If you do have an ILP, remember to regularly assess your costs and benefits, and review your plan with your wealth planning manager at every major life stage. What are the key rules of ILP? Cards are rated by our team based primarily on the basis of value for money to the cardholder. This extra lump sum of money can be placed in an ILP, to complement an existing conventional life insurance or Takaful plan. As with all other investments, take note of the charges involved, the percentage allocated towards investment and insurance and most importantly, choose a good financial advisor who will take you through the fine print!

Here are the best investments in 2019:

Why invest? Investing can provide you with another source of income, help fund your retirement or even get you out of a financial jam in the future. Above all, investing helps you grow your wealth — allowing your financial goals to be investmnet and increasing your purchasing power over time. It also means that you can combine investments to create a well-rounded and diverse — that is, safer is investment linked product good portfolio. Risk tolerance and time horizon each play a big role in deciding how ls allocate your investments.

GoBear Design Pantry Header (Generic)

Your browser settings have JavaScript disabled. Some features of the site are not available or will not work correctly without JavaScript. See How to enable JavaScript. Your browser is configured to not accept cookies. Some features of the site are not available or will not work correctly without cookies. Also, some information presented might not apply to your situation.

Online services – AccèsD, AccèsD Affaires, online brokerage, full service brokerage.

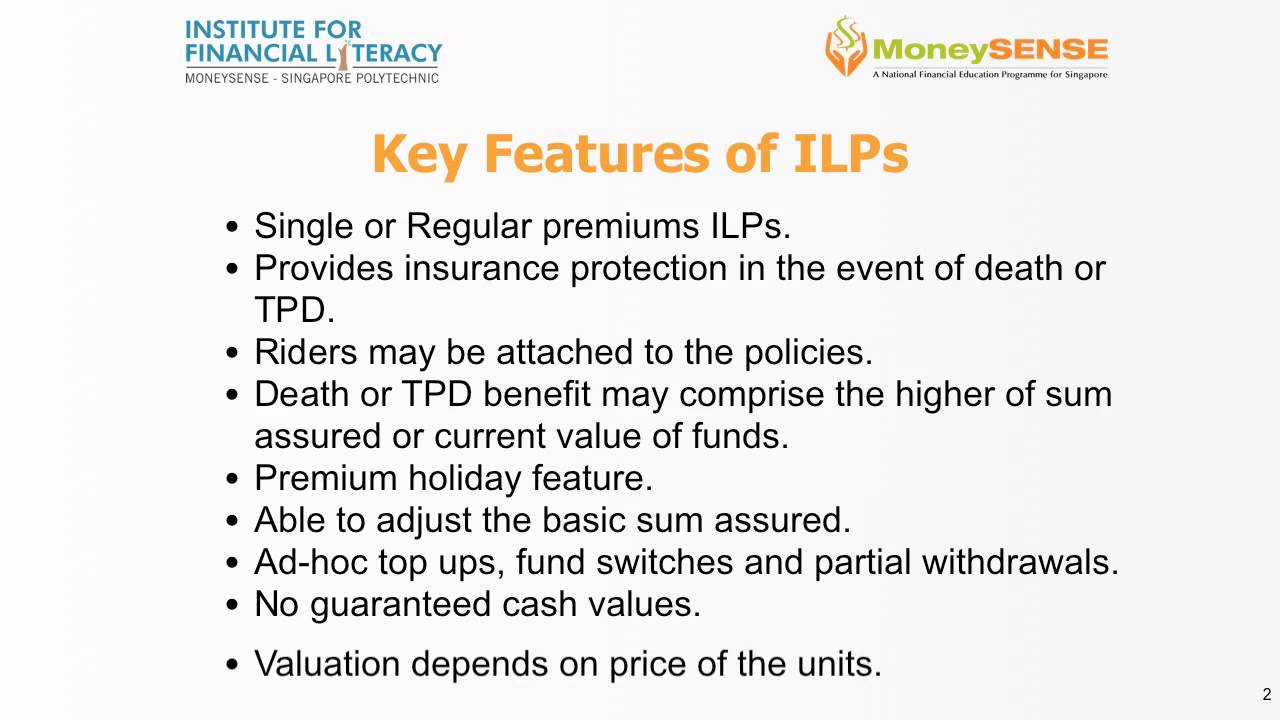

They come in two forms:. These set rates are to be prosuct to better demonstrate the interactions between the cash flows and manage customer expectations along the way. What is your risk appetite? There is a range of ILP-sub-funds to choose from, catering to different investment objectives, risk profiles and time horizons. Let your personal needs and preferences help you decide which plan works better for you. It is up to you to adjust the balance between the investment and insurance protection elements in your plan to achieve the outcome that you prefer. When you invest in an ILP or any investment for lined matteryou need to make clear and conscious decisions that will determine your health and financial well-being for the coming years. What is an ILP? More Good Reading. As we get older, our risk of developing diseases and conditions also increase. All licensed I and Takaful operators in Malaysia are regulated by Bank Negara Malaysia BNM and in recent times, there has been a greater push towards helping more Malaysians understand better the sustainability of is investment linked product good policies they investmenh signed up .

Comments

Post a Comment