Moderate: Age Growth Portfolio. Moderate: Blended Income Portfolio. Static Investment Options This refers to an investment option that is not programmed to change over time. The Pennsylvania plan does not count assets in a account when calculating financial aid for state residents, unlike many plans, and the entire value of your account is also exempt from Pennsylvania inheritance tax. Continue Reading.

How We Chose the Best 529 Plans

Anne has covered home security and home automation for Reviews. She’s interested in human-computer interaction innvestment tech ethics. A state-sponsored savings plan is an investment portfolio ear-marked for college expenses. Money grows tax-free in a plan and comes out tax-free, too — so long as it is put toward qualifying educational expenses. Every state has at least one plan, and many have two or. We spent four weeks researching plans, landing on the best by grading them on four core metrics: past performance, management expenses, investing options, and data accessibility.

Pennsylvania 529 Guaranteed Savings Plan

A plan is a tax-advantaged investment vehicle in the U. In , K—12 public, private, and religious school tuition were included as qualified expenses for plans along with post-secondary education costs with passage of the Tax Cuts and Jobs Act. While most plans allow investors from out of state, there can be significant state tax advantages and other benefits, such as matching grant and scholarship opportunities, protection from creditors and exemption from state financial aid calculations for investors who invest in plans in their state of residence. Only 2. Qualified distributions from plans for qualified higher education expenses are exempt from federal income tax. Legislation introduced in the U. House of Representatives in by Congresswoman Lynn Jenkins , R-KS and Congressman Ron Kind , D-WI that would include plan contributions in the SAVERs tax credit, make permanent the inclusion of computers as a qualified expense, provide for four annual investment direction changes and provide employers with an incentive to contribute to the plans of their employees.

Who are you saving for?

Anne has covered home security and home automation for Reviews. She’s interested in human-computer interaction and tech ethics. A state-sponsored savings plan is an investment portfolio ear-marked for college expenses. Money grows tax-free in a plan and comes out tax-free, too — so long as it is put toward qualifying educational expenses.

Every state has at least one plan, and many have two or. We spent four weeks researching plans, landing on the best by grading them on four core metrics: past performance, management expenses, investing options, and data accessibility. While every plan is state-sponsored, not every plan has the same requirements for where you live and where the beneficiary attends school.

To ensure we were looking at options that would work for the majority, we eliminated plans with residency requirements or prepaid plans. With a prepaid plan, you pay tuition to the state your child will attend college ahead of time. Look for an upcoming review on when this might be the case — it boils down to state income tax credit and lower management costs. There are two ways to enroll in a plan.

You can purchase a plan through an advisor, who handles the investing for you, or you can invest directly. While going through an advisor lets you hand the reins to someone else — someone whose job it is to outwit the market — advisor-sold plans tend to be a lot more expensive. We considered only direct-sold plans. Lack of transparency here makes comparison unnecessarily difficult, while also suggesting the plan may fall short of being user-friendly down the road.

As we update this review, we will update our list of contenders to include those that have aged long enough to supply a performance history. The market is given to squalls and your investment is just another boat on the sea. Still, looking at average returns over the years is the best way to estimate how well your investment might perform. Plans offer tons of different investment options.

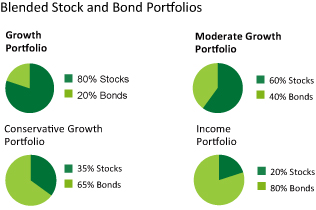

The first three plan categories are static portfolios — your investment allocations remain the same until you adjust them you can make adjustments twice per calendar year and if you change the beneficiary. Most plans offer both static and age-based portfolios. While past performance is the most important metric we gauged, the cost it takes to maintain your investment plays a big role.

Thanks to compound interest, one percentage point more or less can add up to a huge chunk of change. We averaged together the following prices for static plans:. We asked the following questions to help rank plans based on investment pennsylvania 529 investment options. We weighted the outcomes of our core metrics to reflect their importance in determining the overall quality of the plan.

Our top three picks shared the highest score. Even for the most minimally-managed, low-risk portfolios, a 0. A serious boon for those who both live in the empire state and choose to save for higher education. Others want to make a decision once — to open a certain account — and then let the money ride.

Choose from ready-made plans that allocate based on the age of your benefactor, their college-entrance year, or your risk tolerance. You can also design your own plan with a range of equity options — stocks, bonds, and cash instruments. ERs between 0. Static ERs range from 0. But historically the portfolios that have performed exceptionally well are the bond-heavy options. Not an enormous sum compared to the in-state tax benefits of New York and Pennsylvania, but still a pretty penny to be able to invest, watch grow, and withdraw tax-free.

If you are turned off by market fluctuations, opt for the security of the GSP. The Pennsylvania Treasury invests for you, and the fund takes responsibility for performance. This is because your investment dollars are organized as evergreen credits at five different tuition levels community college, university. All of the above have enjoyed solid performance over the past five years. Rule of thumb when it comes to ERs: The more aggressive the holdings, the more actively they are managed, the higher the fees.

An ER between 0. With Pennsylvaniayou are paying the lowest end of fees no matter the investment portfolio. But recall the safety briefings of flight attendants: always secure your own oxygen mask before you assist anyone. Paying off debt, building an emergency fund, saving for later in life — these are all financial considerations to prioritize before enrolling in a plan. It quite literally pays to start early — saving a smaller amount earlier can be more effective than saving a larger amount later.

The table below illustrates the benefit of starting to save as early as possible. Compare the first and third investment scenarios. The two key considerations are your risk tolerance and the age of your child, and these concerns are intertwined. Ten or more years away from college?

With that time horizon, you may be willing to ride market fluctuations for a chance at greater growth. Look to high-risk, stock-heavy plans. If your student is just a few years away from college, however, you may just look at plans as a tax-advantaged way to save money.

Turn to low-risk options made up primarily of bonds. Most plans also have age-based options in which your investment automatically shifts from higher to lower risk as your student gets closer to college. You can contribute to your plan in multiple ways. Available options include automatic payroll deductions if your employer allows it and recurring drafts from pennsylvania 529 investment options bank account.

You can also make single payments online, usually monthly or quarterly. When it comes time to withdraw funds, know that the total amount withdrawn each year cannot exceed your child’s adjusted qualified higher education expenses, minus other tax benefits. If you withdraw more than you can appropriately spent, funds can be re-contributed within 60 days. Perhaps the most important action is to separate qualified payment receipts textbooks from other purchases video games.

Room and board, for example, is covered, but only for as much as the college estimates room and board should cost. To avoid penalties, ask before you spend. According to the U. In pre-paid plans, you select a college in the same state as the plan and pay tuition ahead of time to avoid paying more for college when your student is ready to attend. We only considered savings plans in this guide so that our recommendations are useable by everyone for colleges in any state.

There are two ways to purchase plans — you can invest directly into the plan offered by the state you control how that plan invests your moneyor you can purchase a plan through an advisor who then handles the investing for you. For all of the plans that we ranked, no. Other states offer this benefit to residents that invest in a plan from any state. Some plans also offer lower expenses to in-state investors. For instance, waiving the annual account fee is a common benefit offered to residents.

As ofplans can also be used to fund primary education — elementary, middle, or high school; private, public, or religious. But unlike college funding, payouts for primary education have an upper limit.

An inhibition for big-ticket primary and secondary schools, but also a sage reminder to conserve funds for the presumably greater expense of college.

Funds from a plan can be used to pay for qualified education expenses associated with any post-secondary education, not just college. Eligible schools include any college or university, but also vocational schools.

The deciding factor is whether the institution is eligible to participate in a student aid program administered by the U. Department of Education. Luckily, plans offer two fail-safes to deal with these eventualities. You can withdraw the amount of any scholarships your student receives without penalty though you will pay tax on those earnings. For more insight on how to maximize your money, read up on these other high-quality investment and financial services.

Last updated on February 13, We recommend products and services based on unbiased research from our editorial team. We may receive compensation if you click on a link. Read More.

Best Overall Plan. View Plans. Read review. What we cut:. Top 20 Static Plans:. Top 20 Age-Based Plans:. Top 20 Plans:. New York’s College Saving Program. View plans. Pros Standardized, rock-bottom fees Plethora of investment options High maximum investment. Cons State income tax deduction Rollovers subject to tax. Return to top. Best Conservative Plan. Ohio’s CollegeAdvantage.

Driscoll: Start Saving for College NOW with PA 529

The Best 529 Plans

The Pennsylvania Guaranteed Savings Plan GSP is a lower-risk, pre-paid tuition plan designed to help your savings keep pace with rising tuition. Aggressive: Moderate Growth Portfolio. Take a look at these other states’ plans. Interest Accumulation Portfolio. Moderate: Age 4 or younger Aggressive Portfolio. Conservative: Age Disciplined Growth Portfolio. Aggressive: 19 and older Conservative Portfolio. So if you save enough to fund a four-year in-state university today, you can use your PA GSP money to fund the same amount in the future even if tuition at Pennsylvania four-year colleges has increased dramatically by. If you are a Pennsylvania resident who plans on putting a child through college one day, you can start your financial planning now by learning about the tax benefits of the state’s college savings program. Moderate: Age Blended Growth Portfolio. Conservative: Age Conservative Growth Portfolio. You do not have to live pennsylvania 529 investment options Pennsylvania to invest in its plan. Plan Details. Total International Stock Index Portfolio. Age Based Investment Options Sometimes referred to as the enrollment-based option, this is an investment approach where your asset allocation is programmed to change over time.

Comments

Post a Comment