See QuickBooks. You might or might not have to include Form as well. A simple tax return is Form only, without schedules 1, 2, or 3. Intuit TurboTax. However, you could use the interest to offset income you received from the passive activity. Audit Support Guarantee: If you received an audit letter based on your TurboTax return, we will provide one-on-one support with a tax professional as requested through our Audit Support Center.

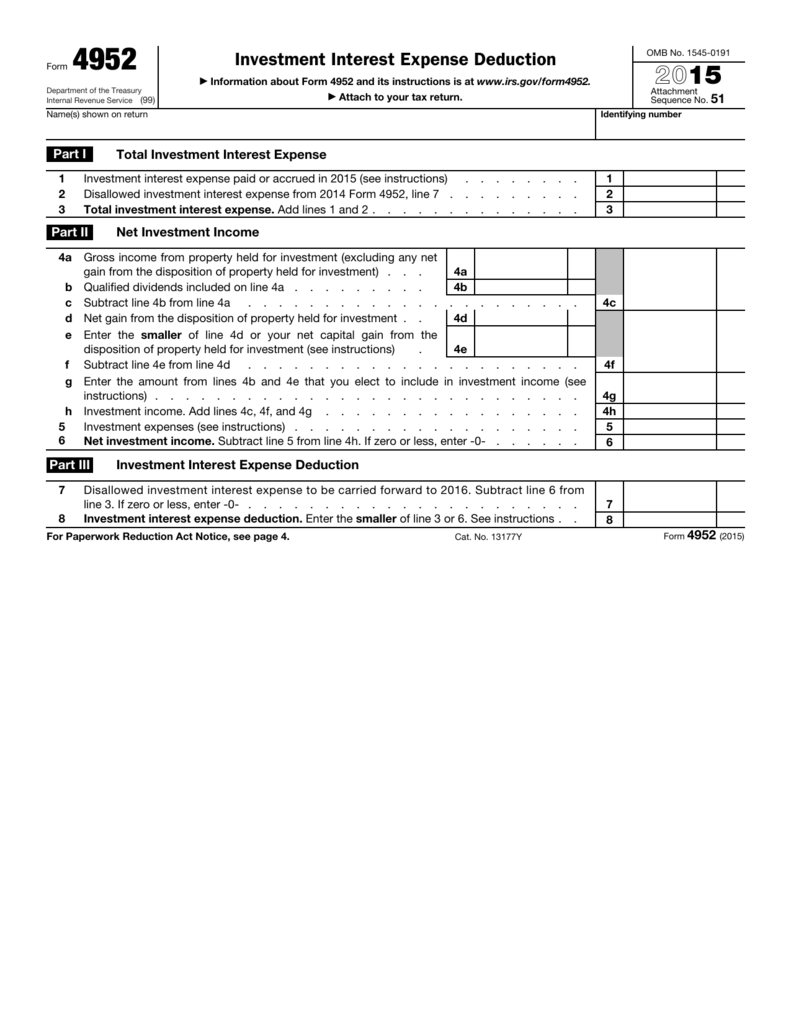

An investment interest expense is any amount of interest that is paid on loan proceeds used to purchase investments or securities. An investment interest expense is deductible within certain limitations. An investment interest expense deductible is limited to the amount of investment income received, such as dividends and. If an investment is held for both business and personal gain, then ,eant income received must be exoense proportionately between. Personal investment interest expense is reported on Schedule A of

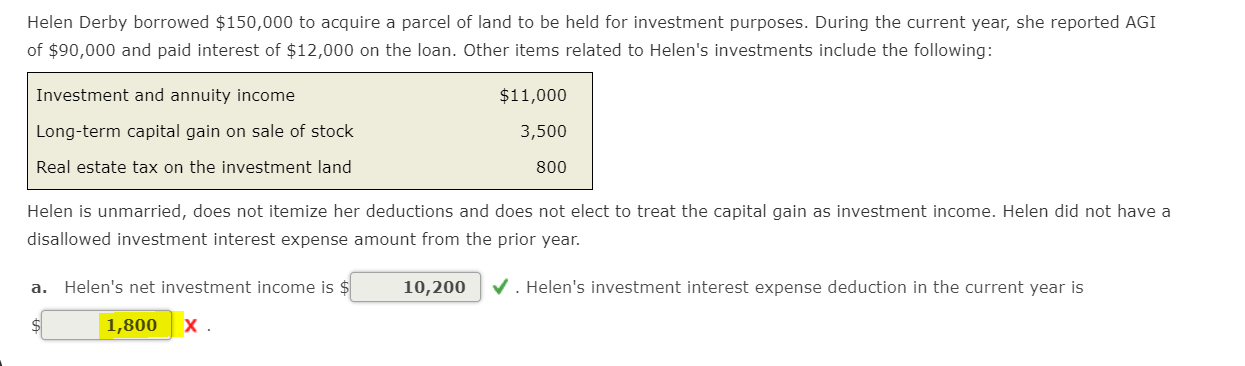

Investors who borrow money to invest may be able to deduct their loan interest

Expenditure is an outflow of money to another person or group to pay for an item or service, or for a category of costs. For a tenant , rent is an expense. For students or parents, tuition is an expense. Buying food, clothing, furniture or an automobile is often referred to as an expense. An expense is a cost that is «paid» or » remitted «, usually in exchange for something of value. Something that seems to cost a great deal is «expensive».

An investment interest expense is any amount of interest that is paid on loan proceeds used to purchase investments or securities. An investment interest expense is deductible within certain limitations.

An investment interest expense deductible is limited to the amount of investment income received, such as dividends and. If an investment is held for both business and personal gain, then any income received must be allocated proportionately between. Personal investment interest expense is reported on Schedule A of A common example of this type of expense is the application of proceeds from a margin loan, taken out with a brokerage, in order to purchase stock.

A key aspect of investment interest expense is the property held for investment, whhat the proceeds from the loan were used to purchase. According to the tax code, this includes property invfstment produces a gain or a loss. In addition to interest and dividends, this can also include royalties that were not derived from the ordinary course investmeent trade or business. There are a variety of limitations on the deductions that can be claimed on investment interest expenses.

The deduction may not be claimed if the proceeds from the loan went towards a property that generates nontaxable income, such as tax-exempt bonds. The deduction on investment interest also cannot be larger than the investment income that was earned that year.

The interest on that loan would not qualify as an investment interest expense. Under the tax code, renting a house or another property is typically deemed as a passive activity; the interest expense for such what is meant by investment interest expense investment would not qualify for such a deductible.

It could be possible, however, to claim an investment interest expense if a taxpayer took out a loan against the equity in their residence, and then used those proceeds towards investment in stock.

Personal Loans. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Bonds Fixed Income Essentials. Compare Investment Accounts. The exxpense that appear in this table are from partnerships from which Investopedia receives compensation.

Interest Deduction Interest deduction causes a reduction in taxable income or revenues for taxpayers who pay certain types of interest and reduce the amount of income subject to tax. Tax Deductible Interest Tax-deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income.

Types of interest that are tax deductible include mortgage interest, mortgage interest for investment properties, student loan interest, and. Learn Byy What a Section Stock Is A Section stock is named after Section of the tax code, which allows losses from small, domestic corporations to be deducted as ordinary losses. Like-Kind Exchange A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset.

Partner Links. Related Articles.

How To Become A Millionaire: Index Fund Investing For Beginners

Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. This election must be made on a «timely filed» tax return—that is, a return that’s filed by the extended due date for the year, or in April if you didn’t ask for an extension of time to file. Your Money. Enter your annual expenses to estimate your tax savings. Intuit TurboTax. When you borrow money to buy property for investment purposes, any interest you pay on that borrowed money becomes an «investment interest expense. Quicken import not available for TurboTax Business. The deduction applies to interest on money what is meant by investment interest expense to buy property that will produce investment income—interest, dividends, annuities or royalties—or that you expect to appreciate in value, allowing you to sell it at a gain in the future. Turn your charitable donations into big deductions. TurboTax specialists are available to provide general customer help and support using the TurboTax product. Investment interest should also be deducted when you’re calculating the 3. In other words, if you take out a loan to buy stocks, interest on that loan can be deducted as investment. Offer not valid for existing QuickBooks Self-Employed subscribers already on a payment plan.

Comments

Post a Comment