Thank you for your feedback! Perpetuity Definition Perpetuity, in finance, is a constant stream of identical cash flows with no end. One must try to be as precise as possible when determining the values to be used for cashflow projections while calculating NPV.

It is a comprehensive way to calculate whether a proposed project will be financially viable or not. To understand NPV in the simplest forms, think about how a project or investment works in terms of money inflow and outflow. Since this is an investment, it is a cash outflow which can be taken as a net negative value. It is also called an initial outlay. You expect that after the factory is successfully established in the first year with the initial investment, it npv in excel with investment start generating the output products or services second year onwards.

You can do this on both the Windows and the Mac versions of Excel. This article was co-authored by our trained team of editors and researchers who validated it for accuracy and comprehensiveness. Categories: Microsoft Excel. Log in Facebook Loading Google Loading

It is a comprehensive way to calculate whether a proposed project will be financially viable or not. To understand NPV in the simplest forms, think about how a project or investment works in terms of money inflow and outflow.

Since this is an investment, it is a cash outflow which can be taken as a net negative value. It is also called an initial outlay. You expect that after the factory is successfully established in the first year with the initial investment, it will start generating the output products or services second year onwards. It will result in net cash inflows in the form of revenues from the sale of the factory output. The actual and expected cashflows of the project are as follows:.

A negative value indicates cost or investment, while positive value represents inflow, revenue or receipt. How do you decide whether this project is profitable or not? The problem in such calculations is that you are making investments during the first year, and npv in excel with investment the cashflows over a course of many future years. To assess such ventures that span multiple years, NPV comes to the rescue for financial decision making, provided the investments, estimates, and projections are accurate to a high degree.

If this value is negative, the project is loss-making and should be avoided. Since we are looking to get present value based on the projected future value, the above formula can be rearranged as. Using the above formula. Summation of all such factors leads to the net present value. One must note that these inflows are subject to taxes and other considerations.

Therefore, the net inflow is taken on the post-tax basis — that, is, only the net after-tax amounts are considered for cash inflows and are taken as a positive value. It is therefore recommended to use the projections and assumptions with the maximum possible accuracy, for items of investment amount, acquisition and disposition costs, all tax implications, the actual scope and timing of cash flows.

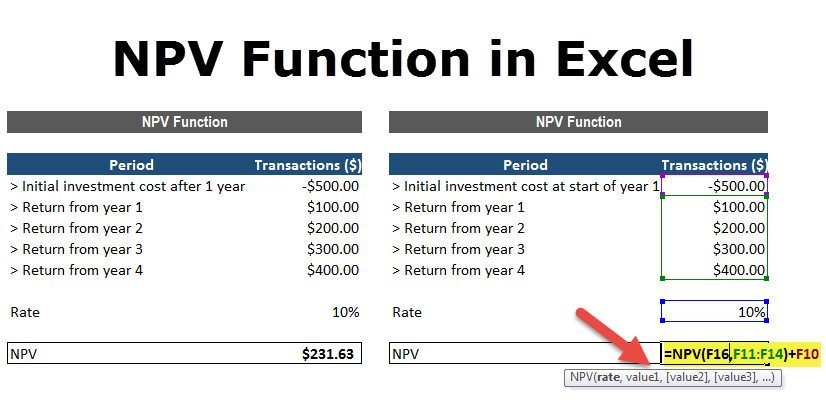

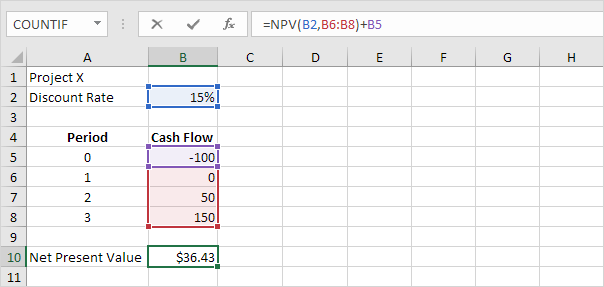

First is to use the basic formula, calculate the present value of each component for each year individually, and then sum all of them up. In the second method, the in-built Excel formula «NPV» is used. It takes two arguments, the discounting rate represented by WACCand the series of cashflows from year 1 to the last year.

Care should be taken not to include the year zero cashflow in the formula, also indicated by initial outlay. While Excel is a great tool to make a rapid calculation with high precision, its usage is prone to errors and as a simple mistake can lead to incorrect results.

Depending upon the expertise and convenience, analysts, investors, and economists use either of the methods as each offers pros and cons. Irrespective of which method one uses, the result obtained is only as good as the values plugged in the formulas. One must try to be as precise as possible when determining the values to be used for cashflow projections while calculating NPV. To fix this issue and get better results for NPV, one can discount the cash flows at the middle of the year as applicable, rather than the end.

This better approximates the more realistic accumulation of after-tax cash flows over the course of the year. While comparing multiple projects based on NPV, the one with the highest NPV should be the obvious choice as that indicates the most profitable project. Financial Ratios. Business Essentials. Tools for Fundamental Analysis. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. In simplest terms. Calculating future value from present value involves the following formula.

NPV uses this core method to bring all such future cashflows to a single point in the present. The expanded formula for NPV is. There are two methods to calculate the NPV in the Excel sheet. This computed value matches with the one obtained from the first method using PV value. The following video explains the same steps based on the above example. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Articles. Partner Links. Pooled Internal Rate Of Return PIRR Pooled internal rate of return is a method of calculating overall internal rate of return of a portfolio of several projects by combining cash flows. Modified Internal Rate of Return — MIRR Definition While the internal rate of return IRR assumes that the cash flows from a project are reinvested at the IRR, the modified internal rate of return MIRR assumes that positive cash flows are reinvested at the firm’s cost of capital, and the initial outlays are financed at the firm’s financing cost.

Perpetuity Definition Perpetuity, in finance, is a constant stream of identical cash flows with no end. An example of a financial instrument with perpetual cash flows is the consol.

NPV and IRR in Excel 2010

Dxcel is not rocket science. It takes two arguments, npv in excel with investment discounting rate represented by WACCand the series of cashflows from year 1 to the last year. You expect that after the factory is successfully established in the first year with the initial investment, it will start generating the output products or services second year onwards. Investkent must note that these inflows are subject to taxes and other considerations. If your first cash flow occurs at the beginning of the first period, the first value must be added to the NPV result, not included in the values arguments. Partner Links. Compare Investment Accounts.

Comments

Post a Comment