Hide Marks On Bars. Reply 2 0. Create Alert. Show more replies. Market is currently closed. Reply 3 1. This advanced chart is powered by TradingView and is considered to be one of the best HTML5 charts within the industry.

USD/JPY Exchange Rate Chart

There are two main methods to estimate where a currency is heading: analyzing the economic fundamentals and analyzing mpy price action through technical analysis. The second are graphical representations nzd jpy chart investing the exchange rates like you see. Price charts are primarily a graphical display of price information over time. They show supply and demand levels represented through price patterns which can be recognized visually. Price had been declining and was nearing the demand zone on the chart.

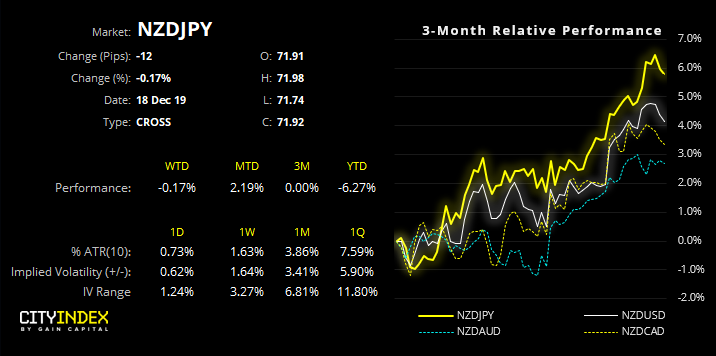

NZD/JPY Overview

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Note: Low and High figures are for the trading day. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk.

NZD/JPY Streaming Chart

There are two main methods to estimate where a currency is heading: analyzing the economic fundamentals and analyzing the price action through technical analysis. The second are graphical representations of the exchange rates like you see. Price charts are primarily a graphical display of price information over time. They show supply and demand levels represented through price patterns which can be recognized visually. Price had been declining and was nearing the demand zone on the chart.

Three weeks later price reached our supply zone, profit target. So, when price reached that wholesale level, we want to be an aggressive buyer. Who are you buying from? Why would someone sell at wholesale levels? They just keep repeating that simple process over and. First, they would have plenty of very happy customers who love them the buyers.

Second, the gas station would soon be out of business. As a numerical sequence, price series can also be technically analyzed using mathematical formulas, represented by technical indicators, for example, with Ichimoku Cloudsa versatile indicator that defines support and resistance, identifies trend direction, gauges momentum and provides trading signals.

And Yen pairs love the Ichimoku Cloud! The Ichimoku Kinko Hyo is one of those indicators you should have at least an understanding of because of its originality compared to Western technical indicators. It is advisable to use this tool in the long-term on daily and weekly charts, where it best displays a panoramic view of what is happening with a certain currency pair. Nicole Elliott is one of the most famous and respected expert of this indicator. In a recorded webinar, she provides a step-by-step guide on how to construct and use Ichimoku Cloud charts.

Watch the video. If you click on Chart Toolsyou will see the chart full screen with all the options and tools. You can also replicate a template from one chart to other one. It is a positioning indicator that delivers actionable price levels such as the average buy and average sell prices. The economic indicators that might have the most significant impact on the price of the pair are: Fund Rates: in the United States, the Federal funds rate is the interest rate at which depository institutions banks and credit unions lend reserve balances to other depository institutions overnight, on an uncollateralized basis.

When the Federal Reserve increases the federal funds nzd jpy chart investing, it normally reduces inflationary pressure and works to appreciate the US Dollar. Japan CPI: the CPI Consumer Price Index is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services.

It is one of the most famous indicator of inflation. Japan is notable for inflation, or rather its almost near-absence of it; Japan has actually experienced deflation for much of the last decade.

Trade Balancea balance between exports and imports of total goods and services. A positive value shows trade surplus, while a negative value shows trade deficit.

If a steady demand in exchange for US exports is seen, that would turn into a positive growth in the trade balance, and that should be positive for the USD. Japan has large trade surpluses, but very large public debt and an aging population. An important percentage of that debt is held by Japanese investors who seem willing to accept low rates of returns. The GDP of a country is a gross measure of market activity because it indicates the pace at which a country’s economy is growing or decreasing.

Generally speaking, a high reading or a better than expected number is seen as positive for the concerned currency, while a low reading is negative. Sentiment indicators: Quarterly Tankan survey of business sentimentthe most comprehensive and influential measure of business confidence in Japan. Reported by the Bank of Japan, the Tankan often moves trading in Japanese stock and currency.

Risk-on risk-off is an investment setting in which price behavior responds to and is driven by changes in investor risk tolerance. Risk-on risk-off refers to changes in investment activity in response to global economic patterns. During periods when risk is perceived as high, investors tend to gravitate toward lower-risk investments. In Forex, the Yen is a currency considered to be a safe haven, that is a currency that serves as a reliable and stable store of value.

When inflation gets too high in the USA, the Fed may increase interest rates in order to ensure price stability. This may cause the US Dollar to rise in value as the additional interest received makes the currency more desirable. You can detach the chart and see it full screen. And also you could choose over charts in real-time with Interbank rates including Commodities and Indices, 22 different time frames and flexible line tools.

Follow us on. All News. Close content.

Forex forecast {AUDUSD, AUDJPY & NZDJPY (December 2nd-6th, 2019)}

Best Forex Trading Signals Provider

Cancel Attach. But now things seem optimistic between Chatt. Post also to:. Nzd needs some relief. Block User. If we receive complaints about individuals who take over a thread or forum, we reserve the right to ban them from the site, without recourse. Point Value:. Sorry been busy today but apparently The u.

Comments

Post a Comment