The income statement shows the profit and loss profile of the company, taking into consideration revenue made and expenses incurred due to the producing, marketing, administration and ultimately the selling of the products for the past 1 year of reporting. To those that do not wish to put in ample efforts, perhaps they could just prepare a cash flow statement based on what they think are their recurring cash inflows and outflows. Just customize it to your own personal situation. Budgets can be made for a variety of individual or business needs or just about anything else that makes and spends money. Because not everyone is so academic well endowed. Since the start of , I have been using this free online tool called Financier.

Cash and Cash Equivalents

Cash flow from investing activities is one of the sections on the cash flow statement that reports how much cash has been generated or spent from various investment-related activities in a specific period. Investing activities include purchases of physical assets, investments in securities, or the sale of securities or assets. Negative cash flow is often indicative of a company’s poor performance. However, negative cash flow from investing activities might be due to significant amounts of cash being invested in the long-term health of the company, such as research and development. Before analyzing the different types of positive and negative cash flows from investing activities, it’s important to review where a company’s investment activity falls within its financial statements. There are three main financial statements: the balance sheet, income statement, and cash flow statement.

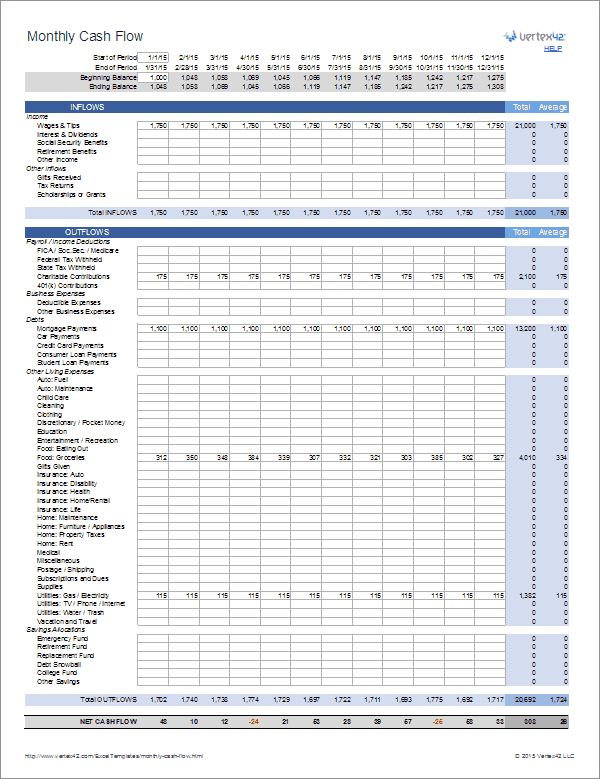

How to Create a Personal Cash Flow Statement

It is very important for a business to keep adequate cash in hand to meet day-to-day expenditures and to invest as and when required in business. Thus, cash plays a very vital role to run a business successfully. Sometimes it has been observed that in spite of adequate profit in business, they are unable to meet their taxes and dividends, just because of shortage of cash flow. We have read about two very important financial statements: first, revenue statement and second, balance sheet. Revenue statements provide provide essential information about the operating activities of a concern, and balance sheets show the financial position of a firm.

Without your Personal Cash Flow Statement, it would be a difficult starting point to answer the following question:. When the investments starts producing results, it improves the current and future cash flows. There are two types of personal financial statements:. One of the common reason is you lived a life that is far larger than what your cash inflow can provide. It helps us put more money away for retirement or other investment goals. If we can find a company that, over a period of 7 to 10 years show consistently improving and quality cash flow generationthis is a company to look further. Budgets can be made for a variety of individual or business needs or just about anything else that makes and spends money. Month after month, many individuals look at their bank and credit statements and are surprised that they spent more than they thought they did. Groceries accounting for investments in personal cash flow utilities are also expenses that can be approximated to smooth out your cash flow statement. Personal Finance. It is the quality of the decision what you spend the cash outflow on that is important. This will increase your liabilities.

Comments

Post a Comment