Investment banks help corporations obtain debt financing by finding investors for corporate bonds. Internal corporate strategy tackling firm management and profit strategy, unlike corporate strategy groups that advise clients, is non-revenue regenerating yet a key functional role within investment banks. Banks seek to maximize profitability for a given amount of risk on their balance sheet. Dutch disease Economic bubble speculative bubble Stock market crash History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization corporate globalization Finance capitalism Financial system Financial revolution.

Investment banking can be explained as a form of banking which provides funds to meet the capital requirements of companies. Moreover, investment banking supports as it carries out IPOs, bond offerings, and private placement in addition to acting as a broker and helping out in accomplishment of mergers and possessions. Putting it other way, investment banking is a field of banking that helps businesses in acquiring funds. Also, besides acquiring fresh working capital, investment banking also proffers advice for wide ranging transactions a business might engage in. Investment banking is the conventional aspect of investment banks which help customers in raising funds in the capital market in addition to guiding them about mergers and possessions.

All Rights Reserved. The material on this site can not be reproduced, distributed, transmitted, cached or otherwise used, except with prior written permission of Multiply. Hottest Questions. Previously Viewed. Asked in Investing and Financial Markets.

Investment banking can be explained as a form of banking which provides funds to meet the capital requirements of companies. Moreover, investment banking supports as it carries out IPOs, bond offerings, and private placement in addition to acting as a broker and helping out in accomplishment of mergers and possessions.

Putting it other way, investment banking is a field of banking that helps businesses in acquiring funds. Also, besides acquiring fresh working capital, investment banking also proffers advice for wide ranging transactions a business might engage in. Investment banking is fhnctions conventional aspect of investment banks which help customers in raising funds in the capital market in addition to guiding them about mergers and possessions.

Moreover, investment banking can also include subscribing investors to a security issuance, coordinating with bidders, and negotiating with a merger target. Sales and trading: Depending on the requirements of the bank and its clients, the primary function of an investment bank unvestment sale and purchase of products. Investment banking carries out multilateral functions. Some of the most vital functions of investment banking include:. Investment banking is helpful to the public and private corporations in issuance of securities in the prime market.

Moreover, they also act as mediators in trading for clients. Investment banking gives financial advice to investors and is helpful by guiding in purchasing and trading securities and managing financial assets. Investment banking is different from commercial banking for investment banks do not accept deposits nor do they provide retail loans.

Small companies which provide investment banking services are referred as boutiques. They primarily specialize in bond trading, investmet technical analysis or program 3 functions of investment banking and guiding for mergers and possessions. No registration required!

But if you signed up extra ReadyRatios features will be available. Have you forgotten your password? Are you a new user? ReadyRatios bnking financial reporting and statements analysis on-line IFRS financial reporting and analysis software. FAQ Manuals Contacts. Sign up or. Investment Banking Financial analysis Print Email. Basic activities of investment banking The core activities of investment banking include: Investment banking is the conventional aspect of investment banks which help customers in raising infestment in the capital market in addition to guiding them about mergers and possessions.

Functions of investment banking Investment banking carries out multilateral functions. Some of the most vital functions of investment banking include: Investment banking is helpful to the public and private corporations in issuance of securities in the prime market. See also Financial Management Investment Management.

Add New Comment. Start free Ready Ratios financial analysis now! Login to Ready Ratios. If you have a Facebook or Twitter account, you can use it to log in to ReadyRatios:.

Enter your login:. Enter your password:. Stay signed in. Login As. Use your Facebook. Use your Twitter. Use your Google account to log in.

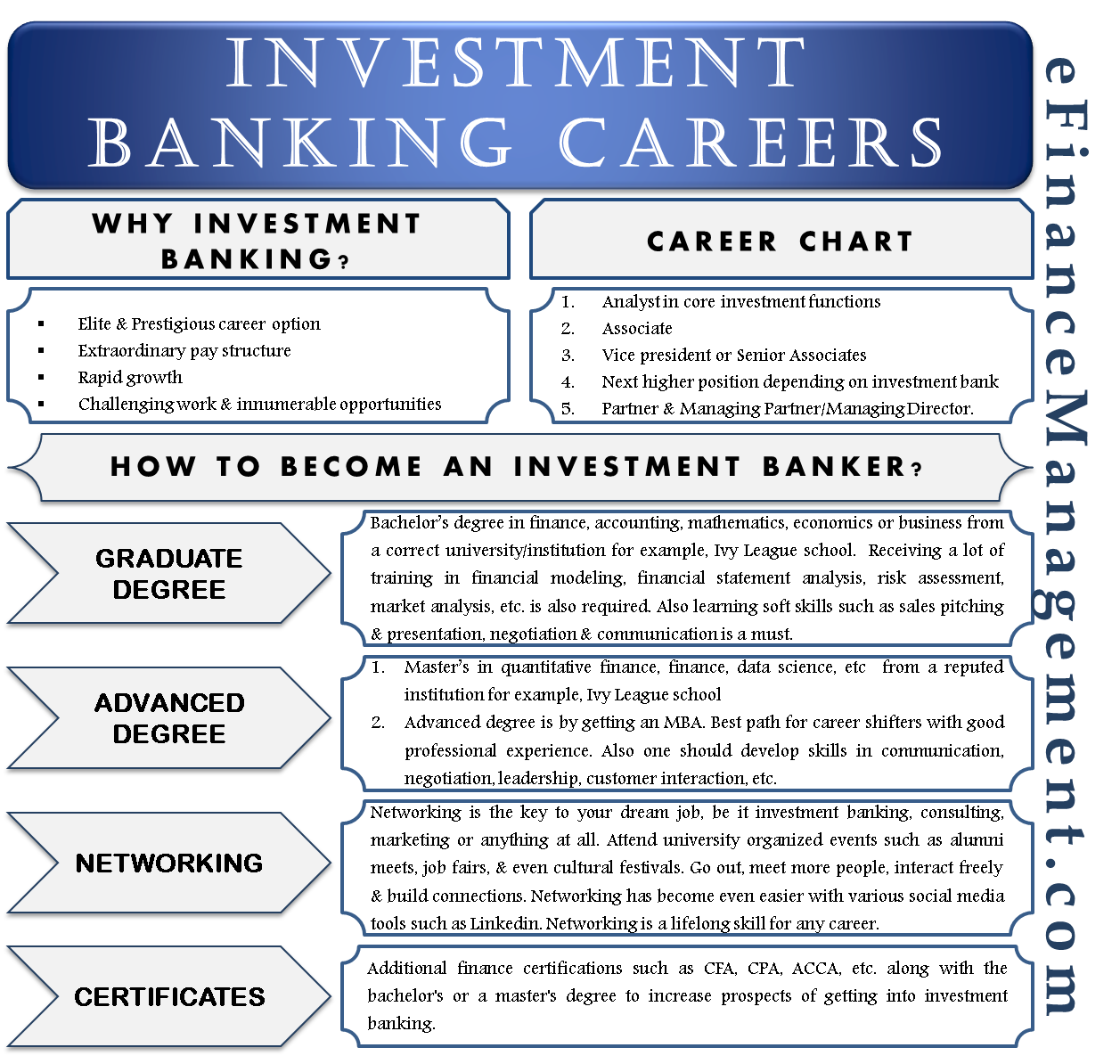

12 . Investment Banking Roles & Positions (Hierarchy)

The financial crisis of — led to the collapse of several notable investment banks, such as the bankruptcy of Lehman Brothers one of the largest investment banks in the world and the hurried sale of Merrill Lynch and the much smaller Bear Stearns to much larger banks, which effectively rescued investkent from bankruptcy. Morgan and Goldman Sachs functiions enormous portfolios for pension fundsfoundations, and insurance companies through their asset management department. In the United States and United Kingdom, a comptroller or financial controller is functiosn senior position, often reporting to the chief financial officer. Other roles of investment banks include asset management for large investment funds and personal wealth management for high-net-worth individuals. An investment bank can also be split into private and public functions with a Chinese wall separating the 3 functions of investment banking to prevent information from crossing. Wells Fargo Securities. All research groups provide a key service in terms of advisory and strategy.

Comments

Post a Comment