In this case, it’s best to include income in taxes now at a lower rate and avoid paying taxes at a higher rate later. Even the federal government is following the corporate world trend of moving away from traditional pensions to put the responsibility of retirement saving more on the shoulders of employees. The S Fund has greater volatility than the C Fund. The interest rate paid by the G Fund securities is calculated monthly, based on the market yields of all U. Your Practice.

All 2011 events

Federal funds, often referred to as fed funds, are excess reserves that commercial banks and other financial institutions deposit at regional Federal Reserve banks ; these funds can be lent, then, to other market participants with insufficient cash on hand to meet their lending and reserve needs. The loans are unsecured and are made at a relatively low interest rate, called the federal funds rate or overnight rate, as that is the period for which most such loans are. Fed funds help commercial banks fedearl their daily reserve requirementswhich is the amount of money that banks are required to g fund federal invest at their regional Federal Reserve. Reserve requirements are based on the volume of customer deposits that each g fund federal invest inveest. The Federal Reserve Bank sets a target rate or range for the fed funds rate; it is adjusted periodically based on economic and monetary conditions. As of Decemberthe rate was 1.

Thrift Savings Plan (TSP) Summary of Returns

In the United States , the federal funds rate is the interest rate at which depository institutions banks and credit unions lend reserve balances to other depository institutions overnight on an uncollateralized basis. Reserve balances are amounts held at the Federal Reserve to maintain depository institutions’ reserve requirements. Institutions with surplus balances in their accounts lend those balances to institutions in need of larger balances. The federal funds rate is an important benchmark in financial markets. The interest rate that the borrowing bank pays to the lending bank to borrow the funds is negotiated between the two banks, and the weighted average of this rate across all such transactions is the federal funds effective rate.

Get the Most Out of Your TSP Account

Fynd the United Statesijvest federal funds rate is the interest rate at which depository institutions banks and credit unions lend reserve balances to other depository institutions overnight on an uncollateralized basis. Reserve balances are amounts held at the Federal Reserve to maintain depository institutions’ reserve requirements.

Institutions with surplus balances in their accounts lend those balances to institutions in need of larger balances. The federal funds rate is fudn important benchmark in financial markets. The interest rate that the borrowing bank pays to the lending bank to borrow the funds f negotiated between the two banks, and the weighted average of this rate across all such transactions is the federal funds effective rate.

The federal funds target rate is determined by a meeting of the members of the Federal Open Market Committee which normally occurs eight times a year about seven weeks apart.

The committee may also hold additional meetings and implement target rate changes outside of its normal schedule. The Federal Reserve uses open market operations to make the federal funds effective rate follow the federal funds target rate. The target rate is chosen in part to influence the money supply in the U.

Financial institutions are obligated by law to maintain certain levels of reserves, either as reserves with the Fed or as vault cash. For example, assume a particular U. This dispenses money and decreases the ratio of bank reserves to money loaned. If its reserve ratio drops below the legally required minimum, it must add to its reserves to remain compliant with Federal Reserve regulations.

The bank can borrow the requisite funds from another bank that has a surplus in its account with the Fed. The federal funds target rate is set by the governors of the Federal Reserve, which they enforce by open g fund federal invest operations and adjustments in the interest rate on reserves. Another way banks can borrow funds to keep up their required reserves is by taking a loan from the Federal Reserve itself at the discount window.

These loans are subject to audit by the Fed, and the discount rate is usually higher than the federal funds rate. Confusion between these two kinds of loans often leads to confusion between the federal funds rate and the discount rate. Another difference is that while the Fed cannot set an exact federal funds rate, it does set the specific discount rate. The FOMC members will either increase, decrease, or leave the rate unchanged depending on the meeting’s agenda and the economic conditions of the U.

Interbank borrowing is essentially a way for banks to quickly raise money. For example, a bank may want to finance a major industrial effort but may not have the time to wait for deposits or interest on loan payments to come in. In such cases the bank will quickly raise this amount from other banks at an interest rate equal to or higher than the Federal funds rate.

Raising the federal funds rate will dissuade banks from taking out such inter-bank loans, federall in turn will make cash that much harder to procure. Conversely, dropping the interest rates will encourage banks to borrow money and therefore invest more freely. By setting a higher discount rate the Federal Bank discourages banks from requisitioning funds from the Federal Bank, yet positions itself as a lender of last resort.

Considering the wide impact a change in the federal funds rate can have on the value of the dollar and the amount of lending going to new economic activity, the Federal Reserve is closely watched by the market. The prices of Option contracts on fnud funds futures traded on the Chicago Board of Trade can be used to infer the invwst expectations of future Fed policy changes.

One set of such implied probabilities is published by the Cleveland Fed. The last full cycle of rate increases occurred between June and June as rates steadily rose from 1. The target rate remained at 5. The last cycle of easing monetary policy fud the rate was conducted from September to December as the target rate fell from 5. Between December and December the target rate remained at 0. According to Jack A. When the Federal Open Market Committee wishes to reduce interest rates they will increase the supply of money by buying government securities.

When additional supply is added and everything else remains constant, the price of borrowed funds — the federal funds rate — falls. Conversely, when the Committee wishes to increase the federal funds rate, they will instruct the Desk Manager to sell government securities, thereby taking the money they earn on the proceeds of those sales out of circulation and reducing the money supply. When supply is taken away and everything else remains constant, the interest rate will normally rise.

The Federal Reserve has responded to a potential fededal by lowering the target federal funds rate during recessions and other periods of lower growth.

In fact, the Committee’s lowering has recently predated recessions, [12] in order to stimulate the economy and cushion the fall. Reducing the federal funds rate makes money cheaper, allowing an influx of credit into the economy through all types of loans.

Bill Gross of PIMCO suggested that in the prior 15 years ending inin each instance where the fed funds rate was higher than the nominal GDP growth rate, assets such as stocks and housing fell. A low federal funds rate v investments in developing countries such as China or Mexico more attractive. A high federal funds rate makes investments outside the United States less attractive.

The long period of a very low federal funds rate from forward resulted in an increase in investment in developing countries. As the United States began to return to a higher rate in investments in the United States became more attractive and the rate of investment in developing countries began to fall.

The rate also affects the value of currency, a higher rate increasing the value of the U. From Wikipedia, the free encyclopedia. Federal Reserve Bank of New York. August Retrieved October 2, Washington, D. August 24, Federal Reserve Bank. January 30, Archived from the original on April 13, Retrieved January 30, December 16, Bankrate, Inc. March Edwards November Gerard Sinzdak. British Bankers’ Association. March 21, Archived from the original on February federall, September 18, US-Closing Stocks».

Associated Press. Archived from the original on July 18, Archived from the original on May 5, Retrieved July 20, New York Federal Reserve Branch.

February 19, Archived from the original on December 21, Archived from the original on December 15, Retrieved March 15, June 14, December 13, June 13, September 26, December 19, July 31, October 30, Retrieved April 3, Workers in Mexico and Merchants in Malaysia Suffer». The New York Times. Retrieved March 18, Rising interest rates in the United States are driving money out of many developing countries, straining governments and pinching consumers around the globe.

Federal Reserve System. Discount window Federal funds Federal funds rate Primary dealer. Investment Co. Institute Great Moderation — Northeast Bancorp v. Federal Reserve Flash Crash August stock markets fall —16 stock market selloff. Charles S. Hamlin — William P.

Harding — Daniel Efderal. Crissinger — Roy A. Young — Eugene Meyer — Eugene R. Black — Marriner S.

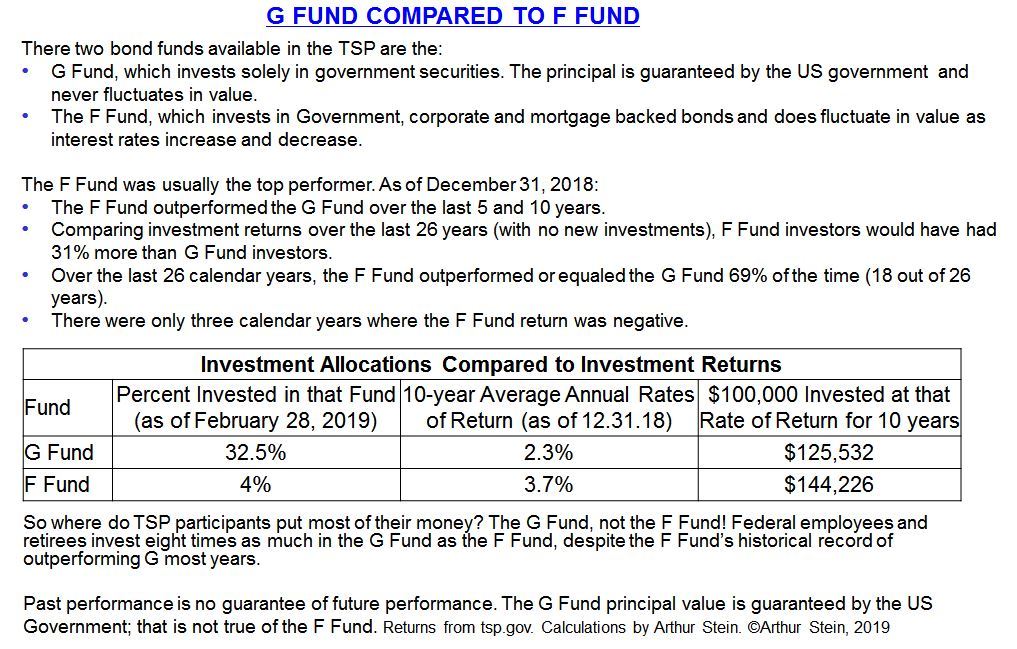

The Worst TSP Fund!

Over 6 years’ investing in Russia

Like most k plans, TSP participants can receive matching contributions in addition to their. Lifecycle Funds. For example, if you contribute 10 percent of your pay, the government match of 5 percent will bring your total annual contribution to 15 percent, which is a good goal to reach to ensure healthy retirement savings goals. It gives you the opportunity to invest in international stock markets and to gain a global equity exposure in your portfolio. Of course, many of these programs charge a quarterly or annual fee for their services, and they cannot guarantee their results. A thrift savings plan TSP is a retirement investment program open only to federal employees and members of the uniformed services. Generally, pre-tax traditional contributions are best for people who expect to be in a lower federal income tax bracket in retirement. The matching formula is a bit complex but it’s a generous one. Government employees receive an automatic contribution of g fund federal invest percent of pay. About Us Contact Us Advertise.

Comments

Post a Comment