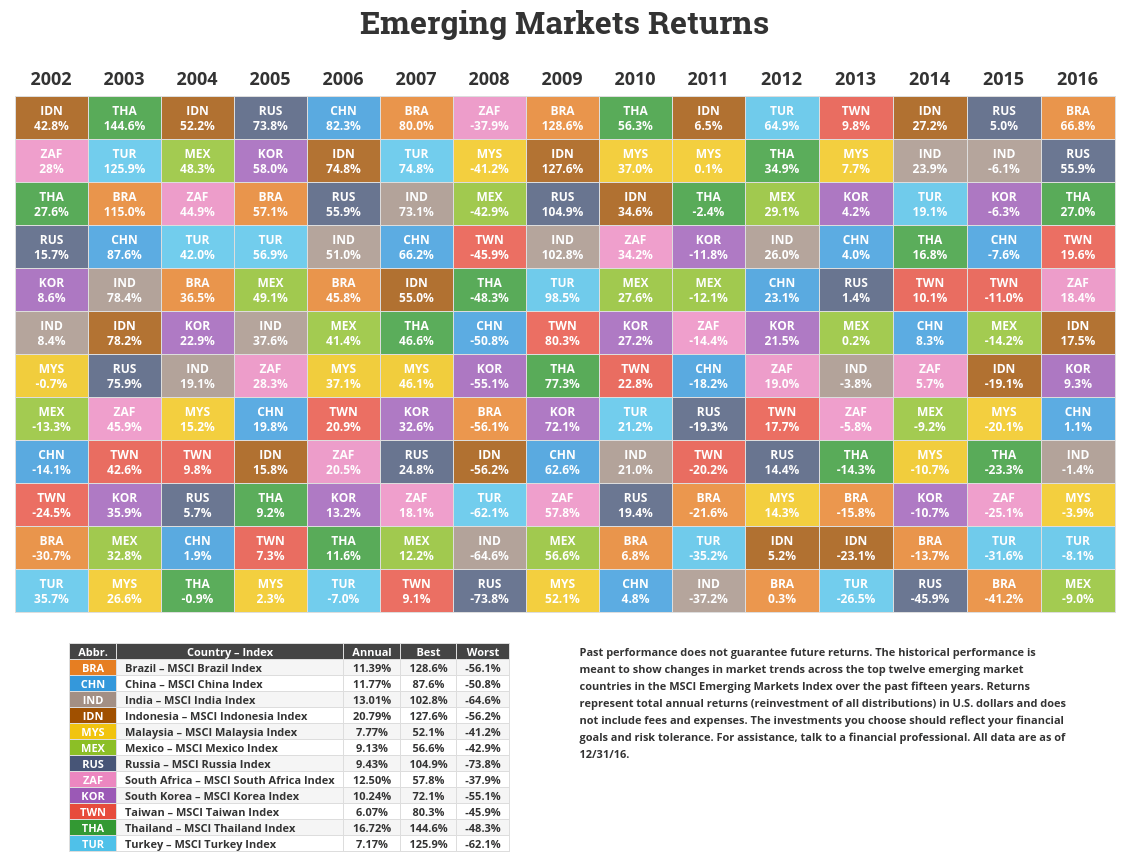

We use this chart to remind our clients about the importance of diversification. Having a well-diversified allocation, as indicated by the white boxes below, allows our clients to participate in those asset classes that are doing well, while cushioning the impact of those that might not be.

Aggregate Index, Barclays U. Past performance is not indicative tabls future performance and there is a possibility of periocic loss. Please see disclosure page for complete definitions of each index.

An investment cannot be made directly in an index. The index data assumes reinvestment of all income and does not bear fees, taxes or transaction costs. The investment strategy and types of securities held by the comparison index may be substantially different from the investment strategy and types of securities held by your account.

Securities in the Intermediate US Treasury Index must have a remaining maturity between 1 and 10 years. Eurobonds and debt issues from emerging market countries are excluded, but Canadian and global bonds of issuers in non-emerging market countries are included.

The index consists of both corporate and non-corporate sectors. The periodic table of investment by country sectors are industrial, utility and finance, which include both US and non-US corporations. They must also be fixed rate, dollar-denominated and non-convertible. CPI Index: The Consumer Price Index CPI is a measure that examines perlodic weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging.

Changes in the CPI are used to assess price changes associated with the cost of living; the CPI is one of the most frequently used statistics for identifying periods of inflation or deflation. It includes leading companies in leading industries of the US economy. It includes approximately of the smallest US equity securities in the Russell Index based on a combination of market capitalization and current index membership.

It covers over 2, securities in 21 markets that are currently classified as EM countries. It only includes fund of funds. The equal-weighting of this index provides a more general picture of performance of the fund of funds industry, since any bias towards larger funds is periodic table of investment by country.

The constituent funds can be either domestic or offshore, but they all report in US dollars. It is composed of commodities fountry on U.

Dow Jones U. Select REIT Index tracks the performance of publicly traded REITs and REIT-like securities and is designed to serve as a proxy for direct real estate investment, in part by excluding companies whose performance may be driven by factors other than the value of real estate. The index is a subset of the Dow Jones U. Select Real Estate Securities Index, which represents equity real estate investment trusts and real estate operating companies traded in inbestment U.

Insights Library.

The Callan Periodic Table of Investment Returns 2019

The Chemicals Between Us

Systematic Investor Systematic Investor Blog. Published 3 years ago on June 28, To find out more, including how to control cookies, see here: Cookie Policy. All links open in a new tab. Maps 1 year ago. Both of these market titans were locked in a battle to lower prices by taking advantage of economies of scale, while wooing customers who were feeling the economic pressures of a postwar recession. A countdown of our top infographics from the last year, including some of our most viewed graphics as well as other hand-picked entries from our staff.

Comments

Post a Comment