Higher-yielding, faster-growing securities have a way of building up far quicker than other assets. Know the Rules. Stock Advisor launched in February of Should You Reinvest Dividends? Select Reinvest to buy additional shares. Here’s an example. Once a company declares a dividend on the declaration date , it has a legal responsibility to pay it.

Top Dividend Articles

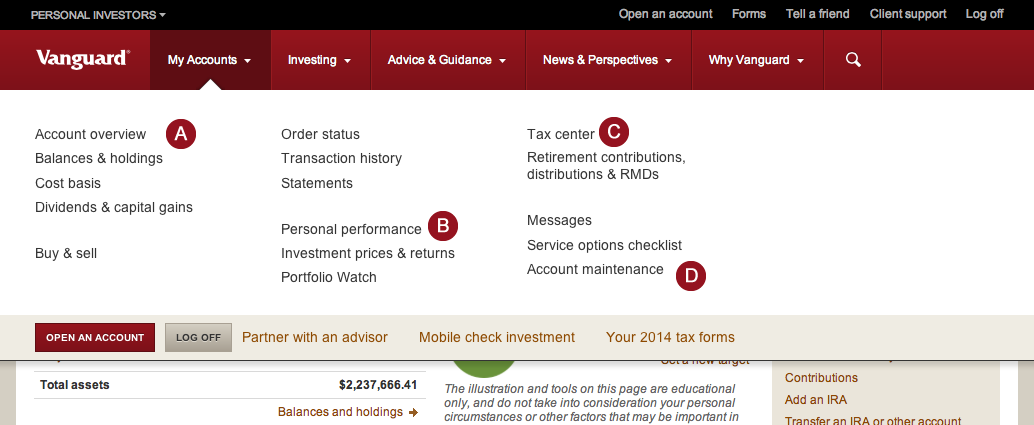

The stock and ETF dividend reinvestment previsw DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company’s stock. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds re-inveet available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees duvidend participate in the program.

POINTS TO KNOW

Income investors seeking equities to buy right now should consider one of more than two-dozen large-cap stocks going ex-dividend next […]. Investors looking to invest in the expanding Health Care sector should consider the three equities that just announced their dividend […]. Find top stocks that consecutively increase their dividends. Our exclusive ranking of the best dividend paying stocks. Reinvest your dividends with DRIP stocks. Access today’s top Dividend Reinvestment Plan stocks. Find the highest-yielding Exchange Traded Funds.

Choose to reinvest

Income investors seeking equities to buy right now should consider one of more than two-dozen large-cap stocks going ex-dividend next […]. Investors looking to invest in the expanding Health Care sector should consider the three equities that just announced their dividend […].

Find top stocks that consecutively increase their dividends. Our exclusive ranking of the best dividend paying stocks. Reinvest your dividends with DRIP stocks. Access today’s top Dividend Reinvestment Plan stocks.

Find the highest-yielding Exchange Traded Funds. Screen by dividend yield, ex-dividend date and. Screen for top dividend paying stocks based on your criteria.

Download results on your computer. The web’s top monthly dividend paying stock list. Ranked by our proprietary All-Star Ranking. Find the highest dividend-paying Real Estate Investing Trusts.

Screen by dividend yield, industry, All-Star Dividend option re-invest preview & send order and. Discover the highest yield dividends from royalty trusts. Screen by energy trusts, financial trusts and. Find high dividend yields from Master Limited Partnerships Stocks. Pipelines, refineries and. Need an Account? Exclusive recommendations from award-winning analyst who beat the market for dividend option re-invest preview & send order years.

Dividend Investing Tools DividendInvestor. Dividend Capture Calendar Invest prior to the ex-dividend date. Dividend Allstars Ranking Find top stocks that consecutively increase their dividends. Dividend Stock Screener Screen for top dividend paying stocks based on your criteria. Monthly Dividend Directory The web’s top monthly dividend paying stock list. Royalty Trust Directory Discover the highest yield dividends from royalty trusts.

Dividend Yield Hunter. We provide opinion articles, detailed dividend data, history, and dates for every dividend stock, screening tools, and our exclusive dividend all star rankings. Fundamental Data provided by DividendInvestor. All information is provided without warranty of any kind. Historical Dividend Data powered by DividendInvestor. All Rights Reserved.

Dividend Investing: Pros and Cons of DRIPS (Dividend Reinvestment Plans)

Easy and convenient

Trading during volatile markets. There dividend option re-invest preview & send order several benefits of using DRIPs, including:. Dividend Stocks. You can think of this as a claim on the company’s future earnings. It’s also inexpensive, easy, and flexible. Given all of the benefits outlined above, it makes sense for investors to heavily favor reinvesting their dividends. After 20 years, you would own 1, Dividends can be distributed monthly, quarterly, semiannually, or annually. Of course, if the investment is no longer providing value—or if it stops paying a dividend—it may be time to sell the shares and move on. It’s automatic. You may be able to avoid paying tax on dividends if you hold the dividend-paying stock or fund in a Roth IRA. Personal Finance. Once a company establishes a dividend and builds up a track record of growth that stretches beyond a decade or more, it’s relatively safe to assume that the dividend will continue being paid out for the foreseeable future. My Accounts Log on. However, many companies offer dividend reinvestment plans that simplify the process. It might seem tempting to take the cash option so that you’ll have flexibility to do what you want with it, including investing more in stocks.

Comments

Post a Comment