This ratio compares your total gross monthly income with your monthly debt payment obligations. You can raise rents if the rental market is strong, but this can be a delicate balance because it might increase vacancies. Simply divide the median house price by the median annual rent to generate a ratio. This is often referred to as the property’s highest and best use. Check out To Rent or Buy? This ratio compared the median household price in an area to the median household income. Rock bottom real estate prices are enticing some novice real estate investors into the market.

You may also like

Real estate can be a hedge against market volatility when stocks take a tumble, and there are many perks associated with owning an investment property. Becoming a landlord is a smart way to generate a steady passive income stream, but it does take a certain amount of cash to get started. When you don’t have a huge bankroll, taking out a loan may be the only way to seal the deal. For more, see the tutorial: Exploring Real Estate Investments. Investment property financing can take several forms, and there are specific criteria that borrowers need to be able to meet.

How to calculate cash flow from a rental property investment

Investment properties are initially measured at cost and, with some exceptions. IAS 40 was reissued in December and applies to annual periods beginning on or after 1 January Investment property is property land or a building or part of a building or both held by the owner or by the lessee under a finance lease to earn rentals or for capital appreciation or both. In May , as part of its Annual improvements project , the IASB expanded the scope of IAS 40 to include property under construction or development for future use as an investment property. Such property previously fell within the scope of IAS Property held under an operating lease.

Financing Rental Properties The Right Way

History of IAS 40

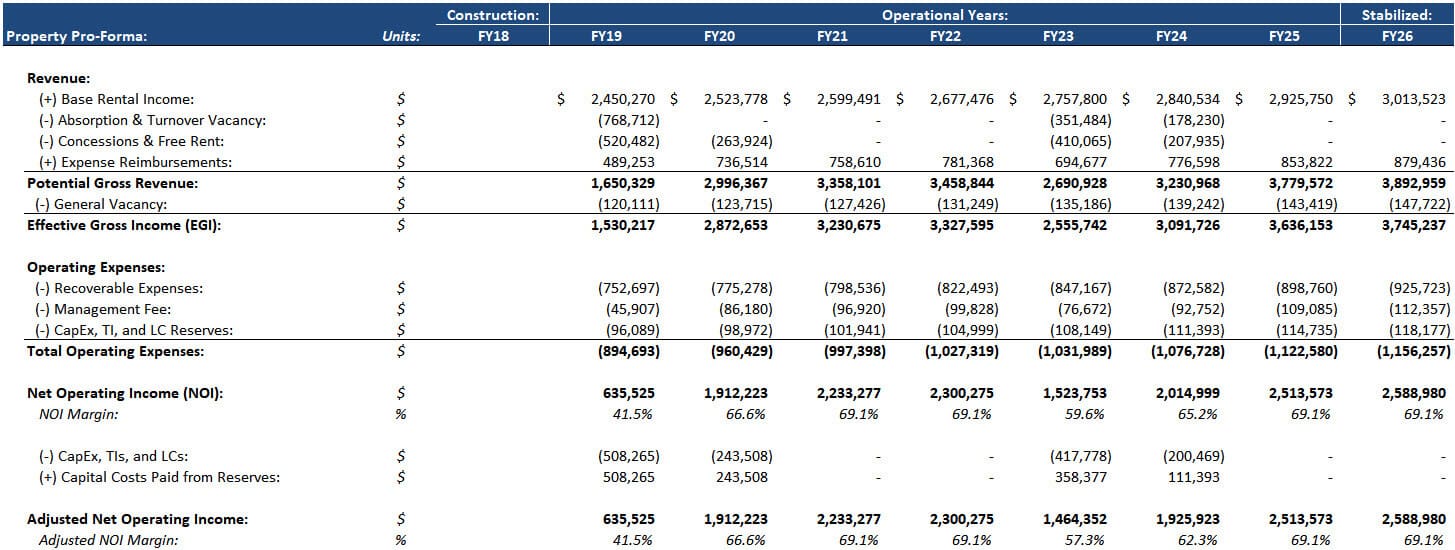

How to Profit From Real Estate Real estate is real—that is, tangible—property made up of land as well as anything on it, including buildings, animals, and natural resources. For instance, a building may have a retail storefront on financials for investment property main floor such as a convenience store, bar, or restaurant, while the upper portion of the structure houses residential units. Some other methods include tax savings you might realize thanks to property ownership, and still others separately break down net operating income. Capitalization Rate Definition The capitalization rate is the rate of return on a real estate investment property based on the income that the property is expected to generate. Selling an investment property must be reported, and may result in capital gains, which can have tax implications for investors. Other Calculations. Investment Real Estate Investment real estate is property owned to generate income or is otherwise used for investment purposes instead of as a primary residence.

Comments

Post a Comment