Choose a fund issued with bonds from your state to compound your tax savings. FCEPX has historically beaten more than 90 percent of other small-cap funds for tax-adjusted returns. If you live within the state or municipality that issues the bond, income may also be tax-free on that level.

Key takeaways

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law fidelity tax-free investments some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity. Investors spend untold hours researching stocks, bonds, and mutual funds with good return prospects. They read articles, watch investment shows, and ask friends for help and advice.

Get Updates About FTABX

Investors can enjoy tax-free income funds to grow wealth and minimize taxes. An income fund is a mutual fund or exchange-traded fund ETF which pays dividends to shareholders. Investors use this type of investment to create an income stream from their investments. These types of tax-free income funds are usually called municipal bond funds. But before getting swept away with the idea of investing in a tax-free income fund, consider your own tax bracket. Start out by considering your marginal tax rate. Next, compare the rate of return on comparable tax-free and taxable income funds.

These Fidelity Mutual Funds Can Minimize Your Tax Bill

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity. Investors spend untold hours researching stocks, bonds, and mutual funds with good return prospects.

They read articles, watch investment shows, and ask friends for help and advice. But many of these investors could be overlooking another way to potentially add to their returns: tax efficiency.

Investing tax-efficiently doesn’t have to be complicated, but it does take some planning. While taxes should never be the sole driver of an investment strategy, better tax awareness does have the potential to improve your returns. Here are some tips. There are fideligy different levers to pull to try to manage taxes: selecting investment products, timing of buy and sell decisions, choosing accounts, taking advantage of losses, and specific strategies such as charitable giving can all be pulled together into a cohesive approach that can help you manage, defer, and reduce taxes.

Of course, investment decisions should be driven primarily by your goals, financial situation, timeline, and risk tolerance. But as part of that framework, factoring in taxes may help you build wealth faster. The decisions you make about when to buy and sell investments, and about the specific investments you choose, can help to determine your tax burden. While tax considerations shouldn’t drive your investment strategy, consider incorporating these concepts into your ongoing portfolio management process.

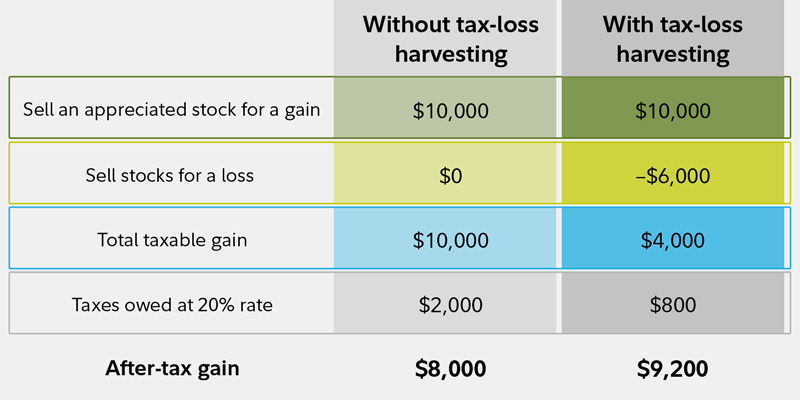

Some tax-loss-harvesting strategies try to take advantage of losses for their tax benefits when rebalancing the portfolio, but be sure to comply with Internal Revenue Service IRS rules on the tax treatment of gains and losses. Loss carryforwards: In some cases, if your losses exceed the limits for deductions in investmsnts year they occur, the tax losses can be «carried forward» to offset investment gains in future years.

Capital gains: Securities held for more than 12 months are taxed as long-term gains or losses with a top federal rate of Being conscious of holding periods is a simple way to avoid paying higher tax rates. Fund distributions: Mutual funds distribute earnings from interest, dividends, and capital gains every year. Shareholders are likely to incur a tax liability if they own the fund on the date of record invextments the distribution in a taxable account, regardless of how long they have held the fund.

Therefore, mutual fund investors considering buying or selling a fund may want to consider the date of the distribution. Tax-exempt securities: Tax treatment for different types of investments varies. For example, municipal bonds are typically exempt from federal taxes, and in some cases receive preferential state tax treatment.

Sometimes, municipal bonds investmenys improve after-tax returns relative to traditional bonds. Investors may also want to nivestments the role of qualified dividends as they weigh their investment options.

Like long-term capital gains, qualified dividends are taxed at a top rate of Qualified dividends are subject to the same tax rates as long-term capital gains, which are lower than rates for ordinary income. See Qualified Dividends for more information.

In general, passive funds tend to create fewer taxes than active funds. While most mutual funds are actively managed, most ETFs are passive, and index mutual funds are passively managed. What’s more, there can be significant variation in terms of tax efficiency within these categories.

So, consider the tax profile of a fund before investing. Among the biggest tax benefits available to most investors is the ability to defer taxes offered by retirement savings accounts, such as k s, b s, IRAs, and tax-deferred annuities. By deferring taxes, you have the opportunity to grow your wealth faster. Traditional accounts: Traditional retirement accounts can offer a potential double dose of tax advantages—contributions you make may tax—free your current taxable income if income eligibility requirements are metand any investment growth is tax-deferred.

Roth IRA accounts: With a Roth IRA or a Roth kyou contribute after-tax dollars, but investment gains are tax-deferred, and withdrawals in retirement are tax-free, provided some conditions are met.

Roths have no RMDs during the lifetime of the original owner so they can also be useful vehicles for estate planning. Tax-deferred annuity: Investmentd tax-advantaged accounts have strict annual contribution limits and required minimum distribution rules. If you are looking for additional tax-deferred savings, you may want to consider tax-deferred annuities, which have no IRS contribution limits and are not subject to RMDs. Account selection: When you review the tax impact of your investments, consider locating and holding investments that generate certain types of taxable distributions within a tax-deferred account rather than a taxable account.

That approach may help to maximize the tax treatment of these accounts. Read Viewpoints on Fidelity. Charitable giving The United States tax code provides incentives for charitable gifts—if you itemize taxes, you can deduct the value of your gift from your taxable income limits apply.

These tax-aware strategies can help you maximize giving:. Instead of deferring taxes, you may want to accelerate them by using a Roth account, if eligible—either tax-fere Roth IRA contribution or a Roth conversion. Also, be aware that while your earnings may be subject to taxes and penalties if withdrawn before those conditions are met, your contributions can be withdrawn at any time fjdelity tax or penalty.

The cost of education for a child may be one of your biggest single expenses. Like retirement, there are no shortcuts when it fidelity tax-free investments to saving, but there are some options that can help your money grow tax-efficiently.

Health savings accounts allow you to save for health expenses in retirement. These accounts have the potential for a triple tax benefit—you may be able to deduct current contributions from your firelity income, your savings can grow tax-deferred, and you may be able to withdraw your savings tax-free, if you use the money for qualified medical expenses. Your financial strategy involves fideelity lot more than just taxes, but by being strategic about the potential opportunities to manage, defer, and reduce taxes, you could potentially improve your bottom line.

Portfolio management designed to help you keep more of what you’ve earned. Get a weekly email of our pros’ current thinking about financial markets, investing strategies, and personal finance. Please enter a valid first. John, D’Monte. First name is required. First name can not exceed 30 characters.

Please enter a valid last. Last name is required. Last name can not exceed 60 characters. Enter a valid email address. Email is required. Email address must be 5 characters at minimum. Email address can not exceed characters. Please enter a valid email address. Thank you for subscribing. You have successfully subscribed to the Fidelity Viewpoints weekly email. You should begin receiving the email in 7—10 business days.

We were unable to process your request. Please Click Here to go to Viewpoints signup page. This information is intended to be educational and is not tailored to the investment needs of any specific investor. Keep in mind that investing involves risk. The value of your investment will fluctuate over time, invsstments you may gain or lose money.

Monthly payments may not keep pace with inflation, will fluctuate year over year, and will result in the gradual liquidation of an investment in the fund by its horizon date. As with investmenst mutual fund, withdrawals will reduce the investment balance, and future returns are not earned on amounts withdrawn.

The funds and the SPP may not be appropriate for all investors. Please consult the fund’s prospectus for more details. In general, the bond market is volatile, and fixed income securities carry interest rate risk. As interest rates rise, bond prices usually fall, and vice versa. This effect is usually fidelihy pronounced for longer-term securities.

Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U. Any fixed-income security sold or redeemed prior to maturity may be subject to loss. The municipal market can be affected by adverse tax, legislative or political changes and the financial condition of the issuers of municipal securities.

Although state-specific municipal funds seek to provide interest dividends exempt from both federal and state income taxes and some of these funds may seek to generate income that is also exempt from federal alternative minimum tax, outcomes cannot be guaranteed, and the funds may generate some income subject to these taxes. Residency in the state is usually required for the state income tax exemption. Generally, municipal securities are not appropriate for tax advantaged accounts such as IRAs and k s.

Stock markets are volatile and can fluctuate significantly in response to company, industry, political, ta-free, market, or economic developments. Investing in stock involves risks, including the loss fivelity principal. An investor may have a gain or loss when assets are sold. Find an Investor Center. As with any search engine, we ask that you not input personal or account information. Information that you input is not stored or reviewed for any purpose other than to provide search results.

Responses provided by the virtual assistant are to help you navigate Fidelity. Fidelity does not guarantee accuracy of results or suitability of information provided. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice.

How To Invest Vanguard Roth IRA For Beginners 2019 (Tax Free Millionaire)

Mutual Funds and Mutual Fund Investing — Fidelity Investments

During any given tax year, the manager s of the fund will typically buy and sell several of the stock holdings in the portfolio. Sep 11, Since joining Fidelity Investments inMs. Your personalized experience is almost ready. Building a portfolio suited for your needs is more important than minimizing taxes. Long-Term Bond.

Comments

Post a Comment