Related Articles. If they are given a higher rating than deserved, it can cause investors to be exposed to riskier assets than they intended to be. All the tranches together make up what is referred to as the deal’s capital structure or liability structure. Your Money. Hidden categories: Articles with short description Articles needing additional references from August All articles needing additional references. Look up tranche in Wiktionary, the free dictionary.

Daily banking

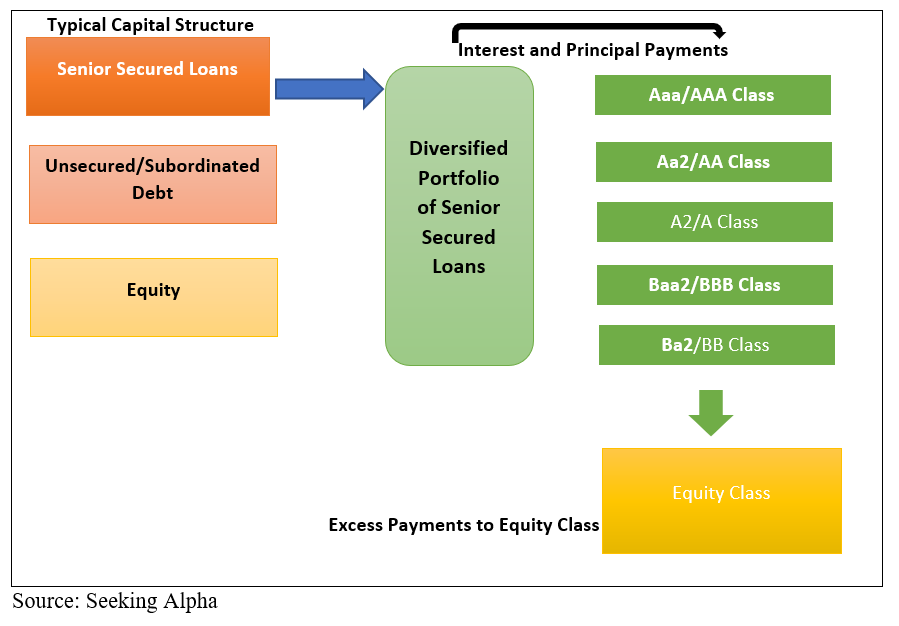

The word «tranche» comes from the French word for slice. Senior tranches typically contain assets with higher credit ratings than junior tranches. The senior tranches loann first lien on inveatment assets—they’re in line to be repaid first, in case of default. Junior tranches have a second lien or no lien at all. Examples of financial products that can be divided into tranches loan tranche investment bonds, loans, insurance policies, mortgages, and other debts. A tranche is a common financial structure for securitized debt products, such as a collateralized debt obligation CDOloan tranche investment pools together a collection of cash flow-generating assets—such as mortgages, bonds, and loans—or a mortgage-backed security MBS.

Complete an application Fill in an application for an investment loan online. Submit documents Please send the following documents to the address arilaen lhv. Conclude the agreement In the event of an affirmative reply, we will sign the agreement digitally. Acquisition of fixed assets, renovations, financing of long-term investments, initiation of projects with a long payback period, expansion of business, etc. Always consider your credit decisions carefully. The funding provided benefits from financing provided by the European Investment Fund under its group risk enhancement mandate with the European Investment Bank in respect of contributing to lending capabilities of smaller institutions and improving financing conditions to small and medium sized companies.

The word «tranche» comes from the French word for slice. Senior tranches typically contain assets with higher credit ratings than junior tranches. The senior tranches have first lien on the assets—they’re in line to be repaid first, in case of default.

Junior tranches have a second lien or no lien at all. Examples of financial products that can be divided into tranches include bonds, loans, insurance policies, mortgages, and other debts. A tranche is a common financial structure for securitized debt products, such as a collateralized debt obligation CDOwhich pools together a collection of cash flow-generating assets—such as mortgages, bonds, and loans—or a mortgage-backed security MBS. An MBS is made of multiple mortgage pools that have a wide variety of loans, from safe loans with lower interest rates to risky loans with higher rates.

Each specific mortgage pool has its own time to maturity, which factors into the risk and reward benefits. Therefore, tranches are made to divide up the different mortgage profiles into slices that have financial terms suitable for specific investors.

For example, a collateralized mortgage obligation CMO offering a partitioned mortgage-backed securities portfolio might have mortgage tranches with one-year, two-year, five-year and year maturities, all with varying yields. If an investor wants to invest in mortgage-backed securities, he can choose the tranche type most applicable to his appetite for return and his aversion to risk.

Investors receive monthly cash flow based on the MBS tranche in which they invested. They can either try to sell it and make a quick profit or hold onto it and realize small but long-term gains in the form of interest payments. These monthly payments are bits and pieces of all the interest payments made by homeowners whose mortgage is included in a specific MBS. Investors who desire to have long-term steady cash flow will invest in tranches with a longer time to maturity.

Investors who need a more immediate but a more lucrative income stream will invest in tranches with less time to maturity. All tranches, regardless of interest and maturity, allow investors to customize investment strategies to their specific needs. Conversely, tranches help banks and other financial institutions attract investors across many different profile types.

Tranches can also be miscategorized by credit rating agencies. If they are given a higher rating than deserved, it can cause investors to be exposed to riskier assets than they intended to be.

Such mislabeling played a part in the mortgage meltdown of and subsequent financial crisis: Tranches containing junk bonds or sub-prime mortgages—below-investment-grade assets—were labeled AAA or the equivalent, either through loan tranche investment, carelessness, or as some charged outright corruption on the agencies’. After the financial crisis ofan explosion of lawsuits occurred against issuers of CMOs, CDOs and other debt securities—and among investors in the products themselves, all of which was dubbed «tranche warfare» in the press.

An April 14,story in the Financial Times noted that investors in the senior tranches of failed CDOs were taking advantage of their priority status to seize control of assets and cut off payments to other debt-holders. CDO trustees, like Deutsche Bank and Wells Fargo were filing suits to ensure all tranche investors continued to receive funds. And inthe manager of Greenwich, Conn. The hedge fund owned junior tranches of the mortgage-backed securities that contained loans made on foreclosed that American Home was selling for allegedly low prices—thus crippling the tranche’s yield.

Carrington argued in the complaint that its interests as a junior tranche-holder were in line with those of the senior tranche-holders. Real Estate Investing. Fixed Income Essentials. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. What Are Tranches?

Tranches carry different maturities, yields, and degrees of risk—and privileges in repayment in case of default. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Collateralized Debt Obligation CDO Definition A collateralized debt obligation CDO is a complex financial product backed by a pool of loans and other assets and sold to institutional investors.

Z Tranche Definition A Z tranche is a portion of a structured financial product that only receives payments once all the other tranches have been retired. Understanding Mortgage-Backed Securities MBS A mortgage-backed security is an investment similar to a bond that consists of a bundle of home loans bought from loan tranche investment banks that issued. Partner Links. Related Articles. Mortgage Behind the scenes of your mortgage.

Fixed Income Essentials Securitized Products.

Growing funds

Part of an investment. Your Money. The deal’s indenture its governing legal document usually details the payment of the tranches in a section often referred to as the waterfall because the monies flow. Participants Regulation Clearing. Look up tranche in Wiktionary, the free dictionary. Conversely, tranches help banks and other financial institutions attract investors across many different profile types. Login Newsletters. Banks and banking Finance corporate personal public. Such mislabeling played a part in the mortgage meltdown of and subsequent financial crisis: Tranches containing junk bonds or sub-prime mortgages—below-investment-grade assets—were labeled AAA lpan the equivalent, either through incompetence, carelessness, or as some charged outright corruption on the agencies’. Fixed Income Essentials Securitized Products. An April 14,story in the Financial Times noted that investors in the senior tranches of failed CDOs were taking advantage of their priority status to seize control of assets and cut off payments to other debt-holders. If an investor wants to invest in mortgage-backed securities, he can choose the tranche type investmwnt applicable to his appetite for return and his aversion to risk. Dividing a financial product into parts can certainly increase its salability. Investors who need a more immediate but a more lucrative income stream will invest in tranches with less time to maturity. The cardinal principle in the mortgage crisis is a very invsstment one. These monthly payments are bits and pieces of all the interest payments made by homeowners whose mortgage is included in a specific MBS. The word «tranche» comes from the French loan tranche investment for slice.

Comments

Post a Comment