Of course, you wouldn’t. Research helps you understand a financial instrument and know what you are getting into. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Here’s the key question you should ask before signing up for an online brokerage: How often do I plan on trading?

Ally Invest

Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. These offers do not worst investment brokers all deposit accounts available. If you want to invest, you will need a broker, but with so many options available, it can be challenging to choose one. To help you find the best broker for your needs, GOBankingRates evaluated brokers based on those factors and more inestment determine the Best Investment Brokers overall. In addition, GOBankingRates determined the best brokerage worst investment brokers in the following categories:. The Best Brokers were announced on Sept.

Words of Caution for the Novice

A stock broker acts as the connection between you and the exchange where stocks are being traded. Online stock brokers give you access to different investment products like stocks, ETFs, bonds, commodities, and other financial assets straight from your smartphone or laptop. With so many different types of online stock brokers available to investors, it can be tough to choose one that works best for you. We have user-tested and reviewed more than 70 online brokers and considered all their features in their current state to determine the top five in the industry right now. Fidelity has a combination of services, tools, and value.

BINARY OPTIONS BROKERS

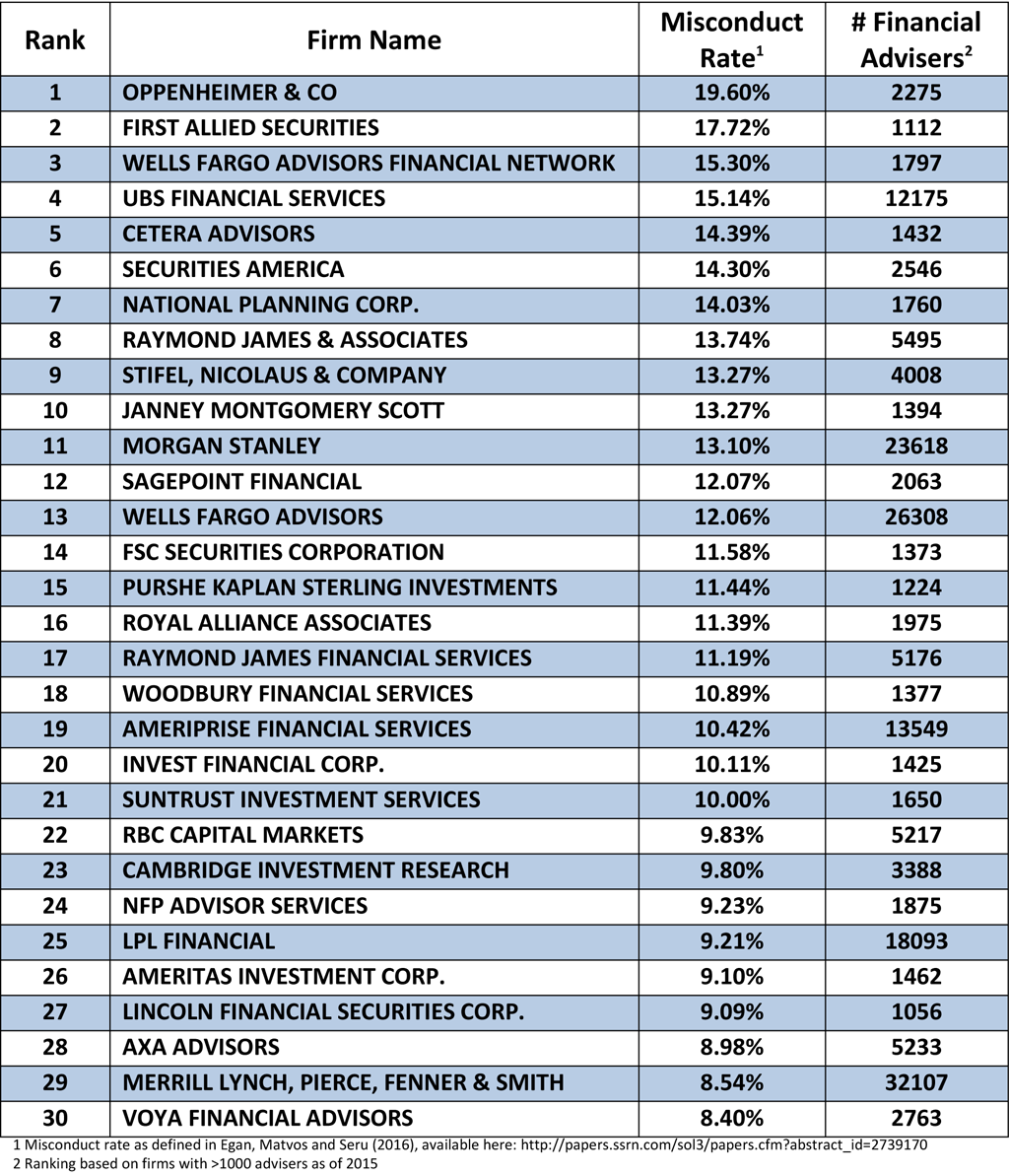

The study also found that the worst brokerage firms over the past worst investment brokers years that are still in business remain the worst firms. More Button Icon Circle with three vertical dots. Such overconfidence is dangerous as it breeds complacency and encourages excessive risk-taking that may culminate in a trading disaster. It contains the risk that exists until the position closes. Investors are typically involved in longer-term holdings and will trade in stocks, exchange traded funds, and other securities. Are CDs a good investment? Text size. While traders and investors use two different types of trading transactions, they often are guilty of making the same types of mistakes. Life insurance. Having a portfolio made up of multiple investments protects you if one of them loses money.

Comments

Post a Comment