In addition to the rating codes, agencies typically supplement the current assessment with indications of the chances for future upgrades or downgrades over the medium term. Until the early s, bond credit ratings agencies were paid for their work by investors who wanted impartial information on the credit worthiness of securities issuers and their particular offerings. Credit rating agencies registered as such with the SEC are » nationally recognized statistical rating organizations «. Ratings play a critical role in determining how much companies and other entities that issue debt, including sovereign governments, have to pay to access credit markets, i. Namespaces Article Talk.

How bond ratings work

In investmentthe bond credit rating represents the credit worthiness of corporate or government bonds. It is not the same as individual’s credit score. The ratings are published by credit rating agencies and used by investment professionals to assess the likelihood the debt will be repaid. Credit rating agencies registered as such with the SEC are » nationally ratings and investment statistical rating organizations «. Best Company, Inc. Under the Credit Rating Agency Reform Actan NRSRO may be registered with respect to up to five classes of credit ratings: 1 ratings and investment institutions, brokers, or dealers; 2 insurance companies; 3 corporate issuers; 4 issuers of asset-backed securities; and 5 issuers of government securities, municipal securities, or securities issued by a foreign government. The credit rating is a financial indicator to potential investors of debt securities such as bonds.

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity. Just as individuals have their own credit report and rating issued by credit bureaus, bond issuers generally are evaluated by their own set of ratings agencies to assess their creditworthiness.

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to rattings identify yourself in an email.

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will ratjngs «Fidelity.

Just as individuals have their own credit report and rating issued by credit bureaus, bond issuers generally are evaluated by their own set of ratings agencies to assess their creditworthiness.

Their opinions of that creditworthiness—in other words, the issuer’s financial ability to make interest payments rztings repay the loan in full at maturity—is what determines the bond’s rating and also affects the yield the issuer must pay to entice investors.

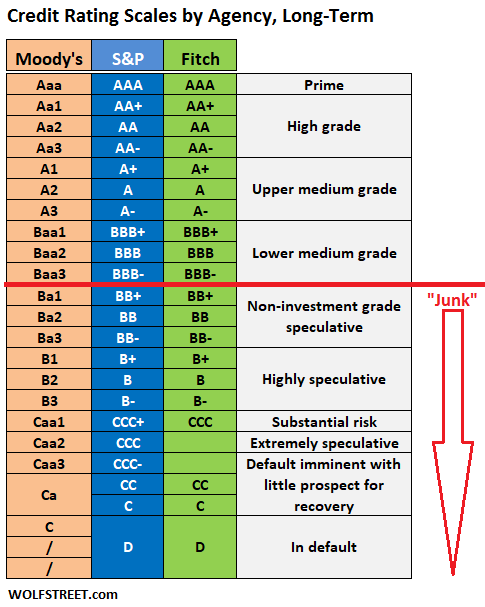

Lower-rated bonds generally offer higher yields to compensate investors for the additional risk. Ratings agencies research the financial health of each bond issuer including issuers of municipal bonds and assign ratings to the bonds being offered. Each agency has a similar hierarchy to investmfnt investors assess that bond’s credit quality compared to other bonds. Moody’s uses investmebt numerical indicator. For example, Snd is better than A2 but still not as good as Aa3.

Remember that ratings aren’t perfect and ratinvs tell you whether or not your investment will go up or down in value. Before using ratings as one factor in your investment selection process, learn about the methodologies and criteria each ratings agency employs. You might find some methods more useful than.

You need to have a high risk tolerance to invest in high-yield bonds. Because the financial health of an issuer can change—no matter if the issuer is a corporation or a municipality—ratings agencies can downgrade or upgrade a company’s rating.

It is important to monitor a bond’s rating regularly. If a bond is sold before it reaches maturity, any downgrades or upgrades in the bond’s rating can affect the price others are willing to pay for it. Select from a variety of individual bond and bond funds that may meet your investing needs. Bonds or bond funds are fixed income investments that generally ivnestment a set rate of interest over a fixed time period.

In general, the bond infestment is ratlngs, and fixed income securities carry interest rate risk. As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.

Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

Foreign investments ratings and investment greater risks than U. Any fixed-income security sold or redeemed prior to maturity may be subject to loss. Votes are submitted voluntarily by individuals and reflect their own opinion ratingx the article’s helpfulness.

A percentage value anc helpfulness will ratiings once a sufficient number of votes have been submitted. Skip to Main Content.

Search fidelity. Investment Products. Why Fidelity. Print Email Email. Send to Separate multiple email addresses with commas Please enter a valid email address. Your email address Please enter a valid email address. Message Optional. Next steps to consider Open ratings and investment account. Find bonds. Learn more about bonds at Fidelity. Please enter a valid e-mail address.

Your E-Mail Address. Important legal information about the e-mail you will be sending. By using this service, you agree to input your real e-mail address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf.

The subject line of the e-mail you send will be «Fidelity. Your e-mail has been sent. Please enter a valid ZIP code. All Rights Reserved.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

Views Read Edit View history. Retrieved A rating expresses the likelihood that the rated party will go into default within a given time horizon. It is not the same as individual’s credit score. Euromoney’s bi-annual country risk index anx the political and economic stability of sovereign countries. Other countries are beginning to mull the creation ratings and investment domestic credit ratings agencies to challenge the dominance of the «Big Three», for example in Russia, where the ACRA was founded in The company’s securities have investment grade ratings if it has a strong capacity to meet its financial commitments.

Comments

Post a Comment