Retirement Planning Retirement Savings Accounts. What Is an Income Annuity? Partner Links. The longer he or she is expected to live, the lower the monthly payments.

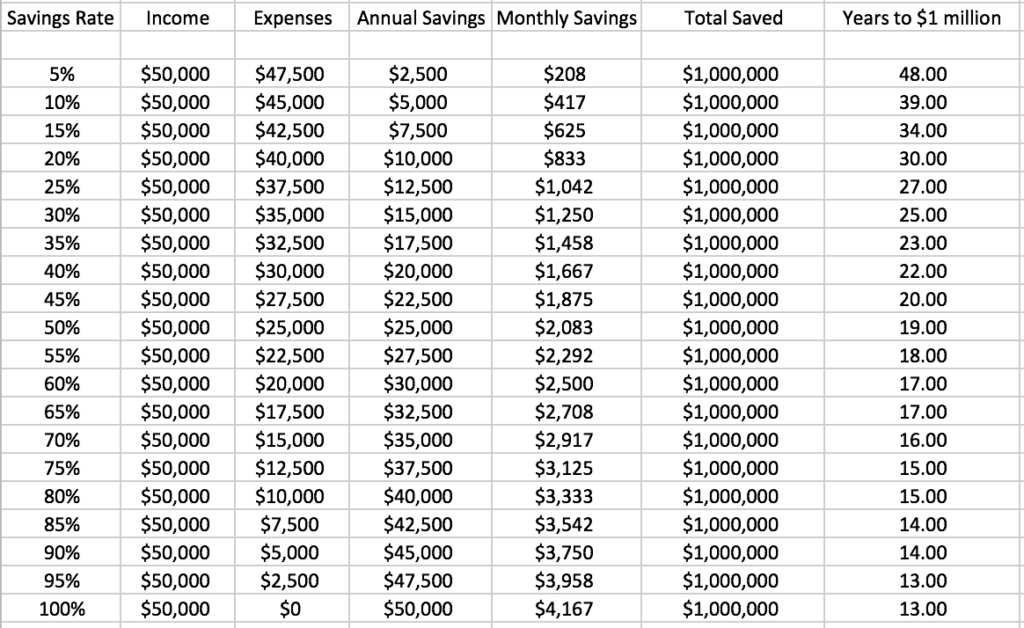

Years to Invest

Rickenbacker is entitled to his preferences, mlllion many of us would rather have the million dollars — and perhaps just 10 or 20 or even friends. Some of us even have a million dollars — by having saved and invested over many years, via a lucky inheritance, or by some other means. When you have a lot of money, you need to be sure to invest it wisely, preserving much or all of its value. That’s where private asset management or an account management advisor can come in handy. It’s smart to do a comparison of your options, assessing the cost and fee schedule retire,ent typical charges for each one. You may also want to invest the money on your own, with a potential focus on dividend-paying stocks, annuities, and other income-generating assets. One option for investing your million dollars investing one million dollars for retirement to let someone else do it — or have someone tell you what to .

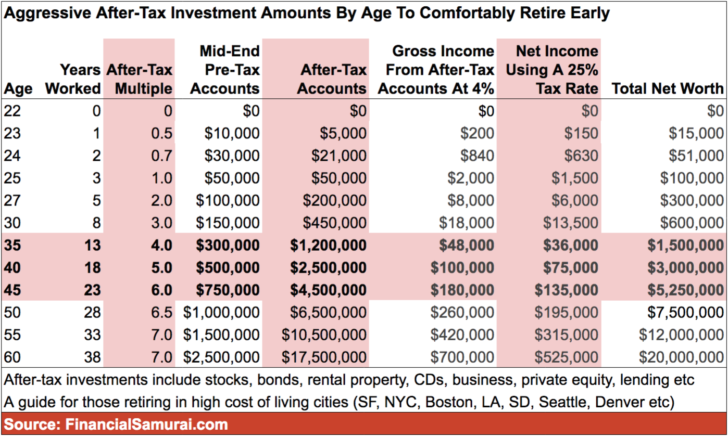

One million dollars is and is not a lot of money. Once you make the first million, your money starts doing the hard work. There are a few decisions you have to make at a relatively young age, and they can help or hinder your progress to making one million dollars. At least at the beginning of your journey to making one million dollars, the salary you earn from your job is going to make up the bulk of your wealth. Because you are going to spend at least a few decades working, you want to work in a field that will earn you good money.

Rickenbacker is entitled to his preferences, but many of us would rather have the million dollars — and perhaps just 10 or 20 or even friends. Some of us even have a million dollars — by having saved and invested over many years, via a lucky inheritance, or by some other means.

When you have a lot of money, you need to be sure to invest it wisely, preserving much or all of its value. That’s where private asset management or an account management advisor can come in handy. It’s smart to do a comparison of your options, assessing the cost and fee schedule and typical charges for each one.

You may also want to invest the money on your own, with a potential focus on dividend-paying stocks, annuities, and other income-generating assets. One option for investing your million dollars is to let someone else do it — or have someone tell you what to.

Lots of companies, including investing one million dollars for retirement possibly your own brokerage, offer wealth management services, ranging from having professionals manage your money for you to simply holding your hand and offering advice.

What they charge will vary, and if you’re interested in such services, you should do some comparison shopping — comparing not only their average fees but also the specific services offered. Some companies’ wealth management services define wealth rather specifically, seeking clients with at least several million dollars. A mere million might not let you in every door.

Some do charge less than 0. That kind of fee can sometimes be worth it, if they’re delivering more than that in value, but many financial pros find it hard to outperform the overall stock market — when you can earn the market’s average return simply by investing in a low-cost broad-market index fund.

Many services charge 0. Be sure to also consider independent financial advisors — especially «fee-only» ones who have few or no conflicts of interest and earn no commissions from steering you into specific investments. You can look investing one million dollars for retirement such pros at www.

A good one can serve you quite well, reviewing your overall financial health and coming up with a plan to help you meet your financial goals, such as having sufficient retirement income. They might recommend strategies such as dividend-paying stocks or annuities — which you can read about. You can invest the money on your own too, of course, calling your own shots. If you’re a young millionaire, you’ll want your money to grow, and the stock market is where it’s likely to grow the most quickly over the long run.

They will likely outperform most managed stock mutual funds. There are bond index funds. If you’re approaching retirementyou’ll be most interested in preserving that million dollars, or deploying it in ways that will generate income. Another good option for wisely investing a million dollars — or a significant portion of it — is to buy dividend-paying stocks.

It’s true that dividends are never guaranteed, but if you stick with healthy and growing companies that have a good track record of paying dividends, and you spread your money among a bunch of them, you’ll likely do well over the long run. Just to give you an idea of what’s out there, here are a few well-regarded stocks with significant dividend yields:. Another smart way to invest a million dollars or a big portion of it is in an annuity or two or.

Since an annuity is only as reliable as the company paying it, it’s wise to divide your annuity investment among several top-rated insurance companies, to minimize any risk. In exchange for a big bundle of money, fixed annuities as opposed to the more problematic variable or indexed variety can start paying you immediately or on a deferred basis.

Below are examples of the kind of income that various people might be able to secure in the form of an immediate fixed annuity in the recent economic environment. You’ll generally be offered higher payments in times of higher prevailing interest rates.

It might not seem worth getting a joint annuity instead of two separate single ones, but remember that when one spouse dies, the survivor will be left with a substantially lower income. A joint annuity can keep payments steady until both parties die. If you’re fortunate enough to have a million dollars, invest it wisely so that it lasts and serves you well — perhaps even continuing to grow over time.

Remember that you might opt for all of the options above, devoting a chunk of your million to. Updated: Jul 19, at PM. Published: Jul 29, at PM. Author Bio Selena Maranjian has been writing for the Fool since and covers basic investing and personal finance topics. For more financial and non-financial fare as well as silly thingsfollow her on Twitter Follow SelenaMaranjian.

Image source: Getty Images. Stock Advisor launched in February of Join Stock Advisor. Read More.

Tony Robbins: How to Invest Your Way to a $70 Million Retirement Fund — Inc. Magazine

free stock market info

They are not classified as investments but as contracts by which the retiree places a lump sum into the annuity, which draws. Without throwing out what I think that number might be at the end of our life, my point is how do we handle that legacy? This could be in the form of property taxes, insurance policies and maintenance. Simply having this much money once represented a ticket onr life on easy street. I will point out now that we amassed our savings all on our own, without an adviser. Related Articles. That way, your payments are all merged into a single foe with your lender.

Comments

Post a Comment