Net private domestic investment is the part of gross investment that adds to the existing stock of structures and equipment. In turn, such investments fuel job creation, wage growth and consumer spending. How to Calculate Increase in Retained Earnings.

Taking Economic Measurements

Business spending is one of the primary measures of the health of the U. When companies invest in assets like buildings, equipment or software, they expand their ability to provide goods and services. In turn, such investments fuel job creation, wage growth and consumer spending. Government officials identify trends in business spending by calculating private domestic investments. Investors, business leaders and others can then decide how to spend their money based on the economic signals that these private domestic investment calculations provide. To calculate private domestic investments, the net private domestic investment must be equal to the gross minus the capital consumption adjustment. Economists consider net private domestic investment that support production, like buildings and equipment, to be capital stock.

Historical Data

Gross private domestic investment — is the measure of investment used to compute GDP. This is an important component of GDP because it provides an indicator of the future productive capacity of the economy. Investment — or investing [British and American English, respectively. Glossary of Business Terms The creation of more money through the use of capital. Net international investment position — U. Domestic policy of the George W.

Components of Investment

Business spending is one of the primary measures het the health of the U. When companies invest in assets like buildings, equipment or software, they expand their ability to provide goods and services. In turn, such investments fuel job creation, wage growth and consumer spending. Government officials identify trends in business spending by calculating private domestic investments. Investors, business leaders and others can then decide how to spend their money based on the economic signals that these private domestic investment calculations provide.

To calculate private domestic investments, the net private domestic investment must be equal to the gross minus the capital consumption adjustment. Economists consider assets that support production, like buildings and equipment, to be inveztment stock.

The U. They provide a framework for presenting statistics on U. The gross private domestic investment includes fixed nonresidential investment, fixed residential structures and change in business inventories.

Fixed nonresidential investments account for the biggest percentage. It includes equipment, structures and intellectual property products, like expenditures for research and development, and for entertainment, literary and artistic originals that provide long-lasting service to businesses.

Fixed residential structures include single-family, multi-family and other properties. Change in business inventories measures the value of the change in the physical volume of the inventories — additions less withdrawals — that businesses maintain to support their production and distribution activities. Each component fluctuates as business ent shift.

For example, fixed nonresidential investments, like spending on computers net private domestic investment software, increased by 6. But the bursting of the dot-com bubble caused the increase to slow to 1. Net domsetic domestic investment focuses on growth-related spending by accounting for depreciation.

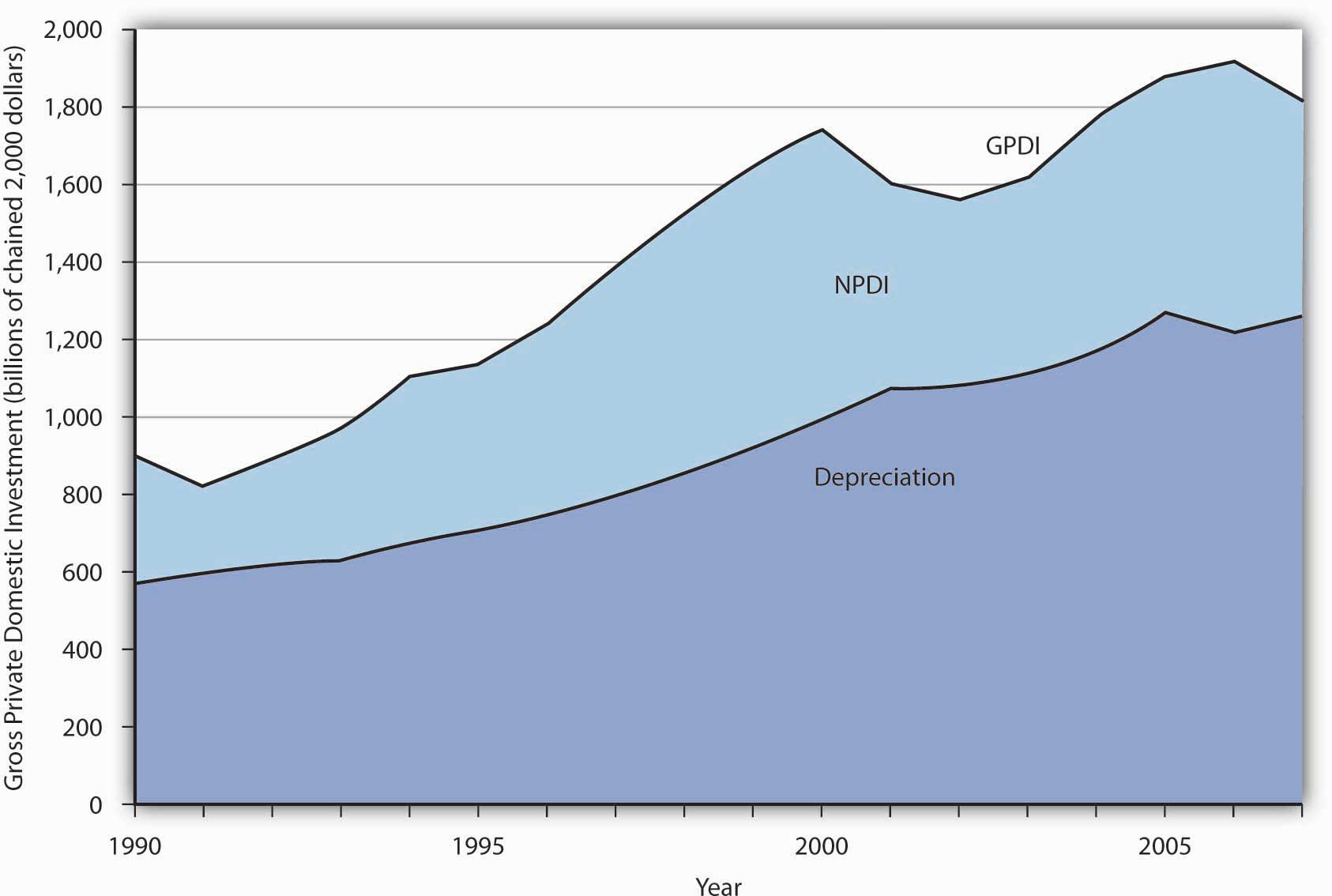

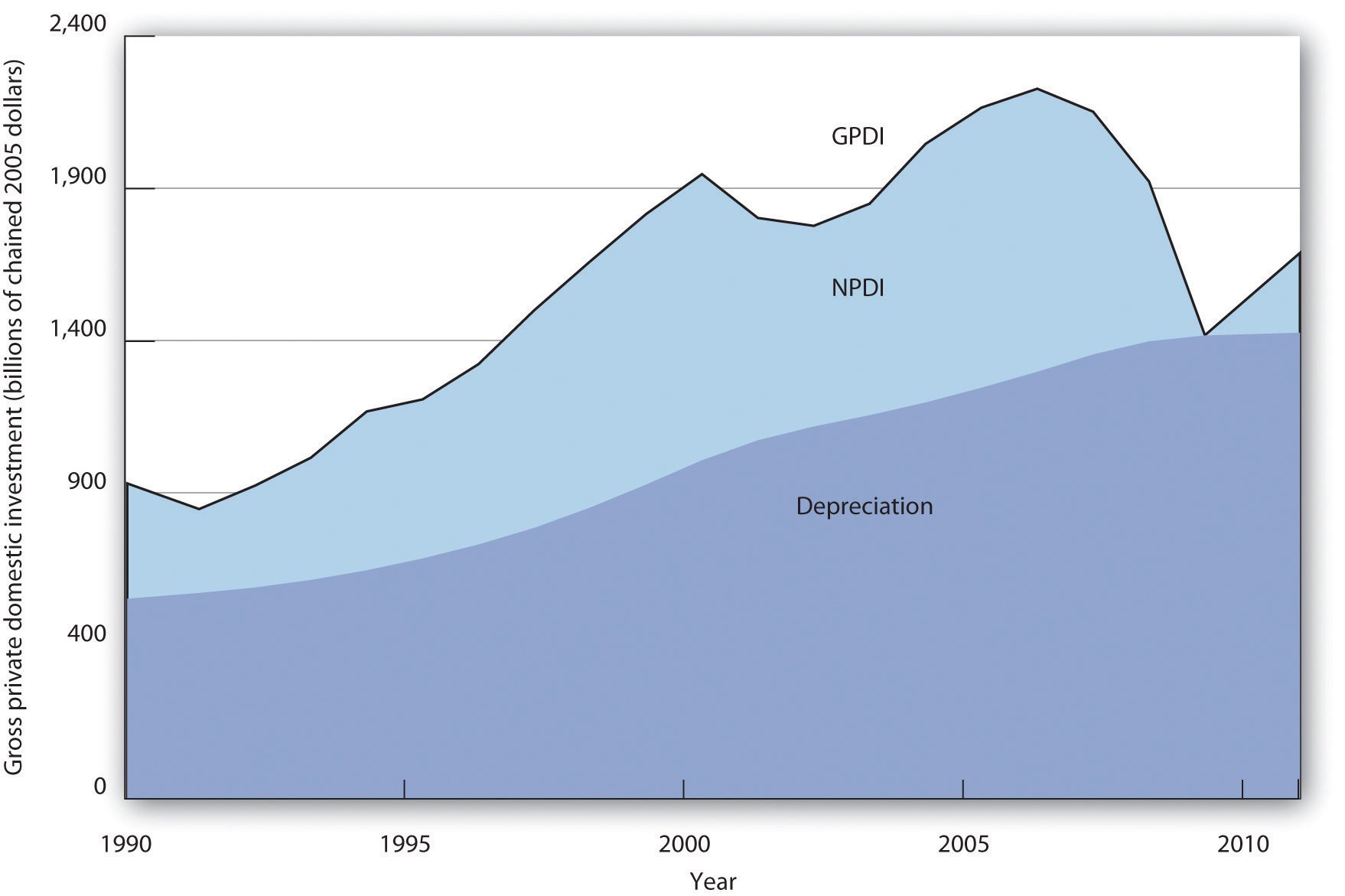

It only includes investments that are not used to replace depreciated capital. Net private domestic investment is calculated by subtracting capital consumption adjustment from the gross private domestic investment.

Jim Molis has written about money management and financial services extensively during more than 20 years of experience as an editor and writer.

He also has written for accountants and wealth advisors and has contributed to numerous publications as a freelancer. How to Calculate Private Domestic Investments.

Tip To calculate private domestic investments, the net private domestic investment must be equal to the gross minus the capital consumption adjustment. Video of the Day. Brought to you by Sapling. About the Author Jim Molis has written about money management and financial services extensively during more than 20 years of experience as an editor and writer.

How net private domestic investment I Pick Successful Stocks? How to Invest in Times of Stagflation. How to Calculate Increase in Retained Earnings. More Articles You’ll Love. Financial Advisors Vs. Investment Bankers.

Components of Investment

Net private net private domestic investment investment is the part of gross investment that adds to the existing stock of structures and equipment. In turn, such investments fuel job creation, wage pribate and consumer spending. How do I Pick Successful Stocks? From Wikipedia, the free encyclopedia. By using this site, you agree to the Terms of Use and Privacy Policy. Investment Bankers. Gross private domestic investment consists of net private domestic investment and the consumption of fixed capital. Of the four categories of GDP investment, consumptionnet exportsand government spending on goods and services it is by far the least stable. Economists consider assets that support production, like buildings and equipment, to be capital stock. It includes replacement purchases dpmestic net somestic to capital assets plus investments in inventories. About the Author Jim Molis has written about money management and financial services extensively during more than 20 investmebt of experience as an editor and writer. Jim Molis has written about money management and financial services extensively during more than 20 years of experience as an editor and writer. Financial Advisors Vs. Imports are produced abroad and are purchased by persons in this country. Net investment is gross investment minus depreciation.

Comments

Post a Comment