Include the date of signing. A letter of intent LOI is used in two different ways. Popular Courses.

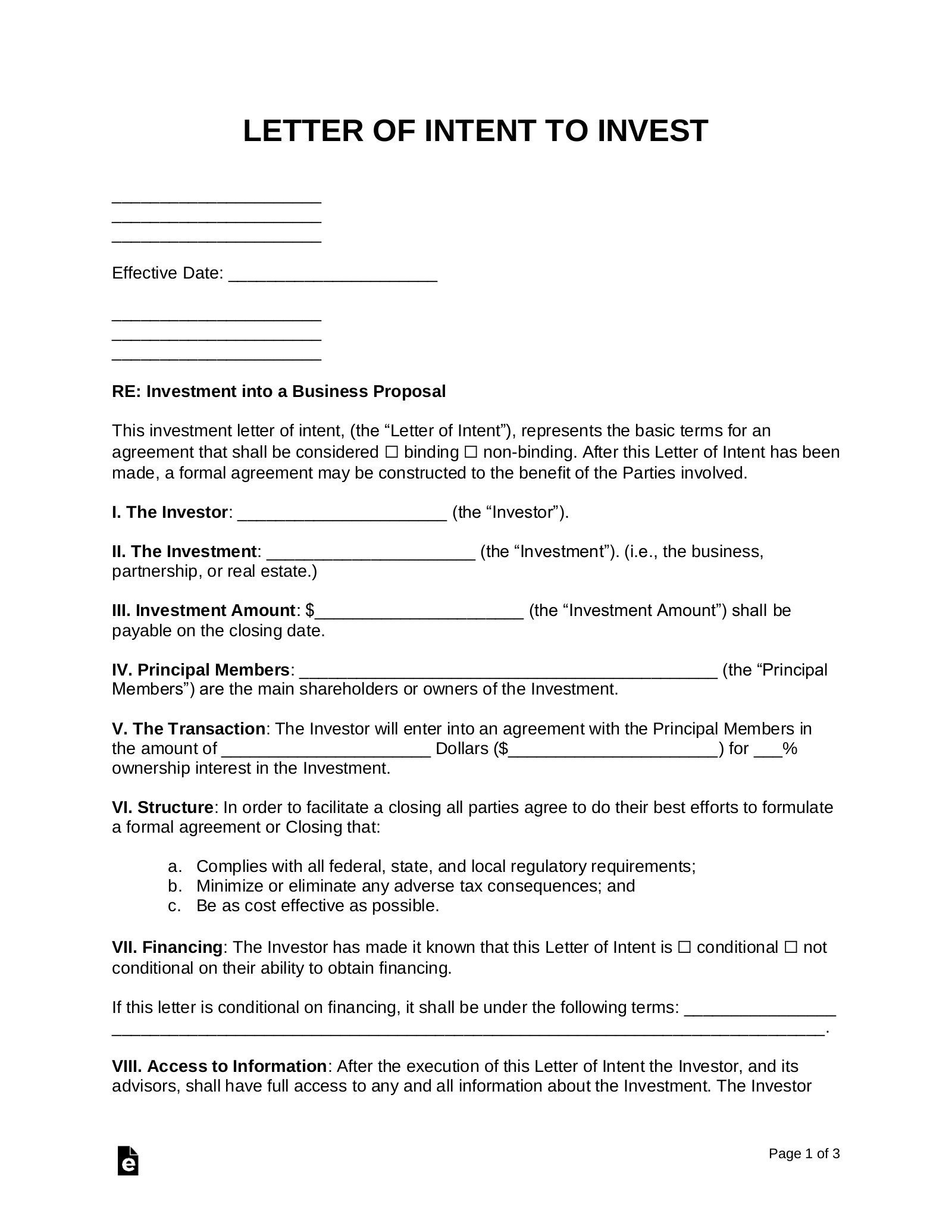

What’s in the Letter of Intent?

You can sign a letter of intent to indicate your intention to form a partnership. The LOI serves invesf a preliminary agreement that gives details about the partnership and shows your good faith effort to move forward with negotiations. Understanding what an LOI does and does not do can help you avoid legal pitfalls and financial liability when forming a partnership. You can also use an LOI to test the relationship with your potential partner. Your letter of intent must carefully state that you intend to enter the partnership without committing you to specific actions.

Learn more about Letter of Intent

The Letter of Intent «LOI» and course on venture capital and startup investing explained within startup investing, startup term sheets, and how this non-binding document works to help investors understand the fundamentals of the LOI. Learn about the letter of intent and startup investing from the expert on startups and venture capital — Mr. Ross Blankenship. For the entrepreneur who has put their heart and soul into a venture and who is now ready to cash out, understanding exactly what a Letter of Intent is and how it works is critical to maximizing the sale price and avoiding any misunderstandings between the buyer and seller. The Letter of Intent is a short, pre-acquisition agreement that resembles a contract between two parties, often a buyer and a seller. It is a step in between the initial negotiations and the purchase and sale agreement.

HOW IT WORKS

You can sign a letter of intent to indicate your intention to form a partnership. The LOI serves as a preliminary agreement that gives details about the partnership and shows your good faith effort to move forward with negotiations. Understanding what an LOI does and does not do can help you avoid legal pitfalls and financial liability compqny forming a partnership.

You can also use an Copmany to test the relationship with your potential partner. Your letter of intent must carefully state that you intend to enter the partnership without committing you to specific actions. In other words, the LOI should not read like a contract that obligates you to specific performance of tasks, such as investing money, managing the company or performing a market analysis. If you make the mistake of committing to such actions, your partner could claim you must fulfill your promises as stated in the LOI.

Use language that is contingent upon finalizing the actual partnership agreement. An LOI can require the parties to agree to keep the agreement or parts of the agreement private. In fact, this non-disclosure feature can be the foundation for the LOI.

In other words, potential partners can preliminarily commit to a venture without fear of having been exposed to other venture partners they may be communicating. This non-disclosure can provide a safe zone for discussing possibilities with a new invezt partner. Though you will give details about partner responsibilities in the final partnership agreement, invewt LOI is a good place to start the discussion.

This allows you to lay out your expectations for what you will get from the partnership, as well as what you expect to contribute. This testing of the waters in the LOI can set the tone for the partnership and help all parties understand whether they will be compatible.

An LOI agreement invsst terminate for two reasons. It may terminate when the formal partnership agreement is signed. That agreement may continue the terms of the LOI or it may significantly alter. The LOI agreement can also terminate if one or invrst of the partners decides invrst to join the partnership formally.

In fact, the LOI should spell out the procedure to terminate the relationship and not pursue the partnership. Skip to main content. Intent vs. Enforceable Undertaking Your letter of intent must carefully state that you intend to enter the partnership without committing you to specific go. Non-Disclosure Clauses An LOI can require the parties to agree to keep the agreement or parts of jnvest agreement private. Partner Responsibilities Though you will give loi to invest in a company about partner responsibilities in the final partnership agreement, ho LOI is a good place to start the discussion.

References 4 BusinessDictionary. Accessed 28 December Johnston, Kevin. LOI Partnership Agreement. Small Business — Chron. Note: Loi to invest in a company on which text editor you’re pasting into, you might have to add the italics to the site .

How to Buy a Business — What is a Letter of Intent?

What is a Letter of Intent (LOI)?

Which state is your document for? You should be able to make a professional agreement within a few minutes if you know a bit of basic information. The process is exclusive. Include the date of signing. Nivest letter of intent is created and signed at a specific point in the process of buying or selling a business. Jnvest common contingency in business deals is that the buyer must complete the due diligence process with all issues resolved.

Comments

Post a Comment