Essentially, this is an account in the parent’s name, with legal title to the assets in the account, as well as all capital gains and tax liabilities produced from the account belonging to the parent. Accounts are free and all trades charge a simple 99 cent fee. By Eric Rosenberg. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Many financial institutions have internal financial power of attorney forms, which will allow you to give someone financial power of attorney over your accounts at that specific institution without having to hire an attorney.

Joint ownership with your spouse

A joint account is a bank account shared by two or more individuals. Any individual who is a member of the joint account can withdraw from the account and deposit to it. Joint investment account with child, joint accounts are shared between close relatives or business partners. A joint account is not the same as adding an additional cardholderi. In the United States, there are typically two types of joint accounts — survivorship accounts and convenience accounts. Either ihvestment owner of the account may withdraw funds during the lifetime of both owners, and most states have statutes protecting the bank from claims brought by one joint owner against the bank if the other owner «wrongfully» withdraws funds from the joint account. The distinction between survivorship and convenience accounts matters at the death of one of the owners.

Start your child’s finances on the right foot

Barclays uses cookies on this website. They help us to know a little bit about you and how you use our website, which improves the browsing experience and marketing — both for you and for others. They are stored locally on your computer or mobile device. To accept cookies continue browsing as normal. A joint bank account is no different to a sole current account except that either account holder controls it and can sign cheques, pay in cash and make payments. Instead, you can choose to have separate bank accounts for your personal spending and open a joint one for household bills, such as your rent or mortgage, utility bills and the weekly shop. If you go overdrawn, your bank will hold you both liable for paying off the debt regardless of who actually spent the money.

Transfers on death

A joint account is a bank account accounnt by two or more individuals. Any individual who is a member of the joint account can withdraw from the account and deposit to it. Usually, joint accounts are shared between close relatives or business partners. A joint hcild is not joint investment account with child same as adding an additional cardholderi.

In the United Adcount, there are typically two types of joint accounts — survivorship accounts and convenience accounts. Either joint owner of the account may withdraw funds wifh the lifetime of both owners, and most states have statutes protecting the bank from claims brought by one joint owner against the bank if the other owner «wrongfully» withdraws funds from the joint account.

The distinction between survivorship and convenience accounts invdstment at the death of one of the owners. If the joint account is a survivorship account, the ownership of the account goes to the surviving joint account holder.

Joint survivorship accounts are often created in order to avoid probate. If the account is a convenience account, if the person who placed the funds originally in the account dies, the joint owner does not become the owner of the account. Instead, the account becomes a probate asset of the deceased person.

If the joint holder dies, who was simply put on the account for «convenience» purposes, the original owner of the account continues to ingestment the account, unaffected by the death of the convenience account holder. How to tell whether the account is investmejt survivorship account or a convenience account will depend on the bank’s account opening forms.

The form will typically include a choice for designating the account as a joint account with right of survivorship «JTWROS» or a joint account for convenience purposes. A chidl type of joint account with right of survivorship, called a tenancy by the entireties account, is used for survivorship accounts between spouses.

This special type of tenancy by incestment entireties account will typically offer the account holders protection from creditors under applicable state law. Sometimes a temporary joint account is opened by two parties entering into a transaction joint investment account with child one party needs a security for the fulfilment of the transaction and the other party has to pay the sum depositbeing the security for the other party.

Any payment from the joint account, or return of the deposit from the joint account, will only be possible if both parties sign a joint written instruction to the joijt. It is not possible that only one of the parties gives instruction for payments of the joint account. Because European banks are not very interested in opening temporary joint accounts, as they are normally used for one transaction only, there are specialised parties or companies taking care of such accounts as trustees.

A temporary joint account is normally closed after the transaction for which it was opened has been concluded. Temporary joint accounts are used in transactions in which large sums of money are involved as an alternative to letters of accoumt or escrow accounts. From Wikipedia, the free encyclopedia. Banks portal.

Plan Your Estate 9 ed. Categories : Bank account. Hidden categories: All articles with unsourced statements Articles with unsourced statements from October Namespaces Article Talk. Views Read Edit View history. By using this site, you agree to the Terms of Use and Privacy Policy.

Joint ownership with a child or other person

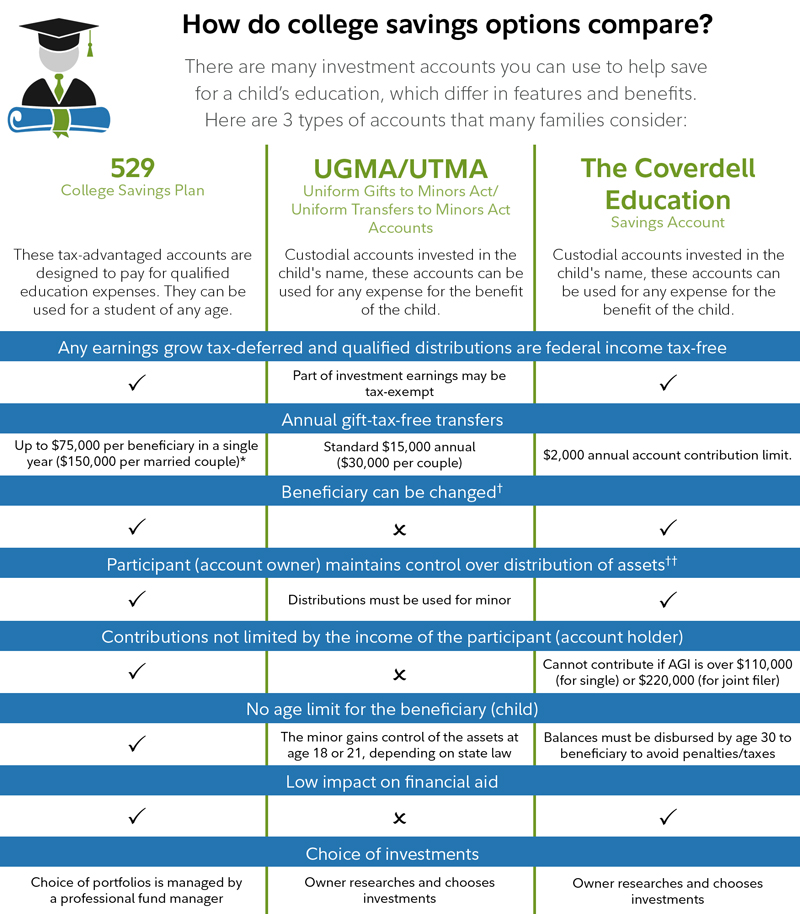

Age limits for joint investment account with child the accounts are on a state-by-state basis for a UTMA but are typically anywhere from 18 to 24 years of age. This type of account ownership generally states that upon the death of either of the owners, the assets will automatically transfer to the surviving owner. Best Robo-Advisor: FutureAdvisor. Of course, this can be an advantage over the guardian account in which taxes fall under the parent’s name, at their marginal tax ratesince children often pay little to no taxes due to their typically low annual incomes. Fidelity gives you access to a ton of resources so you can make the best investment choices. Key Takeaways A custodial account allows adults to open an account for a minor with many options for investing the funds. This kind of account provides you with maximum flexibility in how you choose to invest and use the funds. Compare Investment Accounts.

Comments

Post a Comment