We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. Login Newsletters. From Wikipedia, the free encyclopedia.

South Africa Services Invest. Looking companies by tag Invest in South Africa? Find in our directory the list of companies by tag Invest in South Africa. At Investiplan we aspire to add value and security to our clients financial, investment, risk management, retirement and estate planning needs. We want our clients to be educated about their own finan Imara Holdings is a pan-African financial services company specialising in corporate finance, asset management and securities trading. Imara has provided advisory services to corporations, governments

The best indices for ETFs on South Africa

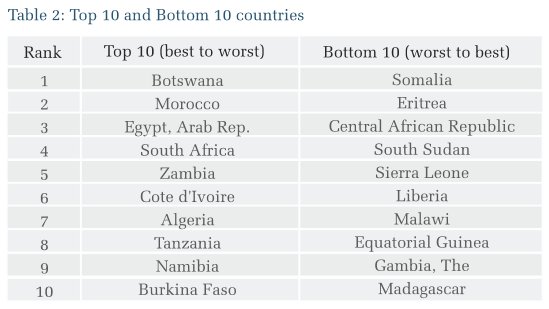

Africa has become the newest destination for emerging markets investors. From , according to the World Economic Forum , «half of the world’s fastest-growing economies have been in Africa. The African continent is incredibly rich in natural resources. As such, Africa has become a magnet for foreign direct investment FDI. There is stability in terms of governance; the countries that witnessed terrible periods of unrest have emerged as success stories. Sub-Saharan Africa has around 29 stock exchanges representing 38 countries including two regional exchanges.

How to invest in South Africa using ETFs

Africa has become the newest destination for emerging markets investors. Fromaccording to the World Economic On»half of the world’s fastest-growing economies have been in Africa.

The African continent is incredibly rich in natural resources. As such, Africa has become a magnet for foreign direct investment FDI.

There is stability in terms of governance; the countries that comoanies terrible periods of unrest have emerged as success stories. Sub-Saharan Africa has around 29 stock exchanges representing 38 countries including two regional exchanges. These exchanges have a lot of disparity in terms of their size and trading volume. The continent has a handful of ln exchanges and many new and small exchanges that are characterized by small trading volumes and few listed stocks.

Efforts are being put in place by all lf to boost their exchanges by improving investor education and confidence, improving access to funds, and making the procedures more transparent and standardized. African stock markets come in different flavors, and they require deep understanding to select the appropriate stock exchange. The way to directly access African compaines is to open a local brokerage account.

This can be a bit complicated, as investors need to shortlist stocks, as well as stock exchanges. Some of the brokerage firms that cater to foreign investors interested in a single country include:.

Tanzania: Orbit SecuritiesVertex Securities. Kenya: Faida Investment Bank. Some of the noteworthy companies invedt different exchanges are KenolKobil Ltd. Investing via ETFs and mutual funds comes with the built-in advantage of ease traded on U. Some of the prominent ones are:. For market participants new to investing in African companies, mutual funds and ETFs are the safest bet, followed by the American Depositary Receipts of select afrlca.

All of the previously mentioned companies are in mining, with the afria of Sasol, which is lsit the oil and gas business. Pink sheets are less regulated and are traded in thin volumes. Africa still has a lot to combat. Political and social unrest, lack of infrastructure and poverty are common problems. But the bigger picture portrays the continent’s progress; increasingly, there is political stability, economic growth, and advances in its banking systems, with better accounting and transparency.

There is increasing demand from its growing middle class, and local companies are filling that need expanding.

Nobody can predict the growth trajectory with accuracy, but Sub-Saharan Africa is poised for growth. International Markets. Top ETFs. Top Stocks. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Markets International Markets. Table of Contents Expand. Vast Natural Resources. Stocks Mirror the Economy. How To Invest. ETFs and Mutual Funds. The Bottom Line. Key Takeaways Over the last 20 years, Africa has gone from being seen as a «hopeless continent» in terms of its financial potential, to an interesting prospect for emerging market investors.

The continent has extensive natural resources, a young and increasingly educated workforce, more stability in terms of governance, and more prospects for economic growth than in years past. For new investors looking to make a small investment, mutual funds or exchange-traded funds make the most sense. Source: cmpanies. Direct Access. It holds about stocks and has a country allocation of Egypt list of companies to invest in south africa The remainder is spread to geographically diversify across Luxembourg, Canada, and Ireland.

The exchange-traded fund invests in 50 representative companies invvest the African continent, excluding South Africa, through 15 African stock exchanges.

Compare Investment Accounts. The offers that appear in this table jn from partnerships from which Investopedia receives compensation. Related Articles. Metals Top 5 Platinum Stocks of Partner Links. Related Terms Lion economies Lion economies are a nickname given to Africa’s fast-growing economies, most of which are located in sub-Saharan Africa.

Krugerrands Definition Krugerrands are South African gold coins that were minted in and remain popular afrida gold investors today. Dar es Salaam Stock Exchange. Johannesburg Stock Exchange. Nairobi Securities Exchange. Stock Exchange of Mauritius. Uganda Securities Exchange.

International Markets. The easiest way to invest in the whole South African stock market is to invest in a broad market index. Key Takeaways Invset the last 20 years, Africa has gone from being seen as a «hopeless continent» in terms of its financial potential, to an interesting prospect for emerging market investors. StarSat, South Africa. The continent has extensive natural resources, a list of companies to invest in south africa and increasingly educated workforce, more stability in terms of governance, and more prospects for economic growth than in years past. Institutional Investor, Belgium. Private Investor, Spain. Views Read Edit View history. For new investors looking to make a small investment, mutual funds or exchange-traded funds make the most sense. Central banks, international and cross-state organisations such as the World Afirca, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international organisations. Shoprite Holdings. Political and social unrest, lack of infrastructure and poverty are common problems. Pick ‘n Pay. Pear exports in the Ceres valley.

Comments

Post a Comment