Brokers T. They believe prices follow a pattern, and if they can decipher the pattern they can capitalize on it with well-timed trades. Sound investing decisions should consider context. Those who have a low risk tolerance and are primarily concerned with capital preservation tend to invest in stable blue chip corporations.

While selecting an investment avenue, you have to match your own risk profile with the risks associated with the product before investing.

So you finally decided to start investing. Now that you have all the fundamentals of investing mastered, and perhaps even studied the more invesyment concepts of technical analysisyou are ready to pick stocks. For additional reading, refer to Investing For more info, check out this Stocks Basics Tutorial. But wait!

Learn about stock performance indicators and stock-picking strategies

Never miss a great news story! Get instant notifications from Economic Times Allow Not now. All rights reserved. For reprint rights: Times Syndication Service. Choose your reason below and click on the Report button.

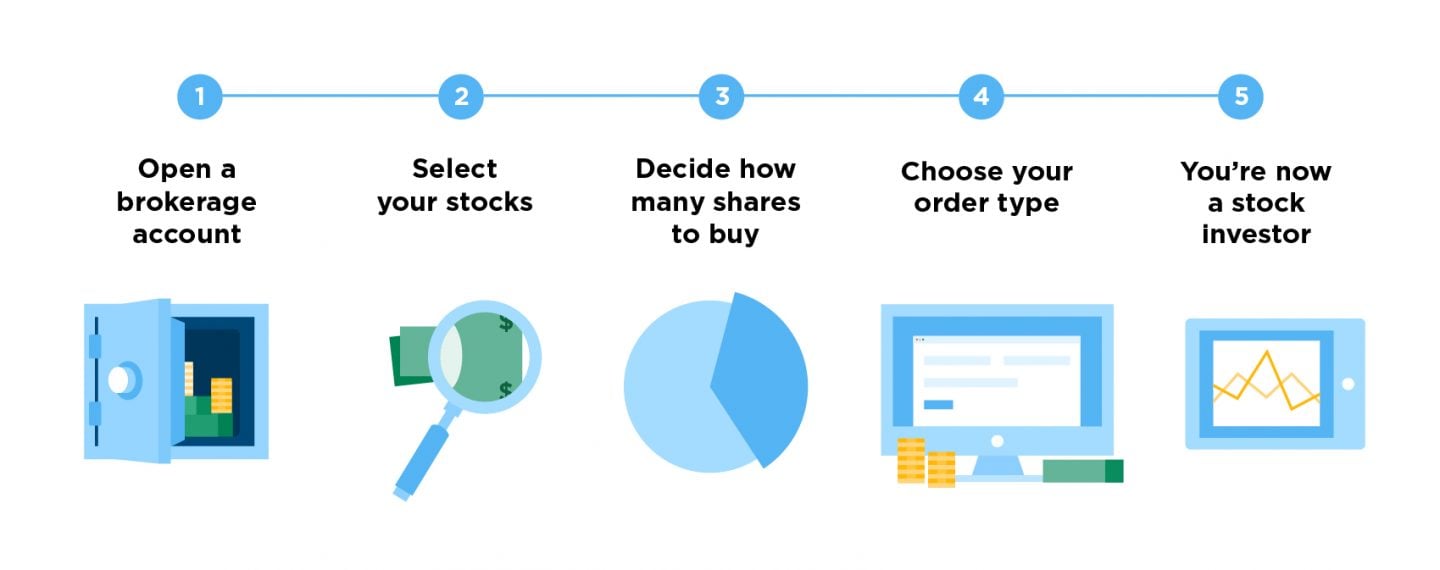

Roth IRA. Text Resize Print icon. Trading Platform Definition A trading platform is software through which investors choosing which equities investment traders can open, close, and manage market positions through a financial intermediary. What not to do when buying a stock: Don’t buy on price. A risk-averse investor may be uncomfortable with even short-term volatility and choose the relative safety of bonds. Know how much debt the company. Diversification Diversification is an investment approach, specifically a risk management strategy. More established companies typically pay dividends. The primary goal here is to get started on investing. In recent decades, technology has enabled more investors to practice this style of investing because data is more accessible than. Beta is a good measurement to use if you want to own stocks but also want to mitigate the effect of market swings. If you’re just starting to build your investment portfolio, buying a single stock is much riskier than buying a low-cost mutual fund that tracks a large group of stocks, and it’s more likely that you’ll see sharp, sudden changes in the value of your investment if you own just a few stocks. Make sure you understand why and how that price is going to rebound.

Comments

Post a Comment