In addition, commercial property leases typically last longer than those of residential leases. Commercial real estate is property that is typically leased out for business and retail purposes. Commercial real estate investing , in particular, is known to provide some of the highest income streams. Unlike residential real estate, the income from commercial real estate is typically related to usable square footage.

Investing in real estate is one of the oldest forms of investing, having been around investjng the early days of human civilization. Predating modern stock markets, real estate leadn one of the five basic asset classes that every investor should seriously consider adding to his or her portfolio for the unique cash flow, liquidity, profitability, tax, and diversification benefits it offers. In this introductory guide, we’ll walk you through the basics of real estate investing, and discuss the different ways you might acquire or take ownership in real estate investments. Real estate investing is a broad category of operating, investing, and financial activities centered around making money from tangible property or cash flows somehow tied to a tangible property. The purest, simplest form of real estate investing is all about cash flow from rents rather than appreciation. Real estate investing occurs when the investor, also known as the landlord, acquires a piece of tangible property, whether that’s raw farmland, land with a house on it, land with an office building on it, land with an industrial learn real estate investing office buildings on it, or an apartment.

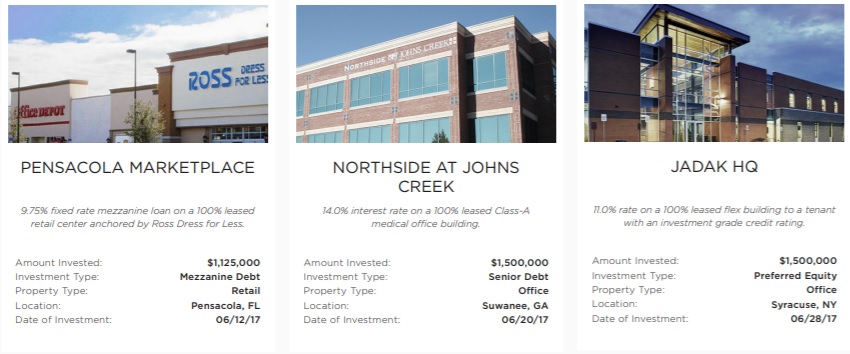

Investing in commercial real estate as an alternative asset is nothing new, but it’s still a mystery to many investors.

Improvement of realty property as part of a real estate investment strategy is generally considered to be a sub-specialty of real estate investing called real estate development. Real estate is an asset form with limited liquidity relative to other investments, it is also capital intensive although capital may be gained through mortgage leverage and is highly cash flow dependent. If these factors are not well understood and managed by the investor, real estate becomes a risky investment. Real estate markets in most countries are not as organized or efficient as markets for other, more liquid investment instruments. Individual properties are unique to themselves and not directly interchangeable, which presents a major challenge to an investor seeking to evaluate prices and investment opportunities. For this reason, locating properties in which to invest can involve substantial work and competition among investors to purchase individual properties may be highly variable depending on knowledge of availability.

Rental Income

When you think about buying real estatethe first thing that probably comes to mind is your home. But physical property can play a part in a portfolio too, especially as a hedge against the stock market. In this article, we’ll examine the leading options for individual investors, listed in approximate order of how direct a real estate investment they are, and reasons to invest.

This is an investment as old as the practice of land ownership. A person will buy a property and rent it out to a tenant. The owner, the landlord, is responsible for paying the mortgagetaxesand maintenance of the property. Ideally, the landlord charges enough rent to cover all of the aforementioned costs. A landlord may also charge more in order to produce a monthly profit, but the most common strategy is to be patient and only charge enough rent to cover expenses until the mortgage has been paid, at which time the majority of the rent becomes profit.

Furthermore, the property may also have learn real estate investing office buildings in value over the course of the mortgage, leaving the landlord with a more valuable asset. According to the U. Census Bureau, real estate in this country has consistently increased in value from to While there was a dip during the subprime mortgage meltdown of toit has now rebounded and has been increasing overall.

An investor must know the market in which he is searching for property or hire an expert to help. For investors seeking an income stream from rental properties, the most important aspects to consider are property location and market rental rates.

As for location, many successful rentals are located in close proximity to major schools. For example, if you buy a property near a state university, students are likely to want to rent it year after year. There are also many other features of a profitable rental propertyand some take time to learn. There are, of course, blemishes on the face of what seems like an ideal investment.

You can end up with a bad tenant who damages the property or, worse still, ends up having no tenant at all. This leaves you with negative monthly cash flowmeaning that you might have to scramble to cover your mortgage payments. There is also the matter of finding the right property. You will want to pick an area where vacancy rates are low and choose a place that people will want to rent. Once you’ve found an ideal property in an area where people want to rent, use a mortgage calculator to determine the total cost of the property with.

It’s also worth researching different mortgage types in order to secure a favorable interest rate for your rental. Perhaps the biggest difference between a rental property and other investments is the amount of time and work you have to devote to caring for it. If you don’t want to, you can hire a professional property manager. But his or her salary then becomes an expense that impact’s your investment’s profitability. This is the wild side of real estate investment. Like the day traders who are leagues away from a buy-and-hold investor, the real estate traders are an entirely different breed from the buy-and-rent landlords.

Real estate traders buy properties with the intention of holding them for a short period, often no more than three to four months, whereupon they hope to sell them for a profit. This technique is also called flipping and is based on buying properties that are either significantly undervalued or are in a very hot area. Pure property flippers will not put any money into a property for improvements; the investment has to have the intrinsic value to turn a profit without alteration, or they won’t consider it.

Flipping in this manner is a short-term cash investment. If a property flipper gets caught in a situation where he or she can’t unload a property, it can be devastating because these investors generally don’t keep enough ready cash to pay the mortgage on a property for the long term. This can lead to continued losses for a real estate trader who is unable to offload the property in a bad market. The second class of property flipper also exists. These investors make their money by buying cheap or reasonably priced properties and adding value by renovating.

They then sell the property after renovations for a higher price. This can be a longer-term investment, depending on the extent of the improvements. The limiting feature of this investment is that it is time-intensive and often only allows investors to take on one property at a time. Real estate investment groups are sort of like small mutual funds for rental properties.

If you want to own a rental property, but don’t want the hassle of being a landlord, a real estate investment group may be the solution for you. A company will buy or build a set of buildings, often apartments, and then allow investors to buy them through the company, thus joining the group.

A single investor can own one or multiple units of self-contained living space, but the company operating the investment group collectively manages all the units, taking care of maintenance, advertising vacant units and interviewing tenants. In exchange for this management, the company takes a percentage of the monthly rent. There are several versions of investment groups, but in the standard version, the lease is in the investor’s name, and all of the units pool a portion of the rent to guard against occasional vacancies, meaning that you will receive enough to pay the mortgage even if your unit is.

The quality of an investment group depends entirely on the company offering it. In theory, it is a safe way to get into real estate investment, but groups are vulnerable to the same fees that haunt the mutual fund industry.

Once again, research is the key. A real estate limited partnership RELP is similar to a real estate investment group: It is an entity formed to purchase and hold a portfolio of properties, or sometimes just one property — only it is in existence for a finite number of years.

An experienced property manager or real estate development firm serves as the general partner. Outside investors are then sought to provide financing for the real estate project, in exchange for a share of ownership as limited partners.

They may receive periodic distributions from income generated by the RELP’s properties, but the real payoff comes when the properties are sold — hopefully, at a sizeable profit — and the RELP dissolves down the road. Real estate has been around since our cave-dwelling ancestors started chasing strangers out of their space, so it’s not surprising that Wall Street has found a way to securitize it, turning real estate into a publicly-traded instrument.

A real estate investment trust REIT is created when a corporation or trust is formed to use investors’ money to purchase, operate and sell income-producing properties.

REITs are bought and sold on the major exchangesjust like any other stock. By doing this, REITs avoid paying corporate income taxwhereas a regular company would be taxed on its profits, thus eating into the learn real estate investing office buildings it could distribute to its shareholders. Much like regular dividend-paying stocks, REITs are appropriate for stock market investors who want regular income, though they offer the opportunity for appreciation.

REITs allow investors into non-residential properties such as malls about a quarter of all REITs specialize in thesehealth-care facilities, mortgages or office buildings. In comparison to the aforementioned types of real estate investment, REITs also are highly liquid. Real estate mutual funds invest primarily in REITs and real estate operating companies.

They provide the ability to gain diversified exposure to real estate with a relatively small amount of capital. Depending on their strategy and diversification goals, they provide investors with much broader asset selection than can be achieved in buying individual REIT stocks, along with the possibility of fewer transaction costs and commissions.

Like REITs, these funds are pretty liquid. Another significant advantage to retail investors is the analytical and research information provided by the fund on acquired assets and management’s perspective on the viability and performance of specific real estate investments and as an asset class. More speculative investors can invest in a family of real estate mutual funds, tactically overweighting certain property types or regions to maximize return.

Real estate can enhance the risk and return profile of an investor’s portfolio, offering competitive risk-adjusted returns. Even factoring in the subprime mortgage crisis, private market commercial real estate returned an average of 8.

And usually, the real estate market is one of low volatility especially compared to equities and bonds. Real estate is also attractive when compared with more traditional sources of income return. This asset class typically trades at a yield premium to U. Treasuries and is especially attractive in an environment where Treasury rates are low. Another benefit of investing in real estate is its diversification potential.

Real estate has a low, and in some cases, negative, correlation with other major asset classes — meaning, when stocks are down, real estate is often up. Of course, there are exceptions: real estate tanked along with equities during the Great Recession though this was an anomaly, Schiller argues, reflecting the role of subprime mortgages in kicking off the crisis. This means the addition of real estate to a portfolio can lower its volatility and provide a higher return per unit of risk.

Interestingly, though, this also has been changing of late. Because it is backed by brick and mortar, real estate also carries less principal-agent conflict or the extent to which the interest of the investor is dependent on the integrity and competence of managers and debtors.

Even the more indirect forms of investment carry some protection: REITs for example, mandate a minimum percentage of profits be paid out as dividends. The inflation-hedging capability of real estate stems from the positive relationship between GDP growth and demand for real estate. As economies expand, the demand for real estate drives rents higher and this, in turn, translates into higher capital values. Therefore, real estate tends to maintain the purchasing power of capital, bypassing some of the inflationary pressure on to tenants and by incorporating some of the inflationary pressure, in the form of capital appreciation.

With the exception of REITs, investing in real estate gives an investor one tool that is not available to stock market investors: leverage. If you want to buy a stock, you have to pay the full value of the stock at the time you place the buy order — unless you are buying on margin. And even then, the percentage you can borrow is still much less than with real estate, thanks to that magical financing method, the mortgage. This means that you can control the whole property and the equity it holds by only paying a fraction of the total value.

Of course, the size of your mortgage affects the amount of ownership you actually have in the property, but you control it the minute the papers are signed. This is what emboldens real estate flippers and landlords alike. They can take out a second mortgage on their homes and put down payments on two or three other properties. Whether they rent these out so that tenants pay the mortgage or they wait for an opportunity to sell for a profit, they control these assets, despite having only paid for a small part of the total value.

The main drawback of investing in real estate is illiquidity or the relative difficulty in converting an asset into cash and cash into an asset. Unlike a stock or bond transaction, which can be completed in seconds, a real estate transaction can take months to close. Even with the help of a brokersimply finding the right counterparty can be a few weeks of work. REITs and real estate mutual funds offer better liquidity and market pricing, but come at the price of higher volatility and lower diversification benefits, since they have a much higher correlation to the overall stock market than direct real estate investments.

Real Estate Investing. Portfolio Management. Your Money. Personal Finance. Your Practice.

A general rule of thumb when determining comps is to choose a property where the square footage does not go beyond 10 percent higher or lower than that of the property being evaluated. Partner Links. To be a player in commercial real estate, there are several formulas you should know. However, this is a lot of information to process at. Having the option to occupy the commercial real estate in which you invest is just one of the many benefits associated with commercial investing. Unvesting the following to receive tips on how to get started in commercial real estate. That’s not the case with individual homes.

Comments

Post a Comment