It appears that QTS is trading close to its «normal» multiple of Since that time, Facebook has grown exponentially, and its credit rating has become investment grade. Load More. Load More. CyrusOne shares appear to have had a boost from Bloomberg reports that several private equity groups and at least one data center REIT peer — Digital Realty — may be considering the company as an acquisition target.

Обзор REIT

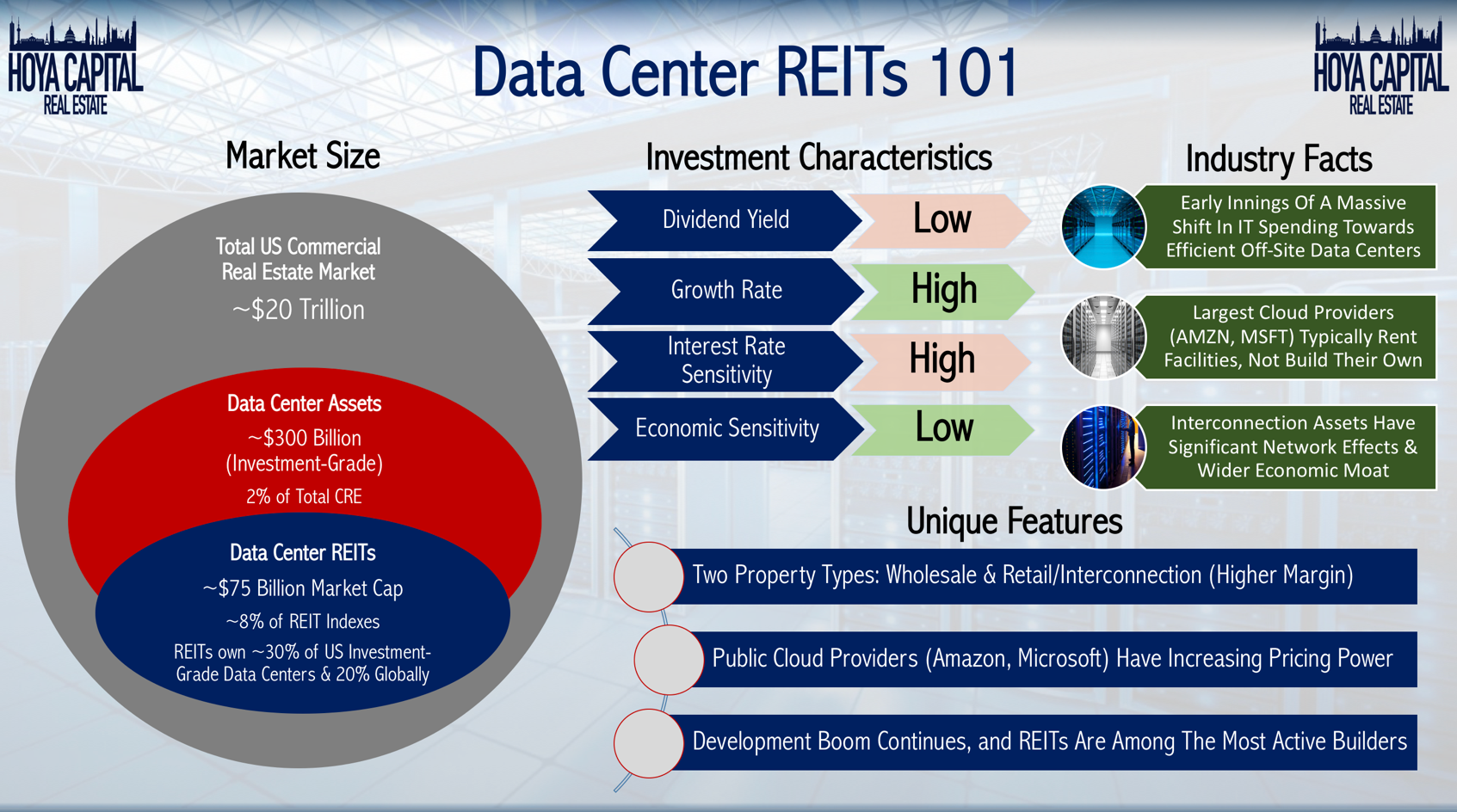

A REIT is a company that owns and typically operates income-producing real estate or related assets. These may include reit investing in data centers buildings, shopping malls, apartments, hotels, resorts, self-storage facilities, warehouses, and mortgages or loans. Unlike other real estate companies, a REIT does not develop real estate properties to resell. Instead, a REIT buys and develops properties primarily to operate them as part of its own investment portfolio. REITs provide a way for individual investors to earn a share of the income produced through commercial real estate ownership — without actually having to go out and buy commercial real estate. These are known as publicly traded REITs. Others may be registered with the SEC but are not publicly traded.

The Bigger Picture

A real estate investment trust REIT is a company that owns, and in most cases operates, income-producing real estate. REITs own many types of commercial real estate, ranging from office and apartment buildings to warehouses , hospitals , shopping centers , hotels and timberlands. Some REITs engage in financing real estate. REITs can be publicly traded on major exchanges, publicly registered but non-listed, or private. Broyhill, cousin of Virginia U. Congressmen Joel Broyhill in [9] who pushed for the creation under Eisenhower.

Tale of the Tape

A REIT is a company that owns and typically operates income-producing real estate or related assets. These may include office buildings, shopping malls, apartments, hotels, resorts, self-storage reit investing in data centers, warehouses, and mortgages or loans.

Unlike other real estate companies, a REIT does not develop real estate properties to resell. Instead, a REIT buys and develops properties primarily to operate them as part of its own investment portfolio.

REITs provide a way for individual investors to earn a share of the income produced through commercial real estate ownership — without actually having to go out and buy commercial real estate. These are known as publicly traded REITs. Others may be registered with the SEC but are not publicly traded. This is one of the most important distinctions among the various kinds of REITs.

Before investing in a REIT, you should understand whether or not it is publicly traded, and how this could affect the benefits and risks to you. Additionally, some REITs may offer higher dividend yields than some other investments. But there are some risks, especially with non-exchange traded REITs. Because they do not trade on a stock exchange, non-traded REITs involve special risks:. You can invest in a publicly traded REIT, which is listed on a major stock exchange, by purchasing shares through a broker.

Publicly traded REITs can be purchased through a broker. Generally, you can purchase the common stock, preferred stock, or debt security of a publicly traded REIT. Brokerage fees will apply. Non-traded REITs are typically sold by a broker or financial adviser. Non-traded REITs generally have high up-front fees. Sales commissions and upfront offering fees usually total approximately 9 to 10 percent of the investment.

These costs lower the value of the investment by a significant. The shareholders reit investing in data centers a REIT are responsible for paying taxes on the dividends and any capital gains they receive in connection with their investment in the REIT.

Dividends paid by REITs generally are treated as ordinary income and are not entitled to the reduced tax rates on other types of corporate dividends. Consider consulting your tax adviser before investing in REITs. You should also check out the broker or investment adviser who recommends purchasing a REIT.

To learn how to do so, please visit Working with Brokers and Investment Advisers. What are REITs? Why would somebody invest in REITs?

What types of REITs are there? What are the benefits and risks of REITs? They generally cannot be sold readily on the open market. If you need to sell an asset to raise money quickly, you may not be able to do so with shares of a non-traded REIT. Non-traded REITs typically do not provide an estimate of their value per share until 18 months after their offering closes. This may be years after you have made your investment. As a result, for a significant time period you may be unable to assess the value of your non-traded REIT investment and its volatility.

To do so, they may use offering proceeds and borrowings. This practice, which is typically not used by publicly traded REITs, reduces the value of the shares and the cash available to the company to purchase additional assets. This can lead to potential conflicts of interests with shareholders. For example, the REIT may pay the external manager significant fees based on the amount of property acquisitions and assets under management.

These fee incentives may not necessarily align with the interests of shareholders. Email Address.

Robinhood APP — HIGH DIVIDEND Yield Data Center REITs!

Learn More

However, looking at factors driving the outperformance, calculating a few valuation metrics, and considering some recent calls by an influential sell-side analyst, may shed some light on share price sustainability going forward. Lines and paragraphs break automatically. Technology-oriented REITs like data centers and wireless towers provide space, power, and connectivity to customers that colocate their equipment and pay rent for the privilege. Hide comments. Equinix is an outlier at the top of the chart with 56 percent price appreciation. Performance-sensitive applications, SaaS, and digital content distribution usually require a geographically distributed IT architecture to provide a good user experience for both business and consumer clients. Brad Thomas currently writes weekly for Forbes. Facebook was an early customer of DuPont Fabros. CoreSite COR posted an earnings trifecta: It beat consensus estimates, raised guidance and had already raised its dividend again in May. Web page addresses and e-mail addresses turn into links automatically. The REITs also have campuses where hundreds of enterprise customers are colocated to take advantage of fast and secure on-ramps to multiple cloud, network and IT service providers. The month performance for Reit investing in data centers shares now is a solid 28 percent, more in-line with its peers. CyrusOne shares appear to have had a boost from Bloomberg reports that several private equity groups and at least one data center REIT peer — Digital Realty — may be considering the company as an acquisition target.

Comments

Post a Comment