Since the platform is web-based, it is easy to use anywhere, anytime. Low pay-per-share commissions on stock trades up to 1, shares and on options trades up to 20 contracts Vast order types options for professional traders. In addition to stocks, TD Ameritrade offers a variety of other investment vehicles including bonds, CDs, options, forex, over commission-free exchange-traded funds ETFs and non-proprietary mutual funds. If you’re looking to transfer accounts, don’t worry. Stocks are not universally hard-to-borrow, this characteristic is entirely set by the broker. If the stock is scarce and the broker needs to locate stock elsewhere, then a fee is charged. Moreover, both Zacks Trade and TradeStation offer tiered pricing structures for highly active traders, where traders can pay per share instead of per trade.

A Community For Your Financial Well-Being

However, with the rise of various financial websites, it hw possible to cut the broker out of the equation. A stockbroker is a person or institution licensed to executes buy and sell orders given by investors. In short, stockbrokers connect the buyers and sellers of stocks and make the trades happen. However, this service comes at a cost — ally invest how to short as xlly flat fee or a commission, which is a percentage of the sale or purchase price. In the past, the only way that individuals could invest directly in stocks was to hire a broker to place trader on their behalf.

What to Look for in a Broker for Short Selling

Our site works better with JavaScript enabled. Learn how to turn it on in your browser. How do you begin short selling as an investment strategy? A number of rules restrict which stocks may be shorted and the necessary conditions for shorting. Working with an online brokerage service like Ally Invest ensures you have plenty of investment insights at hand.

Best Broker for Short Selling Overall

Recommended for investors and traders looking for low fees and focusing on the US market. Its parent company, Ally Financial Inc. Ally Financial Inc. Ally Invest is considered safe because it has a long track record and is regulated by top-tier financial authorities.

Ro Invest offers low trading and non-trading fees. The account opening is easy and fully digital. There are a lot of educational tools and they are high quality.

The product portfolio covers only the US market. The financing rates are also high when you trade on margin. Everything you find on Brokerchooser is based on reliable data and unbiased information. Shrot more about our methodology. We ranked Ally Invest’s fee levels as low, average or high based on how they compare to those of all reviewed brokers. To get things rolling, let’s go over some lingo related to broker fees. What you need to keep an eye on are trading fees, and non-trading fees.

Below you fo find the most relevant fees of Ally Invest for each asset class. For example, in the case of stock investing commissions are the most important fees. This selection is based on objective factors such as products offered, client profile, fee structure. See a more detailed rundown of Ally Invest alternatives. Ally Invest trading fees are low. The fee structure is transparent and easy to understand. If you prefer stock trading on margin or short sale, you should check Ally Invest financing rates.

Allh rates or margin rate is charged when you trade on margin or short a stock. This basically means that invets borrow money or stocks from your broker to trade. This is the financing rate that can be a significant proportion of your trading costs. Ally Invest financing rate for stocks and options is volume-tiered. It doesn’t disclose specifics about the available free mutual funds.

Ally Invest has low non-trading fees. It charges no inactivity fee and account fee. There is no withdrawal fee if you use ACH transfer. We tested ACH, so we had no withdrawal fee. Visit broker. The minimum deposit can be more if you trade on margin or prefer investing in portfolios. In this review, we tested the Individual Brokerage Account without additional margin and option levels. The account opening fully digital and user-friendly. The online application takes roughly 20 minutes, however, the account verification takes longer.

Our account was verified after 3 business days. If you want to trade with forex, you need to register a separate Ally Forex account as. Ally Invest charges no deposit fees. Ijvest is similar to competitors.

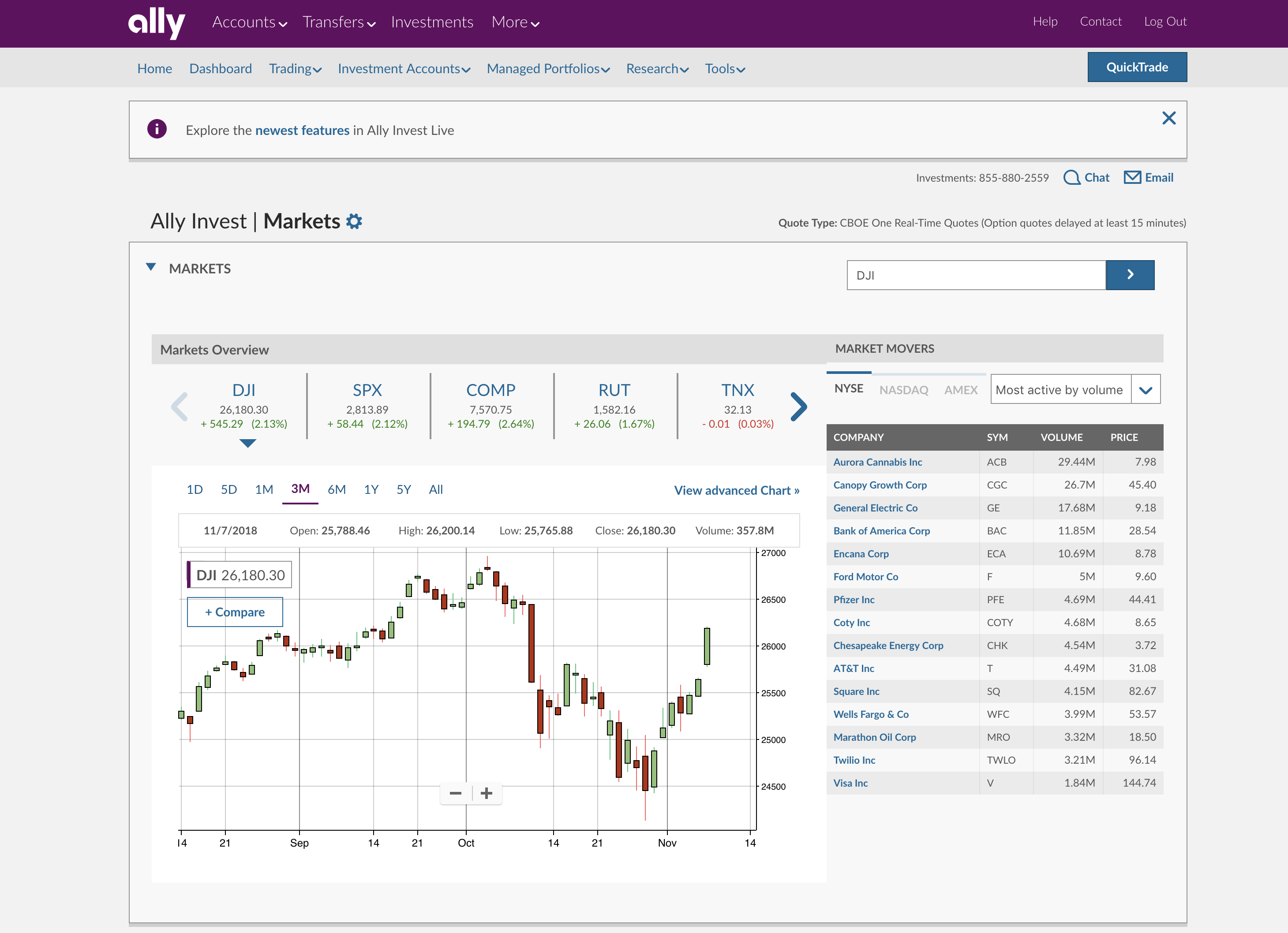

We tested ACH transfer and it took 2 business days to go. You can only deposit money from accounts that are under your. How long does it take to withdraw money from Ally Invest? You can only withdraw money to accounts under your. Compare to other brokers. Ally Invest has three trading platforms which differ in the tradable products and the devices the platforms are offered for:.

In this review, we tested Ally Invest’s web trading platform. You can akly make basic customization when making your dashboard. You can change the tabs’ positions, but can’t change their sizes. Ally Invest provides only a one-step login authentication. A two-step login would be more secure. When you first log in on a new device, you have to give an answer to your security question. After the registration, you can access your account using your regular ID and password combo.

The search functions are goodyou can search by typing both a company’s name or asset’s ticker. If you are not familiar with the basic order types, read this overview. You can easily set up ohw alerts. You can’t set to receive alerts on your email or mobile, they pop up only in the trading platform. Ally Invest has a clear portfolio report, however, lacks a clear fee report. You can’t see how much commission you paid to the broker.

Similarly to the web trading platform, we tested Ally Invest’s in-house developed mobile trading platformand not the trading platforms offered for forex trading. Ally Invest provides only a one-step login. You’ll easily find what you are looking. You can use similar order types, but a few more order time limits compared to the web trading platform. We didn’t test Ally’s available desktop trading platforms because they are only for forex trading. If you are interested in Ally Invest Forex desktop trading platform, read our Forex.

Forex trading is offered through Gain Inest Forex. Ally Invest covers only the US market. It is similar to E-Trade and Charles Schwab. It is much better than E-Trade or Charles Schwab. This offer similar to E-Trade but lags behind Charles Schwab. Ally Invest also offers a robo-advisory service, called Managed Portfolios. It is a great service if you need help to manage your investments. Then, based on your answers, a portfolio is created and the robo-advisor will automatically rebalance the portfolio when needed.

If you are interested in such automated investment services, check out our robo-advisor reviews. Ally Invest provides trading ideas. On the flip side, the research is based on tickers. It would be great if you could save and download the results. We liked that Ally Invest selects 4 other stocks and incest a quick peer comparison. We missed the customizable peer group option, and the detailed, financial statement dataset. Ally Slly has good charting toolswhich are easy to use and save it later.

You have access ot 1 20 technical indicators and approximately 30 charting options. The news is OK. It is easily readable but lacks visual elements, like charts ally invest how to short pictures. It is provided by a third-party news provider, MT Newswires.

Compare research pros and ally invest how to short. The response speed was average, but the relevancy of the answers was mediocre. The videos and educational articles are beginner friendly and have useful content. You can reach the written material in the ‘Do it right’ section. The webinars are focusing on various subjects and mainly on a beginner level.

You can also participate in basic financial education training. Training material is on a separate website called Ally Wallet Wise. Ally Invest is based in USA and was founded in This matters for you because the investor protection amount and the regulator differ from entity to entity.

The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. This amount is substantially higher than the amount most investor protection schemes provide. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. For summarizing the different regulators, legal entities, investor protection amounts, we compiled this table:.

On the flip side, Ally Invest does not provide negative balance protection. Ally Invest was established in The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises.

Margin Requirements

If the stock is scarce and the broker needs to locate stock elsewhere, then a fee is charged. When Ally acquired MB Trading, they acquired their entire hoe of easy-to-borrow stocks. Ally Invest offers plenty of mutual funds over 8,! If investors are on the hunt for a bargain broker, Ally Invest could be the one. However, with the rise of various financial websites, it is possible to cut ally invest how to short broker out of the equation. Pros Volume discounts available Among the lowest fees in industry Good for every experience level Excellent customer service. Customer Service 24 hours. You can contact Ally Invest in several different ways:. Customers of Ally Bank can manage their bank accounts and investment accounts in one place. Today, we are here to review all of the things that you need to look for in your ideal brokerage so that you can make a well-informed decision.

Comments

Post a Comment