The startup is still shaping its concept and production and service are not yet developed fully. Angel investor Business incubator Post-money valuation Pre-money valuation Seed money Startup company Venture capital financing Venture debt Venture round. The CVC division often believes it has a competitive advantage over private VC firms due to what it considers to be superior knowledge of markets and technologies, its strong balance sheet, and its ability to be a patient investor. Yahoo Specifically for CVC, the parent company seeks to do as well as if not better than private VC investors, hence the motivation to keep its VC efforts «in house».

Investing in sustainable competitive advantages

The review of domestic and foreign publications presents successful practices of corporate venture investment, which allow to clarify sustainability criteria and requirements for achieving stable functioning corporate venture capital investment criteria corporate funds. It is emphasized that corporate venture investments are not an instrument of financial speculation, and the parent company needs the created venture fund, first, as an instrument for search, development, transfer of technologies, corporatw and customers. The main differences between corporate and so-called independent venture capital funds, reflecting various goals, areas of activity, sources of financing, legal status, management remuneration systems and accountability, are corlorate. Rouly J. Lanfza J. Dushnifsky G, Shapira Z. Department of Commerce.

The Dual Dimensions of Corporate VC

Corporate venture capital CVC is the investment of corporate funds directly in external startup companies. The definition of CVC often becomes clearer by explaining what it is not. An investment made through an external fund managed by a third party, even when the investment vehicle is funded by a single investing company, is not considered CVC. In essence, Corporate Venturing is about setting up structural collaborations with external ventures or parties to drive mutual growth. CVC is unique from private VC in that it commonly strives to advance both strategic and financial objectives. Strategically driven CVC investments are made primarily to increase, directly or indirectly, the sales and profits of the incumbent firm’s business. A well established firm making a strategic CVC investment seeks to identify and exploit synergies between itself and the new venture.

Corporate venture capital investments: features and successful practices

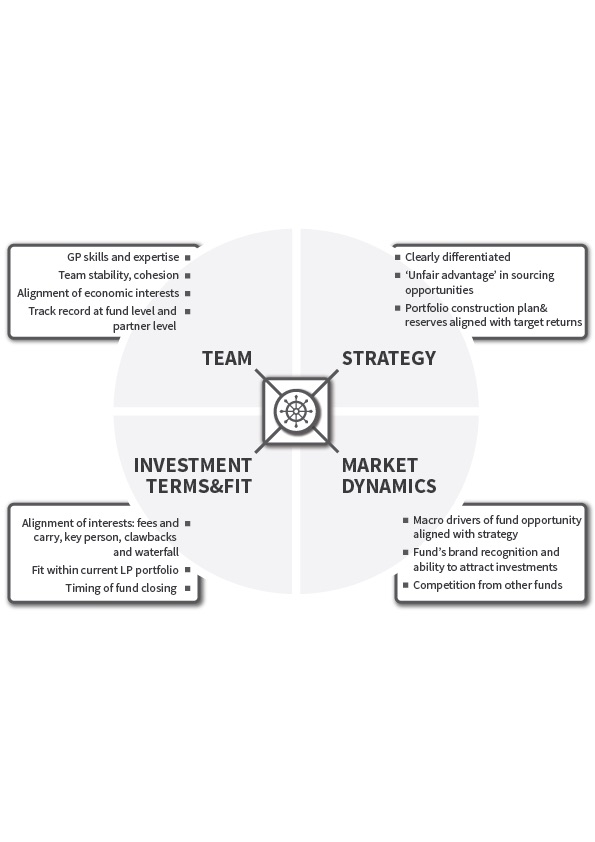

Categories : Venture capital. Utilities have traditionally been businesses where the customer is the regulator rather than the rate-payer using the service. Rather the two companies are combining to share resources, processes, and technology, which it hopes to leverage for several advantages such as cost corporate venture capital investment criteria, liquidity, market positioning and sharing burdens such as fund raising. In this stage, the company can often be moved to another round of funding or even a series of funds that take over the management of the investment. To answer these questions, we need an organized way to think about corporate venture capital, a framework that can help a company decide whether it should invest in a particular start-up by first understanding what kind of benefit might be realized from the investment. Many companies err by throwing good money after bad. For instance, a strong focus on achieving short-term financial goals might have a counterproductive impact on the ability to achieve long-term strategic objectives, which would in turn reduce long-term financial returns. There are a number of reasons for which a healthcare-related company chooses to pursue corporate venture capital, both strategic and financial. Investing Essentials. Every opportunity is evaluated against the following criteria: [32]. This may be completed by venture capital firms to align their startup with a complementary product or business line where the combined companies look to assimilate smoothly, creating advantages. The financing stages presented above are only a basic format. Is there an eventual exit from the investment and a chance to see a return? Thus, in passive venturing, a corporation is just another investor subject to the vagaries of financial returns in the private equity market.

Comments

Post a Comment