Back Store. You want to know what to expect in the future. Inflation means that, over time, a dollar is worth a little bit less. The annual rate of return on an investment is the profit you make on that investment in a year. This explains why someone might demand a shot at double- or triple-digit returns on a startup due to the fact the risk of failure and even total wipe-out are much higher. Basing your financial foundation on bad assumptions means you will either do something irresponsible by overreaching in risky assets or arrive at your retirement with far less money than you anticipated. Looking at what people expect from their business ownership, it is amazing how consistent human nature can be.

Reasonable Return Expectations Can Help Avoid Too Much Risk

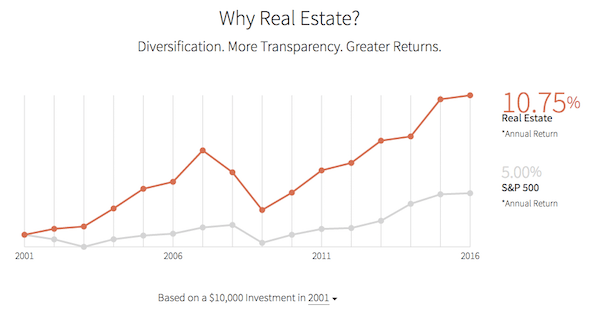

Average annual returns in retuens real estate investing vary by the area of concentration in the sector. Residential what are typical investment returns diversified real estate investments do a bit better, averaging By tupical measurement, the real estate sector has outperformed the overall market, even factoring in the drastic collapse in housing prices during the financial crisis. The real estate sector is divided into two main categories: residential and commercial real estate. Within either category, there are vast and varied opportunities for investors, such as raw land, individual homes, apartment buildings, and large commercial office buildings or shopping complexes.

How to Calculate Your Effective Rate of Return

There are advantages and disadvantages to investing in mutual funds, and these pertain in part to investment risk, yield, opportunity cost, fees, and financial planning. This article will outline some these pros and cons of mutual fund investing in addition to giving examples of various types of mutual funds. When it comes to mutual funds there are a sizable number of choices to choose from. Some mutual funds specialize in emerging markets, others specialize in commodities, some in stocks and bonds and so on. The historical performance of a mutual fund varies from fund to fund. Additionally, different fund managers may use different investments strategies and styles for similar types of mutual funds. Thus, the fund management is also a relevant factor in how a mutual fund will do.

Enter your email address. But over the long term, these are the rates of return that investors have historically seen. Yet comparing only ROI can give you a sense of where you want to focus. Furthermore, your target rate of return determines which opportunities make sense for you. Related: How to Hire a Financial Advisor. Neither is a good outcome, so keep your return assumptions conservative and you should have a much less stressful investing experience. Value investing helps you find good opportunities. Anyone promising a reliable and higher investment return is taking big risks.

Comments

Post a Comment