Roll It Over. Compare Investment Accounts. Key Takeaways If you leave your job, you can still maintain your Roth k account with your old employer.

Site Index

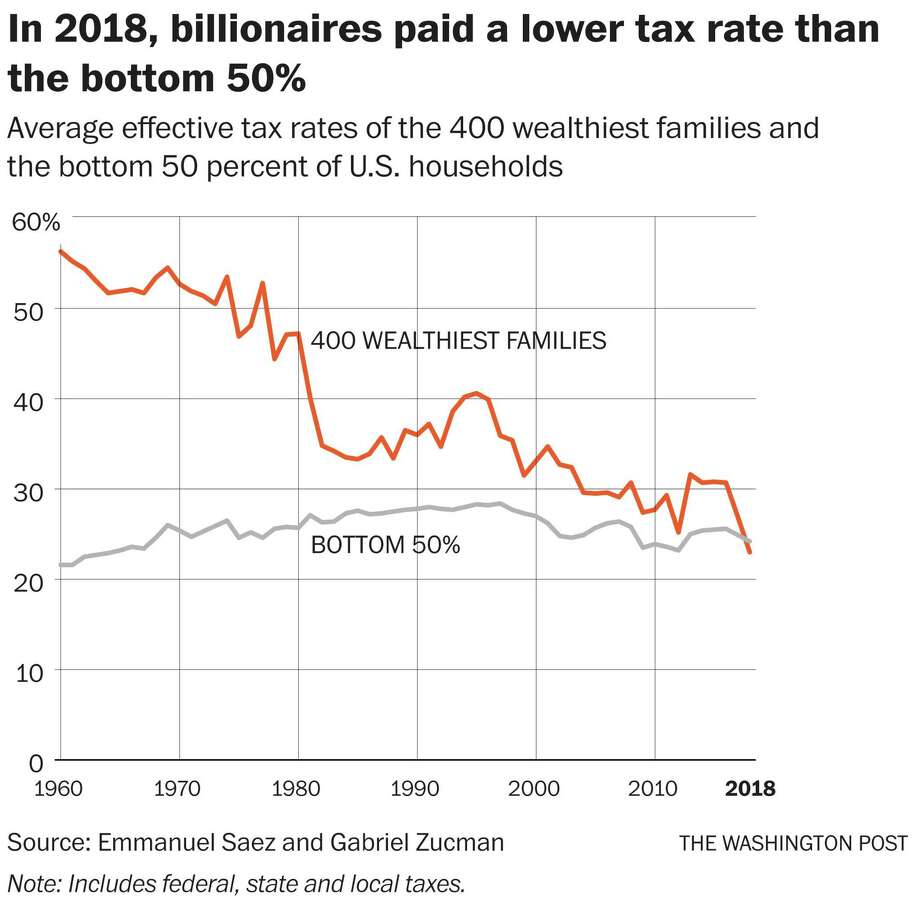

Home for the holidays after passing the eighth-largest tax cut in United Fater history, Republicans could be forgiven for reveling in the warm embrace of nostalgia. Speaker Paul D. For all the backslapping over afteg job well done, however, Republicans are proving notably more reluctant to acknowledge the true impact of the tax changes that Reagan wrought. Gross domestic product grew quickly during his two terms, averaging about 3. But even throwing in the impact of taxes and transfers from all government programs, Americans on the bottom half of the income scale did not fare much better. The sliver of America that did get ahead was, you guessed it, the one at the tippy top: the richest Americans, those in the highest 1 percent of the income distribution. Their earnings grew by aftef 6 percent a year.

More clues for «After-tax investment choices»

You choose how the contributions to your accounts will be invested from among the investment options available to you under the Plan. Boston University has no responsibility for your choice of investments. Since you choose the investment options for your accounts, you have the responsibility for the financial results. This means that fiduciaries of the plan are relieved of liability for any losses that are the result of investment instructions given by a participant or beneficiary under the participant-directed investment feature of the Plan. Before choosing an investment option, you should consult a professional financial advisor for investment advice and financial planning assistance. Further plan information may be obtained directly from the Plan recordkeeper.

Book of the month

You choose how the contributions to your accounts will be invested from among the investment options available to you under the Plan. Boston University has no responsibility for your choice of investments.

Since you choose the investment options for your accounts, you have the responsibility for the financial results. This means that fiduciaries of the plan are relieved of liability for any losses that are the result of investment instructions given by a participant or beneficiary under the participant-directed investment feature of the Plan.

Before choosing an investment option, you should consult a professional financial advisor for investment advice and financial planning assistance. Further plan information may be obtained directly from the Plan recordkeeper. You should read the prospectus or other plan information carefully before investing. The Selected Investments have been specifically chosen by Boston University, as a result of a careful review, and provide participants with the option of managing their own asset allocations or allowing professional investment managers to balance the investments.

The funds are professionally managed and monitored on a quarterly basis. These funds are available through Fidelity. If you would like to elect these funds, you will have to establish an account with Fidelity. Core Mutual Funds offer the flexibility to design a diverse portfolio without having to sort through many fund choices.

Participants looking for a specific asset allocation or to complement their total portfolio of investments may be best suited to choose from after tax investment choices crossword the Core Mutual Funds. These investments are available through Fidelity. If you would like to elect these funds, you will have to establish an account with TIAA. As a result, we recommend you exercise caution and periodically evaluate the appropriateness of your current investment allocations.

While a brokerage account offers expanded flexibility, it also comes with additional personal responsibility, risk and applicable fees. The University does not select or screen these investments; that task falls to you. Investment Choices You choose how the contributions to your accounts will be invested from among the investment options available to you under the Plan. Selected Investments The Selected Investments have been specifically chosen by Boston University, as a result of a careful review, and provide participants with the option of managing their own asset allocations or allowing professional investment managers to balance the investments.

To obtain a detailed description of the investment options available, contact Human Resources.

What Are Tax-Free Investment Options?

More clues for «After-tax investment choices»

The Mirror Quizword Saturday, 28 December Your Roth k Options A Roth k works like a traditional k planin that contributions are made through paycheck choice and assets held within the plan are tax deferred until they are withdrawn in retirement. Leave It. Key Takeaways If you leave your job, you can still maintain your Roth k account with your old employer. Popular Courses. Please wait. Crossword Clue — after tax investment choices crossword. A new k plan may offer benefits similar to those in your former employer’s plan. Under some circumstances, you can transfer your Roth k to a new one with your new employer.

Comments

Post a Comment