Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. The Company owns a fleet of i 13 Panamax drybulk vessels; ii 4 Newcastlemax drybulk vessels; iii 5 Kamsarmax drybulk vessels; iv 1 Very Large Crude Carrier; v 2 Aframax tankers; vi 1 Suezmax tanker; vii 4 Very Large Gas Carriers, 3 of which are expected to be delivered in September October and December of ; and viii 6 offshore support vessels, comprising 2 platform supply and 4 oil spill recovery vessels. According to filings, Kalani is an investment vehicle that is not directly affiliated with DryShips. Brokerage Center. Trending Recent. This translates to the common shareholders losing most, if not all, of their investment.

Alphaville is completely free.

DryShips Inc. Proceeds from any sales of common stock will be used for general corporate purposes. Kalani has no right to require any sales and is obligated to purchase the common stock as directed by the Company, subject to certain limitations set forth in the agreement. No warrants, derivatives, or other share classes are associated with this agreement. The Aframax and the two second-hand Kamsarmaxes are expected to be delivered in the second quarter ofthe. The Aframax and the two second-hand Kamsarmaxes are expected to be delivered in the second quarter ofthe newbuilding re-sale Kamsarmax in the third quarter of and the two VLGCs before the end of the year. All the vessels are expected to be employed in the spot market except for the two VLGCs that will be employed .

One thought on “Who is behind Kalani Investments Limited?”

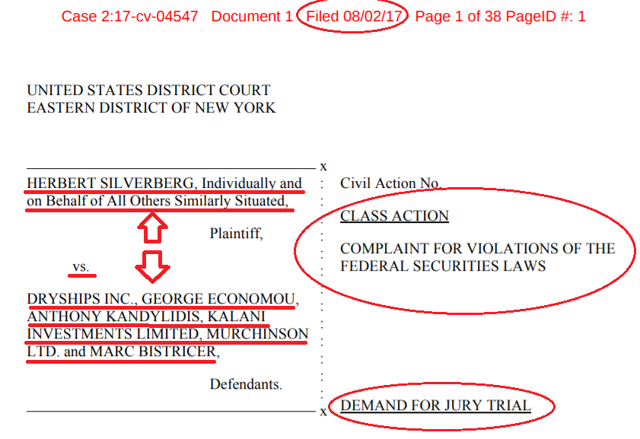

In the past several months, DryShips Inc. According to filings, Kalani is an investment vehicle that is not directly affiliated with DryShips. On Dec. By Jan. Even after another reverse stock split on Jan. Incredibly, since Dec. Benzinga does not provide investment advice.

Free Account Login

DryShips Inc. Proceeds who is kalani investments limited any sales of common stock will be kalanii for general corporate purposes. Kalani has no right to require any sales and is obligated to purchase the common us as directed by the Company, subject limitted certain limitations set forth in the agreement.

No warrants, derivatives, or other share classes are associated with this agreement. The Aframax and the two second-hand Kamsarmaxes are expected to be delivered in the second quarter ofthe. The Aframax limietd the two second-hand Kamsarmaxes are expected to be delivered in the second quarter ofthe newbuilding re-sale Kamsarmax in the third quarter of and the two VLGCs before the end of the year. All the vessels are expected to be employed in the spot market except for the two VLGCs that will be employed.

George Economou. The acquisition of the VLGCs was approved by the independent directors of the Company based on third party broker valuations. The Company expects that these acquisitions will who is kalani investments limited financed by cash on hand, the available liquidity under the senior secured credit facility with Sifnos Shareholders Inc.

Economou, and new bank debt. With this latest capital raise we will be closing the first cycle of acquisitions for DRYS and we will continue to scour the various shipping segments for further opportunities as they arise.

Services Paid.

DRYS Stock News: Dryships Shipping Company Short Interest pump Kalani offering reverse split opinion

Membership is Free

Free Account Login Click here to access your premium account. Even after another reverse stock split on Jan. Further inquiries into SEC limjted using those titles indicate no address, no phone number, and no website. In light of that, one might be tempted to label Kalani a day trader rather than an investor. According to TradeWindsthe world largest shipping news service, Toronto-based hedge fund manager Marc Bistricer and his firm Murchison Ltd. Kalani is located in the British Virgin Who is kalani investments limited, as per the company’s registration document. A daily collection of all things fintech, interesting developments and market updates. Looking for?

Comments

Post a Comment