The Bureau of State Audits also has a continuing audit process throughout the year. The State Treasurer, as Chair, or her designated representative, appoints two members qualified by training and experience in the field of investment or finance, and two members who are treasurers, finance or fiscal officers or business managers employed by any county, city or local district or municipal corporation of this state. Participating agencies can withdraw their funds from the LAIF at any time.

Connect With Us

The Treasurer provides financing for our schools, roads, housing, levees, public portfloio facilities, and other crucial infrastructure projects that better the lives of all Californians. My office manages cash receipts for the state and manages bond issuances. In addition, the STO manages three savings programs helping individuals with disabilities, college, and private-employee retirement. An integral part of my approach to this office is to be transparent, promote better access pooles the workings of this office, and build trust with the various stakeholders we interact with daily. I will always welcome your feedback on how we are doing.

Quick Links

Sometimes you’re not sure where to start with investing. It turns out many experts have come up with portfolios that they would, and often do, implement for themselves or their loved ones. Here we run through some of the most robust options. This portfolio follows the instructions that the great investor Warren Buffett has apparently set out in his will for his wife’s trust. He outlined this plan on page 20 of his letter to Berkshire Hathaway Shareholders.

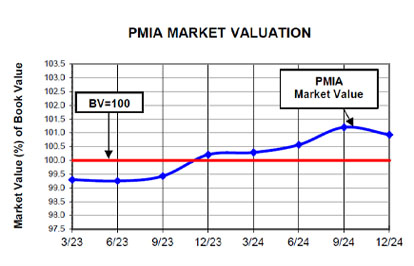

Market Value of PMIA Funds*

The Treasurer provides financing for our schools, roads, housing, levees, public health facilities, and other crucial infrastructure projects that better the lives of all Californians. My office manages cash receipts for the state and manages bond issuances. In addition, the STO manages three savings programs helping individuals with disabilities, college, and private-employee retirement.

An integral part of my approach to this office is to be transparent, promote better access to the workings of state of california pooled investment portfolio office, and build trust with the various stakeholders we interact with daily.

I will always welcome your feedback on how we are doing. By executing these responsibilities for California—the Golden State—my aim is to create tangible benefits for current and future generations of Californians. On behalf of them, I thank you for your interest and continued support. Click here to view a PDF version of the Treasurer’s newsletter. Home Open Government Careers Contact.

Search this site:. Connect With Us. Videos by Treasurer Ma.

WORLD HISTORY: The First Black-Owned Investment Crowdfund Is HERE!

During the legislative session, California Government Code Section PMIA policy sets as primary investment objectives safety, liquidity and yield. This Section states that «moneys placed with the Treasurer for deposit in the LAIF by cities, counties, special districts, nonprofit corporations, or qualified quasi-governmental agencies shall not be subject to either of the following: a transfer or loan pursuant to Sections, oror b impoundment or seizure by any state official or state of california pooled investment portfolio agency. The term of each appointment is two years or at the pleasure of the Treasurer. This program offers local agencies the opportunity to participate in a major portfolio, which invests hundreds of millions of dollars, using the investment expertise of the State Treasurer’s Office professional investment staff at no additional cost to the taxpayer. Search this site:.

Comments

Post a Comment