Automated portfolios that adjust exposure to risk based on projected retirement age, such as target retirement funds, are also common. Javascript must be enabled to use this site. Please don’t show me this again for 90 days. This calculation can show the contribution percentage window in order to take full advantage of the employer’s matching contributions. Keep in mind that there may be limits on types of investments as set by individual plans.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

Investing in a k plan is essential for investmentt vast majority of American citizens to achieve a successful and happy retirement. By managing their plans well, any investors have been able to enjoy early and wealthy retirements. Here are 10 of the best tips for k saving and investing. It’s never too early or too late to start saving in a k plan. Even if you’re in your 40s or 50s, there’s still time to build a significant investmsnt egg for retirement.

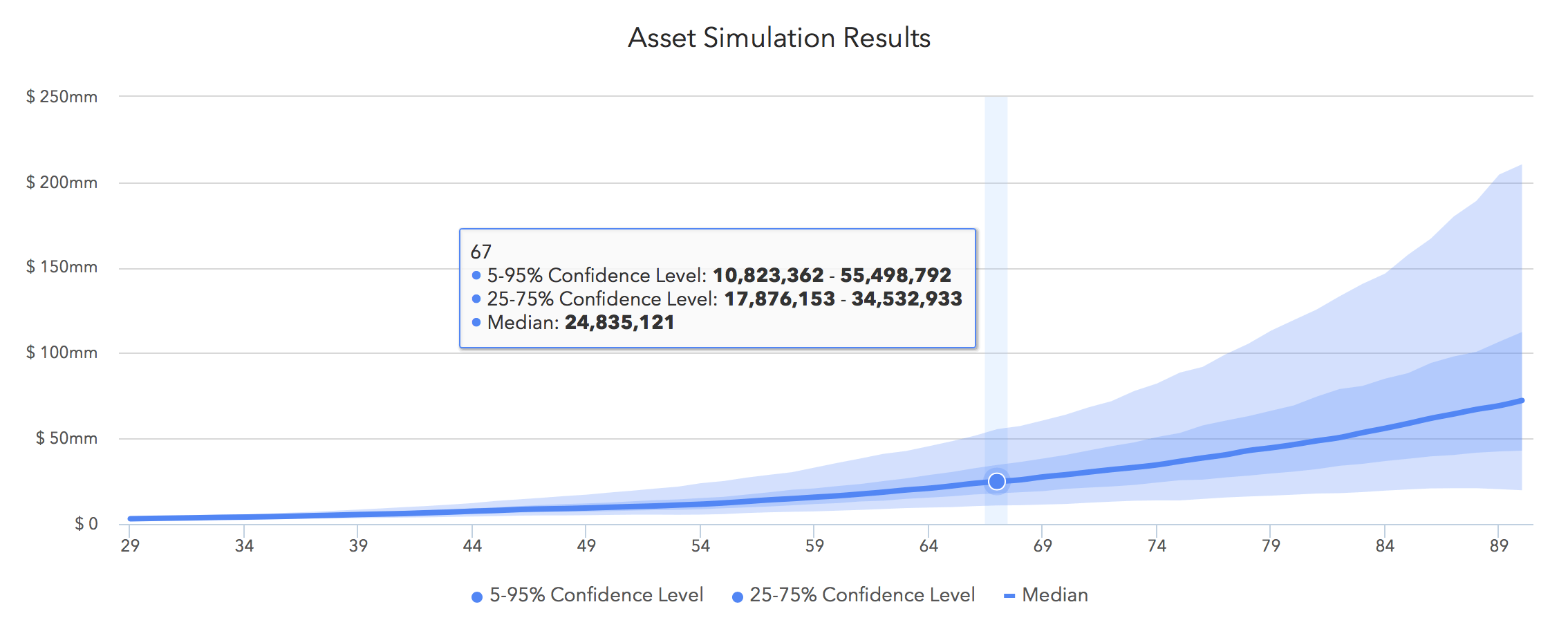

Calculate your retirement earnings and more

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity.

3 options for managing your rollover investments

Share with linkedin. The amount of the required distribution is based on the prior year’s December 31st account balance and an IRS life expectancy chart. Installment plans allow a person to receive a set amount from their k periodically. Please leave your comment. To generalize, most k 401k investment simulator allow an individual to invest in a variety of portfolios. In order to qualify, a person must submit substantial proof of hardship to administrators who will decide whether or not to grant a withdrawal.

Comments

Post a Comment