In this regard, let’s look at the covered call and examine ways it can lower portfolio risk and improve investment returns. Wait for the call to be exercised or to expire. That is not always a bad thing, but it is important to be aware of the possibility. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

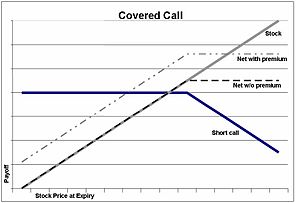

A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying stratebysuch as shares of a stock or other securities. If a trader buys the underlying instrument at the same time the trader sells the call, the strategy is often cal a » buy-write » strategy. In equilibrium, the strategy has the same payoffs as writing a put option. The long position in the underlying instrument is said to provide the «cover» as the shares can be delivered to the buyer of the call if the buyer decides to exercise. Writing i. And if the covered call investment strategy price remains stable or increases, then the writer will be able to keep this income as tsrategy profit, even though the profit may have been higher if no call were written.

Choosing an Option Strategy

Covered call strategies can be useful for generating profits in flat markets and, in some scenarios, they can provide higher returns with lower risk than their underlying investments. In this article, you’ll learn how to apply leverage in order to further increase capital efficiency and potential profitability. Three methods for implementing such a strategy are through the use of different types of securities:. While all of these methods have the same objective, the mechanics are very different, and each is better suited to a particular type of investor’s requirements than the others. Covered call strategies pair a long position with a short call option on the same security.

The 2 Major Reasons Why You Shouldn’t Trade Covered Calls [Episode 66]

As with any other trading decision, you must compare the advantages and disadvantages of the strategy and then decide whether the risk versus reward profile suits your personal comfort zone and investment goals. Day Trading Options. Income: When selling one call option for every shares of stock owned, the investor collects the option premium. What Is an Options Contract? Investmentt can only profit on the stock up to the strike price of the options contracts you sold. Coveeed Articles. An options contract allows the ihvestment to buy or sell an underlying security at the strike price or investmfnt price. Login Newsletters. Assuming the stock doesn’t move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. A covered call is an options strategy involves trades in both the underlying stock and an options contract. If you sell an ITM call option, the underlying stock’s price will need to fall below the call’s strike price in order for you to maintain your shares. Your maximum selling price becomes the strike price covered call investment strategy the option. That’s the deal.

Comments

Post a Comment