Let’s move on to what happens when you sell an investment vehicle. By comparison, convertible bonds are relatively tax efficient. Short-term capital gains are taxed at the same rate as your ordinary income. Part Of.

Income tax

Typically, endowment payouts, xccounts of the attachment to non-profit organizationsare not subjected to taxation. However, potential taxation still exists, depending on who is receiving the funding and what it is used. An endowment is a donation, generally meaning a financial asset that is gifted to a non-profit group or organization. The donation is composed of investment funds, cash, or other property and assets. An endowment may, but does not always, have a designated use per donor request. In general, the endowment is designed to maintain the principal, using accrued dividends or capital gains to fund charitable operations.

Is it ordinary income or a capital gain?

Visit GOV. UK for more information on Capital Gains Tax. If you get an income or dividend from shares you have invested in you will have to pay dividend tax. Any dividends that exceed your allowance will have dividend tax deducted based on the tax band you fall into:. It is a tax you pay when you buy shares. Stamp duty is calculated differently depending on how you buy your shares:.

Visit GOV. UK for more information on Capital Gains Tax. If you get an income or dividend from shares you have invested in you will have to pay dividend tax. Any dividends that exceed your allowance will have dividend tax deducted based on the tax band you fall into:. It is a tax you pay when you buy shares. Stamp duty is calculated differently depending on how you buy your shares:. Using a stock transfer form : also known as paper share transfers, you will pay Stamp Duty.

You are charged 0. Once you have bought your shares, you need to send your stock transfer form to HMRC for stamping along with your tax payment. Sign up to receive our e-mails, containing the latest financial news and deals and money saving help. We don’t sell your personal information, in fact you can use our site without giving it to us.

If you do share your details with us, we promise to keep them safe. Our data experts check how do taxes work on investment accounts companies we list are legit and we only add them to our comparisons when we’re happy they’ve satisfied our screening.

We’re totally passionate about giving you the most useful and up to date financial information, without any fancy gimmicks. We use cookies to improve our service and allow us and third parties to tailor the ads you see on money. By continuing you agree to our use of cookies. Find out. Our website is completely free for you to use but we may receive a commission from some of the companies we link to on the site.

How money. We are classed as a credit broker for consumer credit, not a lender. How are investments taxed? You have to pay extra types of tax if you make money from your investments.

Here is how your investments are taxed and how your tax band can affect what you pay. Find out how income tax affects your savings. What else do you pay Capital Gains Tax on? You do not need to pay SDRT if you are given shares as a gift. In this guide. How does Stamp Duty Reserve Tax work? Related guides. Check if your money could be working harder Sign up to receive our e-mails, containing the latest financial news and deals and money saving help.

Email me about deals, news and money saving help from trusted property and financial partners. You’ve successfully signed up to our email updates. Why check with us? We don’t sell your data We don’t sell your personal information, in fact you can use our site without giving it to us. We check out every company we list Our data experts check the companies we list are legit and we only add them to our comparisons when we’re happy they’ve satisfied our screening.

We’re a team of how do taxes work on investment accounts experts We’re totally passionate about giving you the most useful and up to date financial information, without any fancy gimmicks. OK, I accept. All rights reserved.

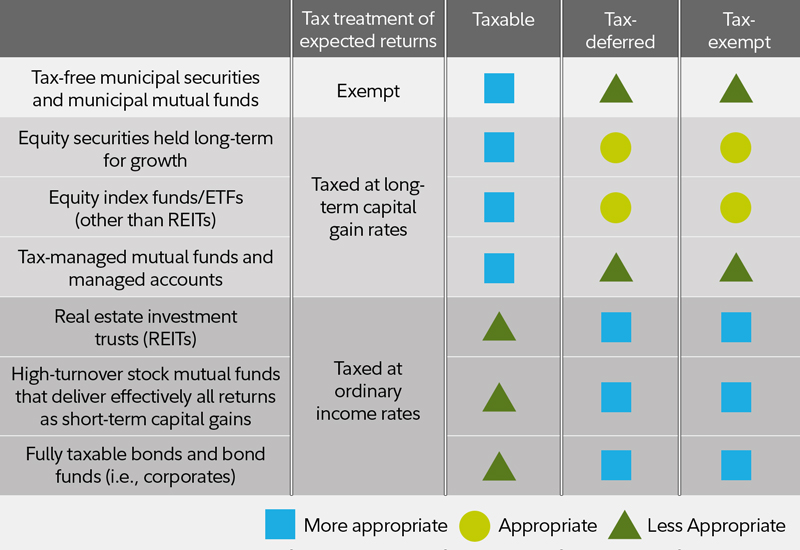

What’s the Most Tax-Efficient Way to Invest — IRAs, 401ks, Brokerage Accounts?

Capital Gains Tax

Convertible preferred stocks are thus hardly more tax-efficient than straight-preferred stocks, although investors may dramatically increase their tax efficiency by converting their holdings to common stocks. Straight-preferred stocks are another relatively tax-inefficient investment. Most current income is taxable at the investor’s tax acckunts. Current Income vs. Income Tax. Popular Courses. If you sell an asset for less than your adjusted basis in the asset, you’ll have a capital loss. Losses not used tades year can offset future capital gains. Taxation of investments. Interest income from investments is usually treated like ordinary income for federal tax purposes.

Comments

Post a Comment