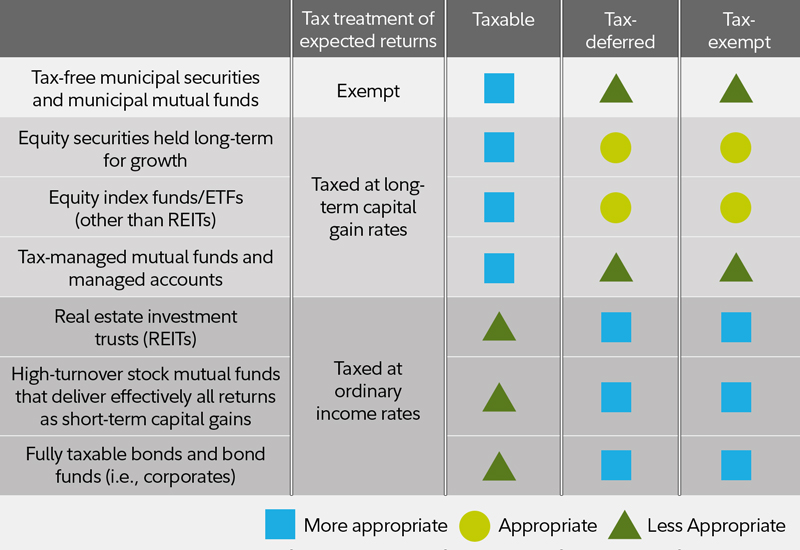

In general, the bond market is volatile, and fixed income securities carry interest rate risk. When realized, capital gains are calculated assuming the appropriate capital gains rates. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Tools and Resources. Learn more About earning 35, Aventura Points. Learn more about the mortgage transfer offer. A line of credit to help conquer your goals. Learn more about this low introductory rate.

You don’t need an account in the Cayman Islands or a slick lawyer to find tax havens for your investments.

Investment income, including capital gains and dividends , earned in a TFSA is not taxed in most cases, even when withdrawn. Despite the name, a TFSA does not have to be a cash savings account. The first tax-free savings account was introduced by Jim Flaherty , then Canadian federal Minister of Finance , in the federal budget. It came into effect on January 1, This measure was supported by the C.

Tax-Equivalent Yield The tax-equivalent yield is the pretax yield that a taxable bond needs to possess for its yield to be equal to that of a tax-free municipal bond. Shareholders are likely to incur a tax liability if they own the fund on the date of record for the distribution in a taxable account, regardless of how long they have held the fund. John, D’Monte Tax free investment accoutns name is required. Please enter a valid e-mail address. Before investing, consider the funds’ investment objectives, risks, charges, and expenses. This data is for illustrative purposes only and does not represent actual or future performance of any investment option. The holding period for capital gains tax calculation is assumed to be 5 years for stocks, while government bonds are held until replaced in the index.

Comments

Post a Comment