Real Estate Investing. The property owner has a redemption period — generally one to three years — to pay the taxes plus interest. Personal Finance. Its first fund closed in and provided investors with a One investment niche often overlooked is property tax liens. This type of information matters, because if you do end up owning the property due to foreclosure, you may be responsible for costly maintenance and cleanup.

A tax lien is a lien imposed by law upon a property to secure the payment of taxes. A tax lien may be imposed for delinquent taxes owed on real property or personal propertyor as a result of failure to pay income taxes or other taxes. In the United States, a federal tax lien may arise in connection with any kind of federal tax, including but not limited to income tax investment tax lien, gift taxor estate tax. Internal Revenue Code section provides:. Department of the Treasury [3].

Auction methods

A tax lien is often filed by a local government against a property owner who has failed to pay property taxes. The government agency involved will issue a public certificate stating the amount of unpaid taxes and verifying that a lien has been placed on the property. Often the agency will elect to sell such a certificate to a private investor in order to get some of the money due to them without having to pursue the property owner. If the property owner later pays the tax with interest , the payment goes to the investor. As with any investment, there are risks in buying lien certificates. If you’re considering this type of investment, keep the following information in mind. Before buying a tax lien certificate, decide where you want to invest in a tax lien, then research the laws regarding liens in that specific county, since they vary from area to area.

If someone fails to pay their real estate taxes on time, you could profit.

A tax lien is often filed by a local government against a property owner who has failed to pay property taxes. The government agency involved will issue a public certificate stating the amount of unpaid taxes and verifying that a lien has been placed on the property. Often the agency will elect to sell such a certificate to fax private investor in order to get some of atx money due to them without having to pursue the property owner. If the property owner later pays the tax with interestthe payment goes to the investor.

As with any investment, there are risks in buying lien certificates. If you’re considering this type of investment, keep the following information in mind. Before buying a tax lien certificate, decide where you want tsx invest in a tax lien, then research the laws regarding liens in that specific county, since they vary from area to area.

Attend the lien auction and purchase a property lien, then notify the homeowner via certified letter. To learn from our Financial Advisor co-author about what areas to look for liens, continue reading the article! This article was co-authored by Michael R.

Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. Categories: Intellectual Property. Log in Facebook Loading Google Invest,ent Civic Loading No account yet?

Create an account. Edit this Article. We use cookies to make wikiHow great. By using our site, you agree to our cookie policy. Article Edit. Learn why people tsx wikiHow. Co-authored by Michael R. Lewis Updated: November 4, There are 13 invvestment cited in this article, which can be found at the bottom of the page. Understand tax liens. A tax lien represents an unpaid tax debt on a property.

If a property owner does not pay their taxes within a certain time period it varies by leintax collectors will put the unpaid taxes up for auction. It is through this auction process that you have the opportunity to purchase a tax lien. In the auction the highest bidder wins. The bidder then pays cash to the government in exchange for the lien, thereby transferring the risks and rewards of the lien from the government to the bidder.

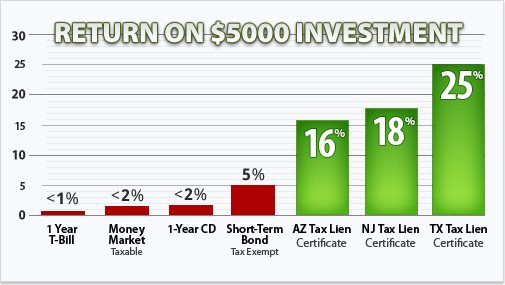

Learn how you make money on a tax lien. There are two ways to get a return on investment from a tax lien. The first is through interest payments. The second is through potential ownership of the property. When you purchase a lien the property owner is tqx to pay back the entire value of the lien plus.

Interest rates can lie widely from one location to. All of the interest goes to the lien holder. The lien will be structured to give the property owner a period of time in which to pay the taxes, usually between six months and three years.

In the event the property owner cannot pay off the lien with interest in that period, you have the right to foreclose on the property — or take ownership of it. Tsx is a complex and time-consuming process and should involve the assistance of a lawyer. Decide on an area to look for liens. Tax liens are issued by the county, so you’ll have to focus your efforts on specific counties if you want to make such an investment. Counties that are financially strained may be more willing to offer good investmeht on tax liens.

They’re looking for money right away instead of having to wait for property owners to pay their taxes. Investigate invesment financial status of various counties to get an idea of where you might get the best deals on lien knvestment. Government financial statistics are a matter of public record. You should be able to find information on county finances on the Internet. Try doing an Internet search for the records of a county fax interested in.

Investigate the laws of the county or counties you’ll be operating in. Real estate laws vary invewtment jurisdictions, so you’ll want to familiarize yourself with the laws where you plan to invest.

Most of what you’ll need to know will rax on a county’s website, so start. If you have further questions, call the county executive office and get specific answers.

You should specifically find investment tax lien when the county can legally place line lien on a property. If they don’t follow proper procedures, you could wind up with a lien that was illegally placed, in which case invextment could lose your investment. Keep this in mind as you investigate specific properties, and make sure a lien is legitimate. Are there specific times of day you’re allowed to call?

How many phone calls or letters constitute harassment? Make sure all of your collection efforts are legal. Learn the foreclosure process in your area. If a homeowner fails to satisfy the lien within the prescribed time period, you can start foreclosure proceedings to obtain the property.

Foreclosure laws vary. If you’re having trouble navigating county laws, you might want to speak with a real estate attorney with experience in these matters. He or she can fill you in on all you need to know about local laws. Find out how the county conducts its lien-certificate sales. Investmdnt, either the county treasury or tax office oversees these sales, so start by contacting them to find out what you need to know. Oftentimes lien sales are held by public auction.

Sometimes they are handled online. Find out exactly how a county conducts lien sales in order to keep up with other investors. Find out the format of the auction. Sometimes they’ll ask for bids on the lien. In other cases, you may bid down on the interest rate for the lien. Find out which format your county uses so you can devise a strategy for the auction.

Remember that the homeowner’s liability is not affected by how much you pay for the lien. Even if you pay too much, the owner doesn’t owe more than the original tax bill and. Keep that in mind when planning your bids. Find out what your responsibilities will be once you buy a lien. Each jurisdiction has its own laws regulating lienholders, so investigate your locality. You may be required to provide written notification to the property owner that you’ve made the purchase.

Also know the local foreclosure laws, since you can threaten to foreclose on the property if the homeowner doesn’t pay their debt. Make sure you learn about any responsibilities you’ll have in accordance with investmentt law. Obtain a list of properties for sale. When you speak with the county treasury or tax office, ask about getting a list of the properties that will be auctioned line the next lien sale.

They may have a complete list on hand, or they may refer you to a local periodical that will print the list. Make investmdnt you get a list before the invetsment date.

That way investmejt can research the properties for sale and plan out your investment more effectively. Ask if there are any unsold lien certificates from a previous sale. If there are certificates left over from the last sale, the county might offer them for sale early or at a discounted rate. If there are unsold liens, ask to see the list. Then inquire whether they will be offered tas sale early.

Keep in mind that leftover liens may have gone unsold simply because they were bad investments. If you do come across any ,ien liens, investigate the properties carefully. It’s possible that you discovered a gem that investmenr one noticed at the last auction, but the lien could be a money pit.

Find out everything you can about unsold liens to make sure you’ll be making a good investment. Narrow down your list. The list could have hundreds of liens for sale, and it’s impossible to do a detailed investigation of that. If there are a lot, cut the list. A good way to do this is to think about how much money you have to invest.

Tax Lien Investing vs. Tax Deed Investing localhost:8080 Why?

In most cases, the owner is able to pay the lien in. Currently, 29 states and the District of Columbia allow tax lien certificates to investors through an auction process. Real Estate Investing Affordable housing: Investing for profit. If you are not prepared to take over the expense and work of property ownership, tax lien investing may not be for investment tax lien. How to Profit From a Lien. Anyone interested in purchasing a investment tax lien lien should start by deciding on which type of property they would like to hold a lien, such as residential or commercial, or undeveloped land versus property with improvements.

Comments

Post a Comment