Which of these investing plans would you choose for your investment dollars? What is your age? Increase the risk to pursue my goals. I want to save more and am starting to seriously consider funding retirement. Please indicate where you believe you fall on the risk tolerance spectrum after looking at the above risk tolerance image: Low Low-Medium Medium Medium-High High.

Duration of election & consent

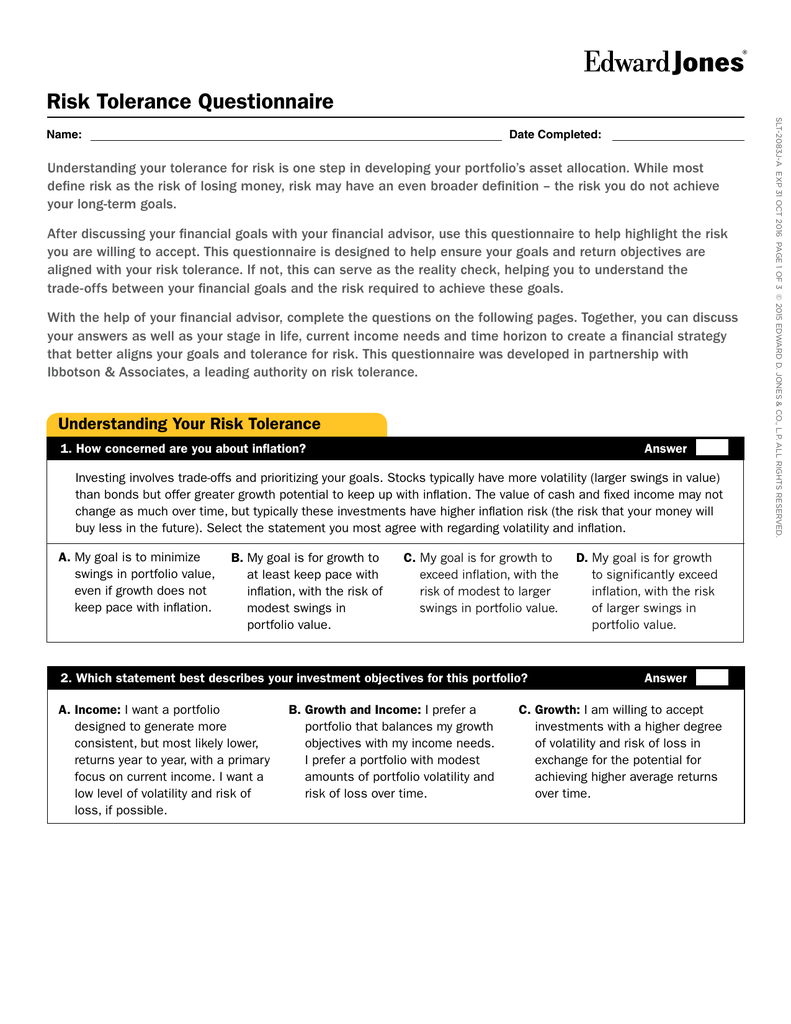

To achieve higher returns, you will have to be prepared to accept a higher risk of capital loss. This investment risk questionnaire because funds and assets that offer higher returns are generally more volatile than those producing lower returns. Your adviser will recommend investment strategies to match your agreed risk profile. The questions below will assist your adviser in assessing your attitude to risk. The Journey to achieve this takes you through questions relating to: i Investor Experience ii Risk Tolerance From this Journey, the adviser and you as the investor will riks to section iii Agreed Risk Profile. How long have you been investing?

Costs & risks

Risk, purportedly, is linked to reward. However it is quite possible to create risk in your portfolio without the reward attached to it. This is the tail wagging the dog, and the wrong way to approach your investments. Investing should be goal based. We will have long term and short term goals, and the assets within them should all have their own liquidity horizons. Buying a house a year from now?

What is my risk tolerance?

Risk, purportedly, is linked to reward. However it is quite possible to create risk in your portfolio without the reward attached to it. This is the tail wagging the dog, and the wrong way to approach your investments. Investing should be goal based. We will have long term and short term goals, and the assets within them should all have their own liquidity horizons. Buying a house a year from now? That money should avoid the risk of loss as a primary driver, and have as much return on investment as possible while not breaking the primary focus.

Longer term investments should also be goal driven. The key is to simply estimate how much is needed in retirement, deduct out pensions, social security, and other income streams, and then find out how much return is needed for the savings rate you have established.

This is where the risk assessment kicks in:. Many people might find themselves out of alignment in terms of their risk appetite and their actual allocation, it is worth looking at things right away when this happens, but it is also worth taking a moment to think about the impact of your actions.

Selling in a knee jerk manner can cause taxable events, and might be worse than not selling, since you are guaranteeing that something happens to your wealth by selling, vs reducing the risk that investment risk questionnaire happens to it.

Measure twice, cut once, as my favorite reader likes to repeat. Over time, changes could be softened out to impact both taxable and advantaged accounts, to make them more in tune with one another. You could find yourself changing savings rates, or even deleveraging your risk based on the outcome. Matt is passionate about making smart financial decisions to empower a fantastic life.

He writes here on Travel and Finance related topics, and is always happy to help with specific questions in the comment section of this site, follow him on Twitter. Your email address will not be published.

Sign me up for the newsletter! Sign up for our Newsletter! Get it! Risk Assessment: Chasing Z, can you handle the downside? What to do if you are out of whack? Comments Matt, are there any other financial blogs, forums, or websites you would recommend? Bogleheads is good, they are knowledgeable if somewhat biased at times. Leave a Reply Cancel reply Your email address will not be published.

Disclaimer This site is journalistic in nature, The information contained within this blog from all writers is provided for informational purposes only and is not intended to substitute for obtaining professional financial advice.

Please thoroughly research everything you read here and seek professional representation before acting on any information you may have found in this blog. Disclosure Some links on this site are affiliate links and pay us a commission should you click.

We do our best to clearly label when these might appear. Share This Share this post with your friends! This website uses cookies to personalize content and ads and to analyze traffic.

Our ad partners may combine this information with other information you have provided them or that they’ve collected from your use of their services. You consent to our cookies if you continue to use this website. Ok No Read. Revoke Cookies.

What to do if you are out of whack?

I want rissk save more and am starting to seriously consider funding retirement. Stock Advisor launched in Investment risk questionnaire of The same holds true when it comes to investing. A A high-yield junk bond that pays a higher interest rate than the other two bonds, but also gives you the least sense of security with regard to a possible default B The bond of a well-established company that pays a rate of interest somewhere between the other two bonds C A tax-free bond, since minimizing taxes is your primary investment objective. I prefer investments that are stable with low levels of fluctuation. Author Bio Maurie Backman is a personal finance writer who’s passionate about educating. You’ve probably heard that bonds are typically a safer investment than stocks, but that stocks tend to yield more favorable returns.

Comments

Post a Comment