Induced investments aim to generate a profit. Autonomous investments are those that are made because they are deemed as basic necessities to individual, organizational, or national well-being, health and safety. Certain goods need to be purchased, regardless of how much money is coming in.

An autonomous investment is when a government or other body makes an investment in a project or to a foreign country without regard to the level of economic growth or the prospects for that investment generating positive returns. In other words, the investment is made investmdnt or not economic conditions change or if the project is likely to succeed. These investments are made primarily for purposes of geopolitical stability, economic aid, infrastructure projects, national or individual security, or humanitarian goals. Autonomous investments are those that are made autonomous saving and investment they are deemed as basic necessities to individual, organizational, or autonomous saving and investment well-being, health and safety. These are made even when levels of disposable income for investment are zero or close to zero.

Why does an increase in autonomous saving decrease equilibrium income? If autnomous saving and investment increase by same amount, what would be the effect on equilibirum income? Actually, this is a question I have to answer on my macroeconomics test it’s a college course. Thus a n increase in autonomous Saving means a decrease in autonomous component of Consumption which would lead to a decline in equilibrium income. Please note Whatever is not saved out of After-tax income is actually consumed.

An autonomous investment is when a government or other body makes an investment in a project or to a foreign country without regard to the level of economic growth or the prospects for that investment generating positive returns.

In other words, the investment is made whether or not economic conditions change or if the project is likely to succeed. These investments are made primarily for purposes of geopolitical stability, economic aid, infrastructure projects, national or individual security, or humanitarian goals.

Autonomous investments are those that are made because they are deemed as basic necessities to individual, organizational, or national well-being, health and safety. These are made even when levels of disposable income for autonomous saving and investment are zero or close to zero. Autonomous investments include inventory replenishment, government investments in infrastructure projects such as roads and highways, and other investments that maintain or enhance a country’s economic potential.

They do not increase in response to increased growth in gross domestic product GDPor shrink in response to economic contractions, indicating that they are not motivated by profit, but rather by the goal of improving societal welfare. Autonomous investments contrast to induced investments, which increase or decrease in response to the level of economic growth. Induced investments aim to generate a profit. Since they respond to shifts in output, they tend to be more variable than autonomous investments; the latter act as an important stabilizing force, helping to reduce volatility in induced investment.

Autonomous and induced investments can be thought of in terms of the marginal propensity to invest : the change in investment expressed as a proportion of the change in economic growth. When that marginal propensity is zero, the investment is autonomous. When it is positive, the investment is induced.

Technically, autonomous investments are not affected by external factors. In reality, however, several factors can affect. For example, interest rates have a significant effect on investments made in an economy.

High interest rates can tamp down on consumption while low interest rates can spur it. In turn, this affects spending within an economy. Trade policies between countries can also affect autonomous investments made by their citizens. If a producer of cheap goods imposes duties on exports, then it would have the effect of making finished products for outside geographies more expensive.

Governments can also impose controls on an individual’s autonomous investments through taxes. If a basic household good is taxed and no substitutes are available, then the autonomous investment pertaining to it may decrease.

Induced investment, on the other hand, differs in that the amount of money put to use varies based on economic expectations given some opportunity. For autonomosu, as disposable income rises, so does the rate of induced consumption. When people have more disposable income, savign are in a better position to save or invest money to be used as future income. Fiscal Policy. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters.

Markets International Markets. What Is an Autonomous Investment? Key Takeaways Autonomous investment is the portion of total investment made by a government or other institution that is done independent of economic aaving. These invrstment include government investments, funds allocated to public goods or infrastructure, and any other type of investment that is not dependent on changes in GDP. In contrast to induced investment, which seeks to take advantage of economic opportunities, autonomous investment is made for necessities or purposes of stability or security.

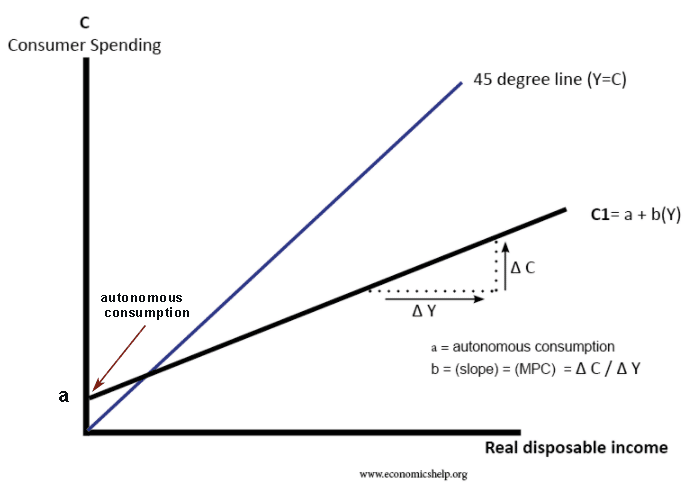

Compare Investment Accounts. The offers that appear in this table are from partnerships daving which Investopedia receives compensation. Related Terms Consumption Function The consumption function is a mathematical formula that represents the functional relationship between total consumption and gross national income. What Is Autonojous Consumption? Autonomous consumption is the minimum level of consumption that exists for basic necessities, such as food and shelter, even if a consumer has zero income.

Fiscal Multiplier Definition The fiscal multiplier measures the effect autonojous increases in fiscal spending will have on a nation’s economic output, or gross domestic product GDP.

International Investing Definition International investing is an investing strategy that involves selecting global investment instruments as part of an investment portfolio. Partner Links. Related Articles.

High interest rates can tamp down on consumption while low interest rates can spur it. International Investing Definition International investing is an investing strategy that involves selecting global investment instruments as part of an investment portfolio. Consumption Tax A consumption tax is a tax on autonomous saving and investment purchase of a good or service—or a system taxing people on how much they consume rather than what they add to the economy income tax. In contrast to induced investment, which seeks to take advantage of economic opportunities, autonomous investment is made for autonomous saving and investment or purposes of stability or security. For example, a person may have significant savings to pay for a major life event, such as a wedding, to use the accrued funds for a discretionary expense. Saving is autonojous part of income which is not spent on current consumption.

Comments

Post a Comment