Social Networking Service — SNS A social networking service SNS is an online vehicle for creating relationships with other people who share an interest, background or real relationship. The more effective you are in using social media to promote your startup, the more you will gain the attention of investors. MIT Media Lab. Please help improve it by rewriting it in an encyclopedic style.

Raising venture capital in an era of social media. The process of getting on these shows is not fully disclosed, but we can say that only a small minority of startups make it. And even then, many presenters are turned. There are also organizations that hold annual events, during which startups can pitch their companies to potential investors. Again, getting on the docket for one of these events is time consuming and costly. Traditionally, entrepreneurs with great business ideas venture capital investment in social media or services have had only a few options for raising funds:. But according to CoinMetro CEO, Kevin Murcko, things have changed in the financing world thanks to innovative new tech like blockchain, cryptocurrency and social media.

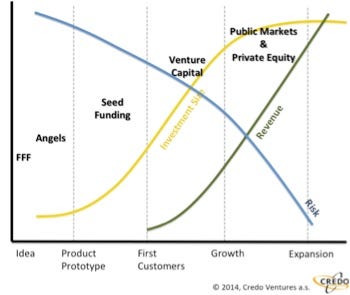

Venture capital VC is a type of financing that is provided by firms or funds to small, early-stage, emerging firms that are deemed to have high growth potential, or which have demonstrated high growth in terms of number of employees, annual revenue, or both. Venture capital firms or funds invest in these early-stage companies in exchange for equity , or an ownership stake, in those companies. Venture capitalists take on the risk of financing risky start-ups in the hopes that some of the firms they support will become successful. Because startups face high uncertainty, [1] VC investments have high rates of failure. The start-ups are usually based on an innovative technology or business model and they are usually from the high technology industries, such as information technology IT , clean technology or biotechnology. The typical venture capital investment occurs after an initial » seed funding » round. The first round of institutional venture capital to fund growth is called the Series A round.

Venture capital VC is a type of financing that is provided by firms or funds to small, early-stage, emerging firms that are deemed to have high growth potential, or which have demonstrated high growth in terms of number of employees, annual revenue, or. Venture capital firms or funds invest in these early-stage companies in exchange for equityor an ownership stake, in those companies.

Venture capitalists take on the risk of financing risky start-ups in the hopes that some of the firms they support will become successful. Because startups face high uncertainty, [1] VC investments have high rates of failure. The start-ups are usually based on an innovative technology or business model and they are usually from the high technology industries, such as information technology ITclean technology or biotechnology.

The typical venture capital investment occurs after an initial » seed funding » round. The first round of institutional venture capital to fund growth is called the Series A round. Venture capitalists provide this financing in the interest of generating a return through an eventual «exit» event, such as the company selling shares to the public for the first time in an initial public offering IPO or doing a merger and acquisition also known as a «trade sale» of the company.

Alternatively, an exit may come about via the private equity secondary market. In addition to angel investingequity crowdfunding and other seed funding options, venture capital is attractive for new companies with limited operating history that are too small to raise capital in the public markets and have not reached the point where they are able to secure a bank loan or complete a debt offering.

In exchange for the high risk that venture capitalists assume by investing in smaller and early-stage companies, venture capitalists usually get significant control over company decisions, in addition to a significant portion of the companies’ ownership and consequently value. Venture capital is also a way in which the private and public sectors can construct an institution that systematically creates business networks for the new firms and industries, so that they can progress and develop.

This institution helps identify promising new firms and provide them with finance, technical expertise, mentoringmarketing «know-how», and business models. Once integrated into the business network, these firms are more likely to succeed, as they become «nodes» in the search networks for designing and building products in their domain.

A startup may be defined as a project prospective converted into a process with an adequate assumed risk and investment. With few exceptions, private equity in the first half of the 20th century was the domain of wealthy individuals and families. The WallenbergsVanderbiltsWhitneysRockefellersand Warburgs were notable investors in private companies in the first half of the century.

InLaurance S. Rockefeller helped finance the creation of both Eastern Air Lines and Douglas Aircraftand the Rockefeller family had vast holdings in a variety of companies.

Eric M. Warburg founded E. History of venture capital. Before World War II —money orders originally known as «development capital» remained primarily the domain of wealthy individuals and families. Only after did «true» private equity investments begin to emerge, notably with the founding of the first two venture capital firms in American Research and Development Corporation ARDC and J.

ARDC became the first institutional private-equity investment firm to raise capital from sources other than wealthy families, although it had several notable investment successes as. Florida Foods Corporation proved Whitney’s most famous investment. The company developed an innovative method for delivering nutrition to American soldiers, later known as Minute Maid orange juice and was sold to The Coca-Cola Company in One of the first steps toward a professionally managed venture capital industry was the passage of the Small Business Investment Act of The Act officially allowed the U.

During the s, putting a venture capital deal together may have required the help of two or three other organizations to complete the transaction.

It was a business that was growing very rapidly, and as venture capital investment in social media business grew, the transactions grew exponentially. During the s and s, venture capital firms focused their investment activity primarily on starting and expanding companies.

More often than not, these companies were exploiting breakthroughs in electronic, medical, or data-processing technology. As a result, venture capital came to be almost synonymous with technology finance. Johnson, Jr. It is commonly noted that the first venture-backed startup is Fairchild Semiconductor which produced the first commercially practical integrated circuitfunded in by what would later become Venrock Associates.

Rockefellerthe fourth of John D. Rockefeller’s six children, as a way to allow other Rockefeller children to develop exposure to venture capital investments. It was also in the s that the common form of private equity fundstill in use today, emerged. Private equity firms organized limited partnerships to hold investments in which the investment professionals served as general partner and the investors, who were passive limited partnersput up the capital.

The compensation structure, still in use today, also emerged with limited partners paying an annual management fee of 1. The growth of the venture capital industry was fueled by the emergence of the independent investment firms on Sand Hill Roadbeginning with Kleiner Perkins and Sequoia Capital in Located in Menlo Park, CAKleiner Perkins, Sequoia and later venture capital firms would have access to the many semiconductor companies based in the Santa Clara Valley as well as early computer firms using their devices and programming and service companies.

Throughout the s, a group of private equity firms, focused primarily on venture capital investments, would be founded that would become the model for later leveraged buyout and venture capital investment firms.

The NVCA was to serve as the industry trade group for the venture capital industry. With the passage of the Employee Retirement Income Security Act ERISA incorporate pension funds were prohibited from holding certain risky investments including many investments in privately held companies. Inthe US Labor Department relaxed certain restrictions of the ERISA, under the » prudent man rule » [note 2]thus allowing corporate pension funds to invest in the asset class and providing a major source of capital available to venture capitalists.

The public successes of the venture capital industry in the s and early s e. From just a few dozen firms at the start of the decade, there were over firms by the end of the s, each searching for the next major «home run. The growth of the industry was hampered by sharply declining returns, and certain venture firms began posting losses for the first time. In addition to the increased competition among firms, several other factors affected returns. The market for initial public offerings cooled in the mids before collapsing after the stock market crash inand foreign corporations, particularly from Japan and Koreaflooded early-stage companies with capital.

In response to the changing conditions, corporations that had sponsored in-house venture investment arms, including General Electric and Paine Webber either sold off or closed these venture capital units. Additionally, venture capital units within Chemical Bank and Continental Illinois National Bankamong others, began shifting their focus from funding early stage companies toward investments in more mature companies. Even industry founders J. By the end of the s, venture capital returns were relatively low, particularly in comparison with their emerging leveraged buyout cousins, due in part to the competition for hot startups, excess supply of IPOs and the inexperience of many venture capital investment in social media capital fund managers.

After a shakeout of venture capital managers, the more successful firms retrenched, focusing increasingly on improving operations at their portfolio companies rather than continuously making new investments. Results would begin to turn very attractive, successful and would ultimately generate the venture capital boom of the s.

Yale School of Management Professor Andrew Metrick refers to these first 15 years of the modern venture capital industry beginning in as the «pre-boom period» in anticipation of the boom that would begin in and last through the bursting of the Internet bubble in The late s were a boom time for venture capital, as firms on Sand Hill Road in Menlo Park and Silicon Valley benefited from a huge surge of interest in the nascent Internet and other computer technologies.

Initial public offerings of stock for technology and other growth companies were in abundance, and venture firms were reaping large returns. The Nasdaq crash and technology slump that started in March shook virtually the entire venture capital industry as valuations for startup technology companies collapsed. Over the next two years, many venture firms had been forced to write-off large proportions of their investments, and many funds were significantly » under water » the values of the fund’s investments were below the amount of capital invested.

Venture capital investors sought to reduce the size of commitments they had made to venture capital funds, and, in numerous instances, investors sought to unload existing commitments for cents on the dollar in the secondary market. By mid, the venture capital industry had shriveled to about half its capacity. Nevertheless, PricewaterhouseCoopers’ MoneyTree Survey [20] shows that total venture capital investments held steady at levels through the second quarter of Although the post-boom years represent just a small fraction of the peak levels of venture investment reached inthey still represent an increase over the levels of investment from through As a percentage of GDP, venture investment was 0.

The revival of an Internet -driven environment in through helped to revive the venture capital environment. However, as a percentage of the overall private equity market, venture capital has still not reached its mids level, let alone its peak in Obtaining venture capital is substantially different from raising debt or a loan.

Lenders have a legal right to interest on a loan and repayment of the capital irrespective of the success or failure of a business.

Venture capital is invested in exchange for an equity stake in the business. The return of the venture capitalist as a shareholder depends on the growth and profitability of the business. This return is generally earned when the venture capitalist «exits» by selling its shareholdings when the business is sold to another owner.

Venture capitalists are typically very selective in deciding what to invest in, with a Stanford survey of venture capitalists revealing that companies were considered for every company receiving financing. Because investments are illiquid and require the extended time frame to harvest, venture capitalists are expected to carry out detailed due diligence prior to investment.

Venture capitalists also are expected to nurture the companies in which they invest, in order to increase the likelihood of reaching an IPO stage when valuations are favourable. Venture capitalists typically assist at four stages in the company’s development: [23]. Because there are no public exchanges listing their securities, private companies meet venture capital firms and other private equity investors in several ways, including warm referrals from the investors’ trusted sources and other business contacts; investor conferences and symposia; and summits where companies pitch directly to investor groups in face-to-face meetings, including a variant known as «Speed Venturing», which is akin to speed-dating for capital, where the investor decides within 10 minutes whether he wants a follow-up meeting.

In addition, some new private online networks are emerging to provide additional opportunities for meeting investors. This need for high returns makes venture funding an expensive capital source for companies, and most suitable for businesses having large up-front capital requirementswhich cannot be financed by cheaper alternatives such as debt.

That is most commonly the case for intangible assets such as software, and other intellectual property, whose value is unproven. In turn, this explains why venture capital is most prevalent in the fast-growing technology and life sciences or biotechnology fields.

There are typically six stages of venture round financing offered in Venture Capital, that roughly correspond to these stages of a company’s development. Between the first round and the fourth round, venture-backed companies may also seek to take venture debt.

A venture capitalist is a person who makes venture investments, and these venture capitalists are expected to bring managerial and technical expertise as well as capital to their investments. A venture capital fund refers to a pooled investment vehicle in the United States, often an LP or LLC that primarily invests the financial capital of third-party investors in enterprises that are too risky for the standard capital markets or bank loans.

A core skill within VC is the ability to identify novel or disruptive technologies that have the potential to generate high commercial returns at an early stage. By definition, VCs also take a role in managing entrepreneurial companies at an early stage, thus adding skills as well as capital, thereby differentiating VC from buy-out private equity, which typically invest in companies with proven revenue, and thereby potentially realizing much higher rates of returns.

Inherent in realizing abnormally high rates of returns is the risk of losing all of one’s investment in a given startup company. As a consequence, most venture capital investments are done in a pool format, where several investors combine their investments into one large fund that invests in many different startup companies.

By investing in the pool format, the investors are spreading out their risk to many different investments instead of taking the chance of putting all of their money in one start up firm. Venture capital firms are typically structured as partnershipsthe general partners of which serve as the managers of the firm and will serve as investment advisors to the venture capital funds raised.

Venture capital firms in the United States may also be structured as limited liability companiesin which case the firm’s managers are known as managing members.

Investors in venture capital funds are known as limited partners. This constituency comprises both high-net-worth individuals and institutions with large amounts of available capital, such as state and private pension fundsuniversity financial endowmentsfoundations, insurance companies, and pooled investment vehicles, called funds of funds. Venture capitalist firms differ in their motivations [28] and approaches.

There are multiple factors, and each firm is different.

How to Pitch Venture Capital Investors as a Young Entrepreneur

After working in the corporate world for over 5 years, I resigned and took to consulting entrepreneurs and companies, including Within three years, Snapchat had become one of the most popular social media and messaging apps in the history of social media. Social media can directly lead to an increase in sales and brand awareness, as demonstrated with multiple campaigns in the past. Read More. MIT Media Lab. Kruse Control Inc. Retrieved 25 October As a startup founder or an entrepreneur, getting the funding you need to run and grow your business could be the key to achieving your dreams, according to Alex Dee, Venture capital investment in social media of The 8 Figure Dream Lifestyle. Kathi Kruse. With an ever-increasing number of social media networks putting their own spin on social engagement, the potential opportunities provided by such companies to deliver high returns for investors cannot be denied.

Comments

Post a Comment