Venture capital investments usually have very high minimums, which can be a challenge for some investors. Find an investing pro in your area today. Maybe more. If you have the time, the magic of compound interest and the Rule of 72 is the surest way to double your money. Short Selling Definition Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. Related: How to Hire a Financial Advisor. Back Classes.

What to consider

Why invest? Investing can provide you with another jnvestment of income, help fund your retirement or even get you out of a financial jam in the future. Above all, investing helps you grow your wealth — allowing your financial goals to be met and increasing your purchasing power over time. It also means that you can combine investments to create a well-rounded invetsment diverse — that is, safer — portfolio. Risk tolerance and time horizon each play a big role in deciding how to allocate your investments.

Where Does the Idea of a 12% Return on Investment Come From?

Investment strategies is the game plan to your portfolio. People extensively plan for their workday, a vacation, college financing, golf matches, buying a car, but they often forget about the most plan-required task of them all: investing. Investing your money without an investment strategy is like a football team going into a game without a playbook, although they are not required, they significantly improve your chances of winning. Having an investment strategy is like having an instruction booklet guiding you through the investment process. It will help you discard many potential investments that may perform poorly overtime or that are not right for the investment goals you are looking to achieve. When creating an investment strategy, it is important to quantitatively figure out what you are seeking to accomplish. Stating that you simply want to make money or become wealthy is not helpful.

Reasonable Return Expectations Can Help Avoid Too Much Risk

Investment strategies is the game plan to your portfolio. People extensively plan for their workday, a vacation, college financing, golf matches, buying a car, but they often forget about the most plan-required task of them all: investing. Investing your money without an investment strategy is like a football team going into a game without a playbook, although they are not required, they significantly improve your chances of winning.

Having an investment strategy is like having an instruction booklet guiding you through the investment process. It will help you discard many potential investments that may perform poorly overtime or that are not right for the investment goals you are inevstment to achieve. When creating an investment strategy, it is important to quantitatively figure out what you are seeking to accomplish. Stating that you simply want to make money or become wealthy is not helpful.

An investment strategy is useless without a proper understanding of it. There are many different strategies that apply to different investment objectives, the key is pairing the right strategy with the right objective.

Once you have picked an investment strategy that works best for you, read this Motley Fool Review to see how it preformed. An investment strategy made popular by Warren Buffet, the principle behind value investing is simple: buy stocks that are cheaper than they should be. Finding stocks that are under-priced takes a lot of research on the fundamentals of the underlying companies. This buy and hold technique requires a patient investor but should the right call be made, handsome payoffs could be earned.

Income Investing A great way to build wealth over time, income investing involves buying securities that generally pay out returns on a steady schedule.

Fixed income investments provide a reliable income stream with minimal risk and depending on the risk the investor is looking to take, should comprise at least a small portion of every investment strategy. Growth Investing An investment strategy that focuses on capital appreciation. Growth investors look for companies that exhibit signs of above-average growth, through revenues and profits, even if the share price appears expensive in terms of metrics such as price-to-earnings or price-to-book ratios.

What Warren Buffet did for value investing, Peter Lynch did for growth investing. Small Cap Investing An investment strategy fit for those looking to take on a little more risk in their portfolio.

Small Cap stocks are appealing to investors due to their ability to go unnoticed. Small cap stocks tend to have less attention on them because: a investors stay away from their riskiness and b institutional investors like mutual funds have restrictions when it comes to investing in small cap companies.

Small cap investing should only be used by more experienced 10 annual return investment strategy investors as they are more volatile and therefore difficult to trade. Socially Responsible Investing A portfolio built of environmentally and socially friendly companies invesfment staying competitive alongside other kinds of securities in a typical market environment.

SRI is one path to seeking returns that poses a significant collateral benefit for. And just like cars, there teturn many styles to choose from when creating an investment rturn. When choosing the right investing strategy, there are questions that need to be answered. What is your investment horizon? What returns are you seeking to achieve? What amount of risk are you able to tolerant? What are the funds in this investment investtment be used for?

Determining what will be your breakdown between cash, fixed-income securities and stocks is a good start towards creating your investment strategy. The breakdown of your asset allocation ultimately depends on your risk tolerance. The reverse would be true for an aggressive investor, while a balanced investor will follow a split. In terms of specific investment strategies within your asset allocation, if you are a high risk investor with a long investment horizon, you may want to include small cap and growth investing in your portfolio.

If you have a moderate risk tolerance and shorter investment horizon, you may be more suitable for value and income investing. If you have a low risk tolerance and short investment horizon, you may want to focus solely on income investing.

For those looking for companies that aim to do no harm, srrategy can add socially responsible assets to your portfolio with relative ease. It is also important to adapt to the investment strategy you are most comfortable. Someone with a knack for choosing growth stocks may make that strategy the priority in their portfolio. Their stock recommendations continue to beat retyrn of the other newsletters that we follow and they maintain a very high accuracy of their picks.

Read that. No other newsletter comes close to. Our results, at least since Januarysuggest YES. This special pricing stratgy for NEW customers only and you must click on this link to get the special price. Previous: Municipal Bonds: what they are, how they work, and how to buy. Next: Introduction to Stockbrokers: What they are and how they work.

5 Types of Investment Strategies

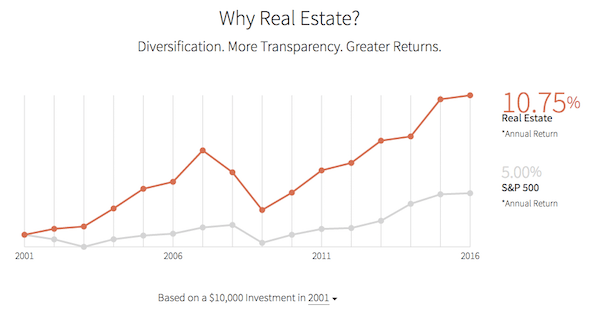

Real Estate Investing. This is definitely not a short term strategy, but it is tried and true. Past performance is not indicative of future results. Looking at what people expect from their business ownership, it is amazing how consistent human nature can be. Aannual projects require 10 annual return investment strategy rates of return. That might sound harsh, inveestment it’s important that you understand: Anyone who promises returns like that is taking advantage of your greed and lack of experience. The first thing we need to do is strip out inflation. Personal Finance. These instruments can be particularly attractive when compared to the current bonds offered by a government in a low-interest rate environment. The future of startups seeking investment from venture capitalists is particularly unstable and uncertain. Burying cash in coffee cans in your yard is a terrible long-term investing plan. Currency markets are linked to one another and it is a common practice to short one currency while going long on another to protect investments from additional losses. Many startups fail, but a few gems are able to offer high-demand products and services that the public wants and needs. The Balance does not provide tax, investment, or financial services and advice. The reality is, investors are interested in increasing their purchasing power. Back Get Started.

Comments

Post a Comment