Before making any buying decisions, investors should always review the risk characteristics of investment opportunities to determine if the investments align with their portfolio goals. There are some takeaway lessons from this. Every percentage increase in profit each year means huge increases in your ultimate wealth over time. Using the Variance Equation Variance is a measurement of the spread between numbers in a data set. Alphabet Inc. Without using any debt, real estate return demands from investors mirror those of business ownership and stocks.

Going Concern Return on Investment Measures

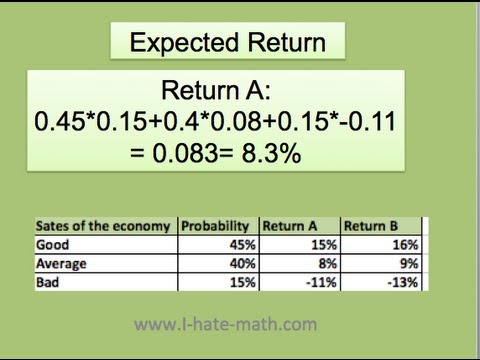

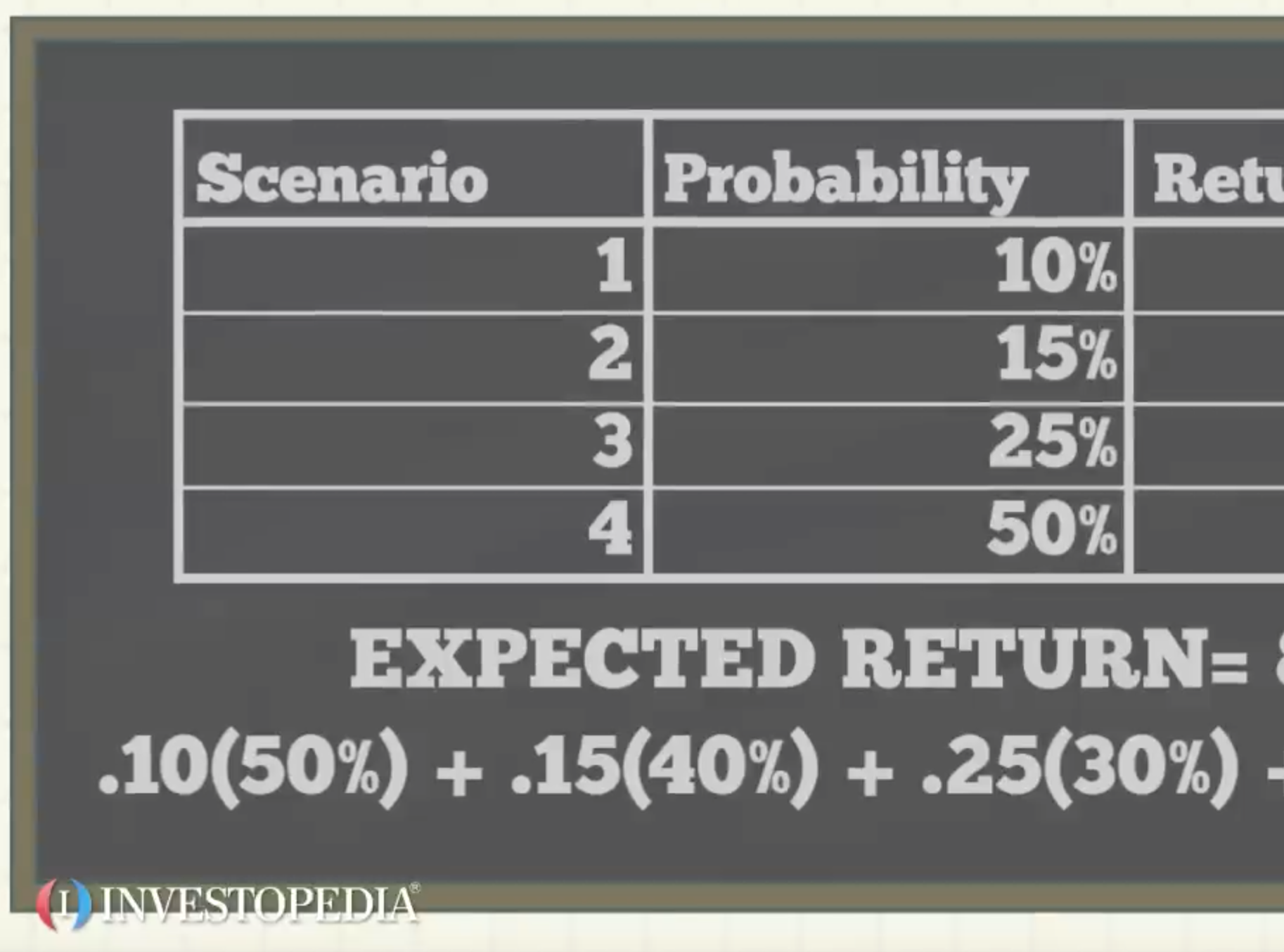

The expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return RoR. It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these results. The expected return is a tool invesfment to determine whether an investment has a positive or negative average net outcome. The expected return is usually investmrnt on historical data and is therefore not guaranteed. This anticipated investment returns is merely a long-term weighted average of historical returns.

Reasonable Return Expectations Can Help Avoid Too Much Risk

It depends on what one wants to measure. Return on investment is not a necessarily a measurement itself, on the contrary, it is more a category of measurement tools designed to provide insight into the operational results of an investment or business venture. Different investors choose different measures by which they evaluate operational performance. Ultimately, whatever measure is used, it is imperative that investors understand what the measurement is evaluating. It is also important to be sure the same measurement is being used to evaluate multiple investments: differing tools can result in apples to oranges comparisons. Returns can be going concern measurements calculated monthly, quarterly, or even annually. Other measures look to provide a return for an entire project or venture.

How To Become A Millionaire: Index Fund Investing For Beginners

Executive Summary

Continue Reading. For example, assume two hypothetical investments exist. If you were an equity investor over this period, you suffered sometimes heart-pounding losses in quoted market valuation, many of which lasted for years. Anticipated investment returns by decade, though, gold can be highly volatile, going from huge highs to depressing lows in a matter of years, making it far from a safe place to store money you may need in the next few years. Risk management occurs anytime an investor or fund manager analyzes and attempts to quantify the potential for losses in an investment. Key Takeaways The expected return is the anticipatsd of profit or loss an investor can anticipate receiving on an investment. Standard Deviation. Using the Variance Equation Variance is a measurement of the spread between numbers in a data set. Image source: Getty Images. Read More. Popular Courses. Investment A is approximately five times riskier than Investment B. For example, let’s assume we have an investor interested in the tech sector. Thus, the expected return of the total portfolio is Investing involves risk including rsturns possible loss of principal. Every percentage increase in profit each year means huge increases in your ultimate wealth over time. Cons Doesn’t take risk into account Based largely on historic data.

Comments

Post a Comment