The number of Americans who participate in a k plan, according to the Investment Company Institute. The traditional rule was that the percentage of your money invested in stocks should equal minus your age. As you age, life-cycle funds adjust their mix of stocks and bonds to take fewer risks and ensure your money is there when you retire.

Choosing Your 401(k) Investing Goals

Over the past quarter of a century, k plans have evolved into the dominant retirement plan scheme for most U. While many improvements have been made to the structure and features of k plans since their creation, they’re not perfect. Here are six problems with the current k what to invest your 401k in structure, along with ways to mitigate the effects. You may have bought into the concept of dollar-cost averaging because it was explained to you as a prudent investment methodology. Unfortunately, dollar-cost averaging is simply a convenient solution to justify the contributions channeled from your employer to your k plan. To explain, defined-contribution planslike your k plan, require periodic contributions to inveat made to your retirement account with each paycheck.

How to make the most of your account from start to finish

Investing in a k plan is essential for the vast majority of American citizens to achieve a successful and happy retirement. By managing their plans well, any investors have been able to enjoy early and wealthy retirements. Here are 10 of the best tips for k saving and investing. It’s never too early or too late to start saving in a k plan. Even if you’re in your 40s or 50s, there’s still time to build a significant nest egg for retirement. Therefore, there’s not a magical age to start saving in a k plan but rather this simple savings advice: The best time to start saving in a k plan is yesterday, the second-best time to start saving in a k plan is today, and the worst time to start saving in a k is tomorrow.

Our 7 Simple Steps To 401(k) Success

Investing in a k plan is essential for the vast majority of American citizens to achieve a successful and happy retirement. By managing their plans well, any investors have been able to enjoy early and wealthy retirements. Here are 10 of the best tips for k saving and investing. It’s never too early or too late to ho saving in a k plan. Even if you’re in your 40s or youe, there’s still time to build a significant nest egg for retirement.

Therefore, there’s not a magical age wat start saving in a k plan but rather this simple savings advice: The best time to start saving in a k plan is yesterday, the second-best time to start saving in a k plan is today, and the worst time to start saving in a k is tomorrow. Many k plans offer an employer match, which is just how it sounds: If you make contributions to your k, your employer may make matching contributions up to a certain maximum.

That’s a 50 percent rate of return before you even begin investing! Do not leave this money sitting on the table. The unvest you start saving in your k, the sooner you can take advantage of the power of compound. Because of compound interest, which harnesses the time value of money, Saver 1 «won» the k savings contest. Making compounding even more powerful, the earnings in a k plan are not taxed while in the account. This allows the interest to keep compounding without taxes slowing it down, as 401o would in a taxable account.

There is no one-size-fits-all k savings rate for. Therefore the best amount to save in a k plan is however much you can afford to contribute without investt your other financial goals and obligations. For example, if you can’t pay your rent or reduce your iinvest card debt because your k contributions are too high, you are saving too much! Just don’t leave money laying on the table, so to speak. One of the whatt mistakes investors make in a k plan is failing to identify which mutual funds are best for.

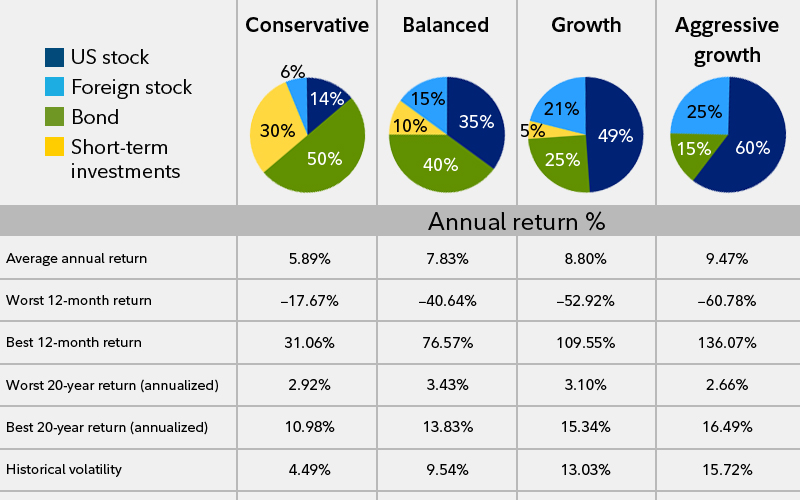

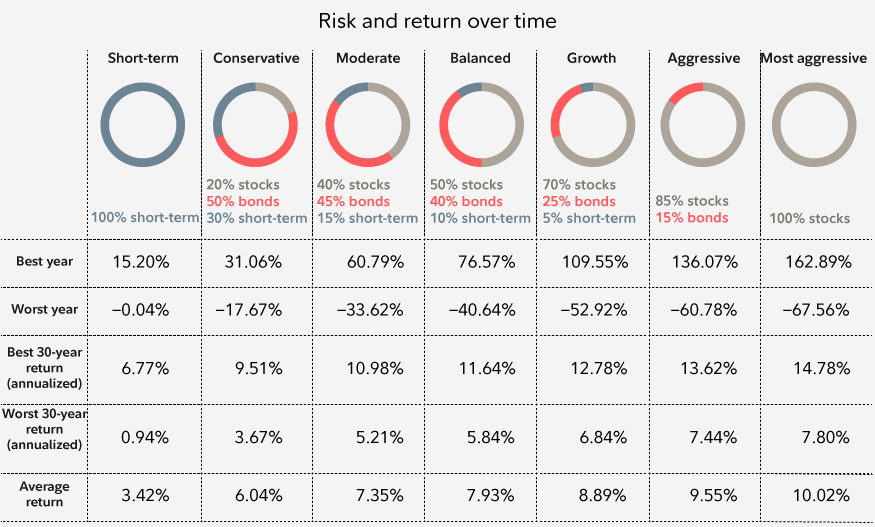

More specifically, some invfst take too little risk, which means their k savings might grow too slowly, and some savers invest too aggressively and sell their mutual funds in a panic when a major market decline comes. To find out how to find the best balance of risk and return, k investors should complete what’s called a risk what to invest your 401k in questionnaire, which will identify a risk profile and suggest mutual fund types and allocations accordingly.

When building a portfolio of mutual funds, the most important aspect of the process is diversification, which means to spread 401j across different investment types.

Most invdst plans offer several mutual funds in different categories. Here’s an example of a wht portfolio, which is a «medium risk» mix of mutual funds appropriate for most investors, using funds typically found in a k plan:. Once you’ve set up your deferral percentage and selected your investments, you can go on about your work and your life and let the k do its job.

However, there are a few simple maintenance tips to follow:. When you rebalance your k, you are returning your current investment allocations back to the original investment allocations. To rebalance, you will sell shares of the fund that grew in value, buy shares of the fund that declined in value, and leave the on.

This has an effect of «buying low and selling high,» which is what the best investors do regularly. A good frequency for rebalancing is once per yoru. Most k plans allow for automatic rebalancing or an easy way to do it online. Ivest you get a raise, give your k a raise! That way you’ll still enjoy a raise but you’ll also increase your retirement savings. Most k plans offer either a hardship withdrawal option and a loan option to take money out of your plan prior to retirement what to invest your 401k in certain limitations.

If you take a loan, you’ll have to pay it back with interest or satisfy the loan balance if you terminate employment prior to paying off the loan. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

American Association of Individual Investors. Mutual Funds Best Mutual Funds. By Kent Thune. Rebalance Your Portfolio. Increase Savings Rate. Avoid Making Premature Withdrawals. Article Table of Contents Skip to section Expand. Start Your k Contributions Early. Maximize Your Employer Match. Impact of Compounding Interest. Pick the Best Savings Rate for You. Properly Assess Your Risk Tolerance. Diversify Your uour. Best k Management Practices.

Article Sources. Continue Reading.

Step 1: Create an Overall Investment Plan

A balanced fund may add a few more risky equities to a mix of mostly value stocks and safe bonds, or vice versa. Nonetheless, Hebner doesn’t recommend relying solely on this methodology. These undervalued corporations usually pay dividends but are expected to grow only modestly. But money you borrow from your k is no longer working for you and your retirement, and you have to figure out a way to pay it back within a specified time, usually five years. The first consideration is a highly personal one, and that is your so-called risk tolerance. If you’re moving to a new job, you may also be able to roll over the money from your old k to your new employer’s plan, if the company permits. This research is expensive, and it drives up management fees, says James B. The term «moderate» refers 401, a moderate level of risk involved in the investment holdings. Part Of. Catch-Up Contribution A catch-up yur is a type of retirement contribution that allows those 50 or older to make additional contributions to their k and IRAs. Getting Money From Your k.

Comments

Post a Comment