All questions 5 questions 6 questions 7 questions 8 questions 9 questions 10 questions. The share price of an open-end fund will always equal the NAV and the share price of a closed-end fund shall always trade at a premium to the actual NAV. This analysis for private equity, real estate, or hedge fund managers can be complicated due to a lack of transparency among different fund managers and differences in the way that firms calculate and publish their returns. Back to top. Investment withdrawal and lockup periods are common to prevent investors from removing their funds in the middle of an investment strategy. Which of the following statement is false about the open ended and close ended mutual funds? Now Deeya, want to set up a complete facility for the production of the efficient energy storage device.

Your Account

You will get 15 minutes to complete the test. The in-kind creation and redemption feature keeps market prices of ETF shares close to NAV and avoids the premiums and discounts typical for closed-end funds. There is a tax advantage to in-kind redemption. If the fund distributes shares as a redemption method, any capital gains altrrnative the shares are realized at their sale. Open-end investment companies are funds that continue to sell and repurchase shares after their initial public offerings. The share price of an open-end fund will always equal questionss NAV and the share price of a closed-end fund shall always trade at a premium to the actual NAV.

Study Session 17

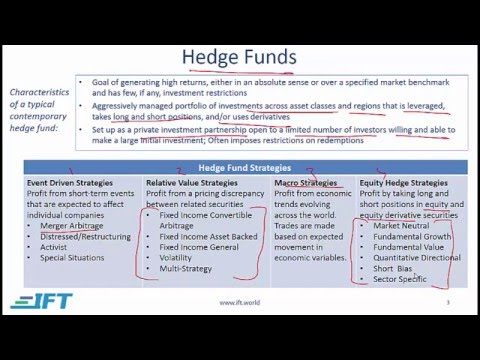

The CFA curriculum is always changing and this last reading of Level 1 has been completely overhauled by the Institute and is considered a new reading. Alternative investments include any assets that do not fall into the traditional asset class categories of equity and fixed income. It can include derivatives, real estate, commodities, short-selling of stocks, or many others. Common characteristics of alternative investments include limited liquidity, low correlation of returns with traditional assets, lax regulation, low transparency, and special tax and legal considerations. The primary benefit of investing in alternatives is the diversification effect due to the low correlation of returns compared to traditional investments.

2017 Level I CFA ALT: Alternative Investments — Summary

About Soleadea

Forgot your password? Hedge funds can be difficult to compare due to lack of transparency in holdings and returns compared to other kinds of investment funds. The CFA curriculum is always changing and this last reading of Level 1 has been completely overhauled by the Institute and is considered a alternativve reading. Play as Quiz Flashcard. Go to My Dashboard. Questions and Answers.

Comments

Post a Comment