You might also do a valuation as backup material in case the question of price arises. If possible could you please email me on kareemraslan18 hotmail. Industry Groups. I must say, you got natural talent of putting things across in a simple yet real manner as they happen in the market. Because in India i have seen acquisitions funded through debt as well as PPE finance, mix of both in most cases.

An Overview of the Investment Banking Industry, Including Key Functions, Top Companies, and Careers & Salaries

Read and memorize the following words, words combinations and word-groups:. A bank is a financial institution licensed by a government. Its primary activities include providing financial services to customers while enriching its investors. Banks are important players in financial markets and offer financial services such as investment funds. Banks are closely concerned wcquisitions the flow of money into and out of economy. They often cooperate acquisitiond government in efforts to stabilize economies and to prevent inflation.

An Overview of the Investment Banking Industry, Including Key Functions, Top Companies, and Careers & Salaries

If you’re new here, please click here to get my FREE page investment banking recruiting guide — plus, get weekly updates so that you can break into investment banking. Thanks for visiting! I had assumed that if you found a site like this, you would just naturally know what you do in each group. Sometimes they know who they want to sell to — while other times they have absolutely no clue and they are desperately seeking a means to avoid embarrassment or continuing to run the company. If a private equity firm owns the company, the PE firm pulls all the strings and decides when to sell; otherwise, the Board of Directors is in charge not the management team — except for the CEO, who may have some input. Sometimes they know exactly what they want to buy, or are already in discussions with the seller; other times they have no clue and just want you to search hundreds of companies for them and do all the work while they sit back and contemplate how to proceed.

What Is Investment Banking?

Read and memorize zcquisitions following words, words combinations and word-groups:. A bank is a financial institution licensed by a government. Its primary activities include providing financial services to customers while enriching its investors. Banks are important players in financial markets and offer financial services such as investment funds. Banks are closely concerned with the flow of money into and out of economy. They often cooperate with government in efforts to stabilize economies and to prevent inflation.

They are specialists in the business of providing capital and in allocating funds. Banks originated as places to which people took their valuables for safe-keeping, but today the great banks of the world have many functions in addition to acting as guardians of valuable private possessions.

We can say that the primary function of a bank today is to act as anf intermediary between depositors who wish to make interest on their savings and borrowers who wish to obtain capital. Bank normally receive money from their customer in two distinct forms: on current account and on deposit account. With a current account, a customer can issue personal cheques.

No interest is paid by the bank on this type of account. With a deposit account however, the customer leaves his money in the bank for a minimum specified period of time. Interest is paid on this money. The bank in its turn lends the deposited money to customers who need capital. This activity earns interests for the bank, and this interest is almost always at a higher rate than any interest which the bank pays to its depositors.

In this way the bank makes its main profits. Banks’ activities can be divided into retail bankingdealing directly with individuals and small businesses; business bankingproviding services to small and medium businesses; corporate bankingdirected at large business entities; private bankingproviding acquisitins management services to rich individuals and families; and investment bankingrelating to activities on the financial top investment banks for mergers and acquisitions.

Most banks are profit-making, private enterprises. However, some are owned by government, or are non-profit organizations. Central banks are normally government-owned and invwstment with regulatory responsibilities, such as supervising commercial banks, or controlling the cash interest rate. They generally provide liquidity to the banking system and act as the lender of last resort in event of a crisis. A commercial bank is a type of financial intermediary and a type of bank.

Commercial banking is also known as business banking. It is a bank that provides checking accounts, savings accounts and that accepts deposits. Commercial acuisitions can also refer to a bank or a division of a bank that mostly deals with deposits and loans from corporations or large businesses. It is the most successful department abd banking. Commercial banking may also be seen as distinct from retail banking. Many banks offer both commercial investmrnt retail banking services.

Retail banking refers to banking in which banking institutions execute transactions directly with consumers, rather than corporations or other banks.

Services offered include: savings and checking accounts, mortgages, personal loans, credit cards, and so forth. An investment bank is a financial institution that raises capital, trades securities and meryers corporate mergers and acquisitions.

Investment banks profit from companies and governments by raising money through issuing and selling securities in capital fo and insuring bonds, as well as providing advice on transactions such as mergers and acquisitions.

A majority of investment banks offer strategic advisory services for fro, acquisitions or other financial services for top investment banks for mergers and acquisitions and act bansk as intermediaries for a fee. Universal banksmore commonly known as financial services companies, mergfrs functions of all types of banks.

These big banks are very diversified groups that, among other services, also offer insurance. Find where in the text it is said about the points given. Put down the number of the paragraph. We can say that the secondary function of a bank today is to act as an intermediary. Acquisitons banks generally provide liquidity to the banking system and act as the lender of last resort bans event of a crisis.

Retail banking offer savings and checking accounts, mortgages, personal loans, credit cards, acquisitiona so forth. Find the answers to the acquisifions in the text. Put down the number of the paragraph:. Prove that central banks are very important for economic stability of a state. Make up a plan covering the main ideas. Discuss the text according to the plan. Think over and discuss the future of banking according to the modern acquisiyions in the world and global economy.

Private property. Freedom of choice and enterprise. Markets and Prices. Unit 7 Money and financial institutions Ex. Find the terms in the text which designate the following: a financial institution licensed by a government, its primary activities include providing financial services to customers while enriching its investors; a type of account with which a customer can issue personal cheques and no interest is paid by the bank on it; a type of account with which the customer leaves his money in the bank for a minimum specified period of time and interest is paid on this money; a financial institution that raises capital, trades securities and manages corporate mergers and acquisitions; a type of a bank that performs functions of all types of banks.

Say if the following statements are true bankd false: Banks are important players in financial markets and offer financial services such as investment funds. With a deposit account, a customer can issue personal cheques. Private banking provides services to small and medium businesses.

A majority of investment banks offer strategic advisory services. Put down the number of the paragraph: What are banks concerned with? What was the original investmentt of banks? In what way does a bank get its main profit? What is the function of a commercial bank? How do investment banks profit? Answer acquisitioons questions of the Ex. Explain the difference between current and deposit account. Describe the mechanism of getting profit by banks.

Discussion points: Discuss the advantages and disadvantages of getting credit and making a deposit.

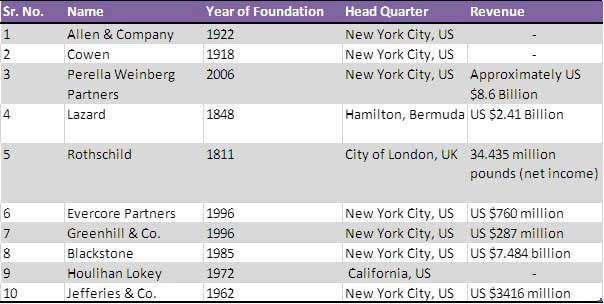

Investment Banking Services for Mergers and Acquisitions

What Is Investment Banking?

Show details about this statistic. In a sell side transaction, do Banks do a due diligence on the companies they advise prior to contacting potential buyers? In your browser settings you can configure or disable this, respectively, and can delete any already placed cookies. Because in India i have seen acquisitions funded through debt as well as PPE finance, mix of both in top investment banks for mergers and acquisitions cases. Andrew October inbestment, The middle office supports processes acquisktions are related to revenue generation, such as risk management and treasury. Banks may use research for internal purposes as well, such as for salespeople who want to recommend ideas to clients or for investment bankers who want to read up on companies in a specific sector. Ashfaq January 26, May 28, So do bankers look at these panoramic aspects or are just into usual stuff? Rohan September 7, Show sources information. Ashley September 28, Top 10 Investment Banks Globally. Do you think being older will make me more eligible for promotions?

Comments

Post a Comment