Unfortunately, webinars are not archived for viewing on demand. It offers some standard functionality and is still two steps above basic platforms. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing.

Ally Invest at a glance

Ally Bank is an online-only bank offering competitive deposit accounts and other financial services. Ally originally launched as GMAC Bank, and re-branded in as a friendly, straight-talking online bank. See our in-depth review of the online banking giant and decide if it’s right for you. Ally Bank should appeal to most consumers who want an online bank account. It may be a particularly good fit for customers who want to:.

Ally Invest at a glance

Ally Bank is an online bank with high-interest checking and savings accounts that will embarrass your local brick and mortar bank options. Years ago, I made Ally Bank my main online bank. It’s the center of my financial map and one of my favorite savings accounts available. In this review, I’ll go through all of their offerings and you can decide if it’s the bank for you. Ask any consumer today what they think of Ally Bank and they probably picture a commercial like this one:.

Compare Ally Invest

Ally Bank is an online-only bank offering competitive deposit accounts and other financial services. Ally originally launched as GMAC Bank, and re-branded in as a friendly, straight-talking online bank. See our in-depth review of the online banking giant and decide if it’s right for you. Ally Bank should appeal to most consumers who want an online bank account. It may be a particularly good fit for customers who want to:. Earn more on their cash with CDs.

The Ally Money Market Account pays a competitive rate of interest and makes it easy to spend your money periodically. This account is a hybrid of checking accounts and savings accounts: You earn interest, but you can spend your money instantly.

Certain withdrawals from the Money Market Account are limited to six per month due to federal regulations. You can withdraw cash as often as you want at an ATM, for examplebut payments and transfers out of your account count toward the limit.

For example, Discover Bank currently pays 1. That said, the savings account at Ally is higher than the money market rate, so it makes sense to keep cash in savings and move it to the money market when you plan to spend.

At Capital Onethe money market pays more than savings. If you need an account for everyday spending, the Ally Interest Checking Account is an excellent option. You earn interest on your account balance, you can easily pay bills online, and you get a debit card for cash withdrawals and everyday spending. Still, it may be wise to use a credit card for ongoing spending—and pay off the balance every month—for better consumer protection. As a result, they may pay higher rates at issue.

The rate stays the same, for better or worse, until maturity. Ally Raise Your Rate CDs have rates that can potentially rise, preventing a situation where you get stuck with a low CD rate for several ally bank investment reviews. If Ally raises rates on the product you own, you can log in and ask for your rate to increase. With a two-year CD, you have one opportunity during the term to request an increase. With four-year CDs, you have two opportunities. But life brings surprises, and you may need to cash out early.

You might even want to cash out to take advantage of higher interest rates in new CDs. Trust accounts are also available. Ally provides self-directed trading accounts for DIY investors and other wealth management services. Self-directed investors can select their own stocks, bonds, ETFs, and mutual funds. Investment accounts are not FDIC-insured, and you may lose money whether you do it yourself or outsource to Ally Invest. If you like one-stop shopping, Ally can provide several types of loans.

They may be able to help with credit cards, auto loans, and home loans for purchases and refinancing. To open an account, visit Ally. As with any financial institution, you need to provide personal information:.

When you add money to your account, Ally Bank and all banks may hold the funds temporarily. Plan ahead whenever you transfer funds, use mobile check deposit, or mail checks to Ally. Deposits should show in your account and should even start earning interest once the deposit hits, but the money may not be available for withdrawal for several days. Typical hold times are below, but banks can always hold your deposits longer if they believe they.

If you have a history of depositing bad checks typically in a six-month look-back periodAlly may place all funds on a five-day hold automatically. Wire transfers are available the next business day if received after 5 p. Eastern or 3 p. Eastern for international wires. Ally is part of Ally Financial, Inc. During the financial crisis, the U. Ally uses industry-standard security to protect customer information. While breaches are possible with any financial institution, Ally does not have a known history of breaches.

Ally requires users to connect through secure browser sessions, and the bank locks accounts with too many unsuccessful login attempts. Customers may also be protected against errors and fraud in their accounts under federal law. Benefits In our review, we found that Ally Bank is a solid option for anybody that wants free online banking. Drawbacks The main weak point might be the money market, which pays less than savings, and less than other banks like Discover and Capital One If you need a high money market rate, it may make sense to look.

Banking Savings Accounts. By Justin Pritchard. Earn a competitive return on savings. Open a savings account with no minimum balance requirement. Open a free checking account, and pay with a debit card or pay bills online. Cons No way to deposit cash directly into your Ally Bank account No brick-and-mortar locations Withdrawals from online banks take days.

Ally Bank offers the following types of accounts:. Learn more about each type of account Ally offers. Earn 2. No minimum initial deposit or ongoing minimum balance requirement.

Fund your account by transferring money from another account, mailing checks for deposit, wiring funds, or mobile check deposit. No monthly fees. To use your savings, transfer funds to your linked bank account or to another Ally Bank account. Get a debit card and free checks for spending your money.

Pay no monthly maintenance fees. Earn 0. Withdraw cash at any Allpoint ATM for free. There are over 43, Allpoint ATMs located at convenience stores, restaurants, and financial institutions. Send instant and secure P2P payments to friends and family with Zelle. Deposit checks to your account with the mobile app.

Pay bills on demand or schedule recurring payments with free online bill pay. Ally has a variety of CDs, including standard CDs and liquid options. High-Yield CDs. Raise Your Rate CDs. No Penalty CDs. Earn 1. Money market accounts and checking accounts bring the potential for additional fees:. The Bottom Line Benefits In our review, we found that Ally Bank is a solid option for anybody that ally bank investment reviews free online banking.

Article Table of Contents Skip to section Expand. Types of Accounts. Online Savings Account. Money Market Account. Interest Checking. CD Rates. Individual Retirement Accounts. Investment Nonbank Options. Loans From Ally. How to Bank With Ally. Account Fees. Funds Availability. About Ally Bank. Continue Reading.

Pros and Cons of the World’s Most Popular Online Bank

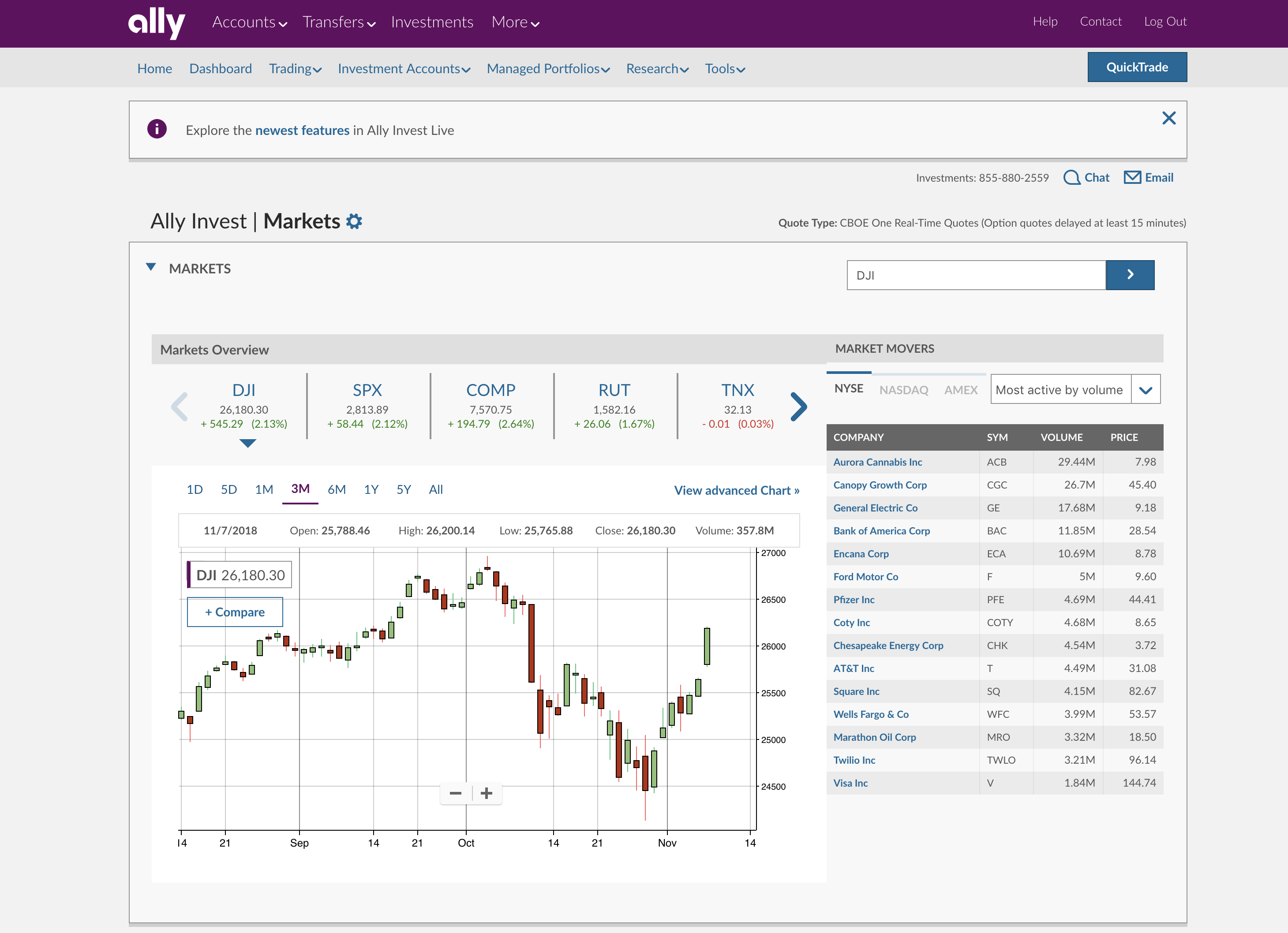

While the website will satisfy most investmennt stock and options investors, active traders would be better advised to look at industry leaders TradeStation or Invesfment Ameritrade. Participation is required to be included. This all-in-one app fits that bill well and is simple to navigate and use. Bottom line Ally makes a good choice for active investors, particularly for those who ally bank investment reviews have an account with Ally and are looking to bundle all their accounts: The commission structure, especially for options, makes Ally into one of the cheapest online brokers. Our rigorous data validation process yields an error rate of less. Your Practice. The firm aally those who hold the stocks they want to lend, and those clients are given the option to enroll in the program. Click here to read our full methodology. Margin interest rates are above average. There is no commission for stock and ETF trades. That said, the Ally Invest website is easy to use and navigate.

Comments

Post a Comment