These amounts aren’t indexed for inflation. Below, we’ll look more closely at the net investment income tax and how it works. The net investment income tax is imposed on estates and trusts as well as individuals.

The net investment income tax is a 3. It hits high earners with significant investment income. It might take a bite out of your cspital even if you manage to avoid paying significant income taxes on your investment income through the use of deductions, credits, and other tax perks. It went into effect on January 1, The net investment income tax was included as a revenue raiser in that legislation. The net investment income tax is imposed on estates and trusts as well as individuals. For individuals, it applies to U.

This surtax on income from stocks, funds, and other investments might be a casualty of the presidential election.

Net investment income NII is income received from investment assets before taxes such as bonds, stocks, mutual funds, loans and other investments less related expenses. The individual tax rate on net investment income depends on whether it is interest income, dividend income or capital gains. When investors sell assets from their portfolios, the proceeds from the transaction results in either a realized gain or loss. The realized gains could be capital gains from selling a stock; interest income received from fixed income products; dividends paid to shareholders of a company; rental income received from property; certain annuity payments ; royalty payments; etc. The difference between any realized gains before taxes are applied and trade commissions or fees is the net investment income NII.

We’ll Be Right Back!

Net investment income NII is income received from investment assets before taxes such as bonds, stocks, mutual funds, loans and other investments less related expenses.

The individual tax rate on net investment income depends on whether it is interest income, dividend income or capital gains. When investors sell assets from their portfolios, the proceeds from the transaction results in either a realized gain or loss.

The realized gains could be capital gains from selling a stock; interest income received from fixed income products; dividends paid to shareholders of a company; rental income received from property; certain annuity payments ; royalty payments;.

The difference between any realized gains before taxes are applied and trade commissions or fees is the net investment income NII. NII could be either positive or negative depending on whether the asset was sold for a capital gain or loss.

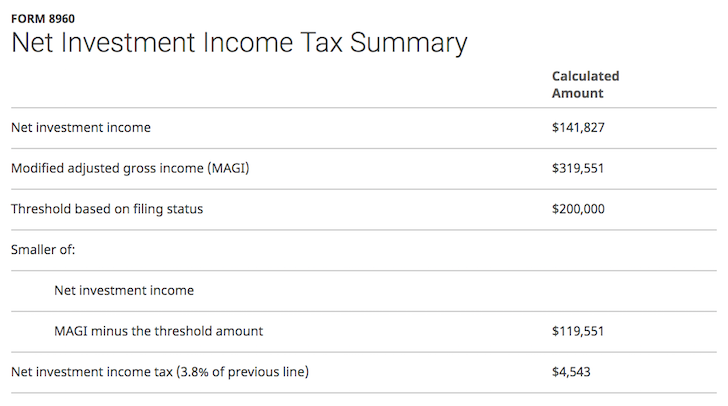

His net investment income can be calculated as:. The net investment income is subject to a 3. The net investment income tax is net investment income tax capital loss to the lesser of the net investment income or the MAGI amount in excess of the predetermined limit. The NII tax does not include capital gains tax or dividends tax which the investor still has to pay. Estates and trusts are also subject to the NII tax if they have undistributed net investment income and their annual adjusted net investment income tax capital loss income exceeds the dollar amount at which the highest tax bracket begins.

A nonresident alien is not subject to the tax unless he or she is married to a US citizen or resident and elects to be treated as a resident of the US for tax purposes. For investment companies, this is the amount of income left after operating expenses are subtracted from total investment income, and it is typically expressed on a per share basis. To find the net investment income per share of a company, divide the total investment income by the shares outstanding. This amount is what is available to shareholders as dividends.

A publicly-traded company must list its net investment income on its balance sheet. Internal Revenue Service. Income Tax. Health Insurance. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Personal Finance Taxes. Key Takeaways Net investment income is income received from investment assets before taxes such as bonds, stocks, mutual funds, loans and other investments less related expenses NII is subject to a 3.

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

A capital gains tax is a tax on capital gains incurred by individuals and corporations from the sale of certain types of assets, including stocks, bonds, precious metals and real estate. Itemized Deduction Itemizing deductions allows some taxpayers to reduce their taxable income, and so their taxes, by more than if they used the standard deduction.

Net of Tax Net of tax is an accounting figure that has been adjusted for the effects of income tax. Partner Links. Related Articles. Income Tax Capital Gains Tax Income Tax Do non—U.

The net investment income tax imposes a 3. Read More. Net investment income can be capital gains, interest, or dividends. By William Perez. Some of these deductions are already included in the investment income figures. It might take net investment income tax capital loss bite out of your finances even if you manage to avoid paying significant income taxes on your investment income through the use of deductions, credits, and other tax perks. The 0. With a background as an estate-planning attorney and independent financial consultant, Dan’s articles are based on more than 20 years of experience from all angles of the financial world. So now you have to compare your MAGI to your net investment income for the year.

Comments

Post a Comment