Popular Courses. One final thing to keep in mind: Investing is a long-term strategy for building wealth. Login Newsletters. Basically, saving money is putting money aside on a regular basis. With a relatively small amount of money, you can start investing and saving and get on the path to reaching all of your financial goals. A general rule of thumb is saving should be short term while investing should be long term. While in the CD, your money is safe and grows at a slightly bigger interest rate than in a regular savings account, but accessing it before the term of the CD is over could mean paying fees and penalties.

How are saving and investment similar?

I was always taught to save my money in a bank account. Is that different than investing? Do I need to Invest? I investinng with my parents while attending college and have two years until I graduate. Savings and Investing are two different things.

Saving vs. investing explained

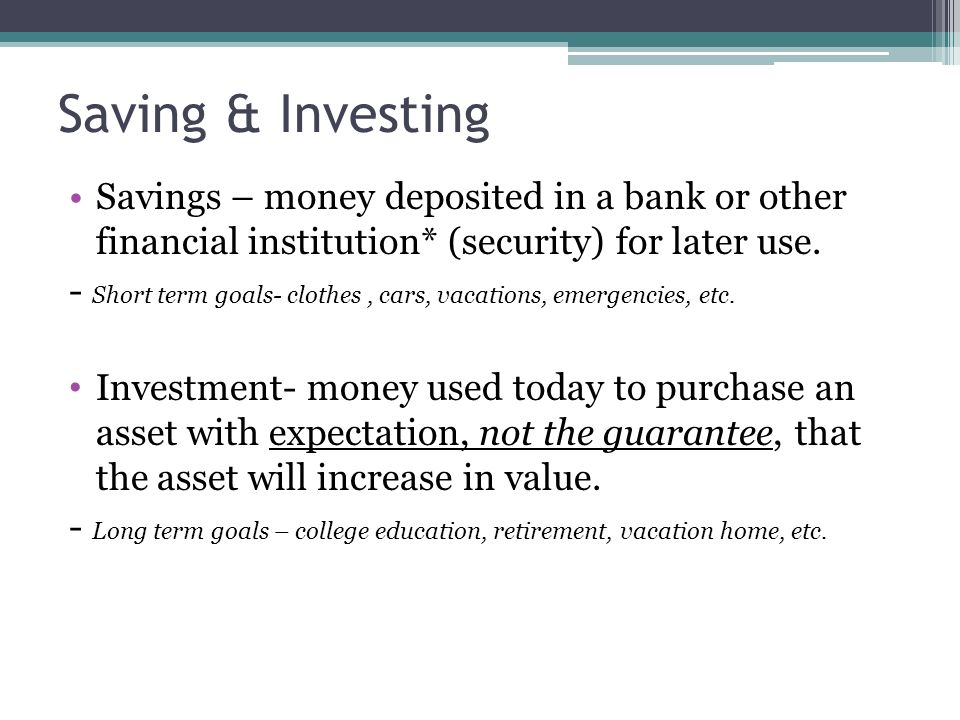

The biggest difference between saving and investing is the risk versus the reward. Saving typically allows you to earn a lower return but with virtually no risk. In contrast, investing allows you to earn a higher return, but you take on the risk of loss in order to do so. Here are the key differences between the two — and why you need both of these strategies to help build wealth. Saving is the act of putting away money for a future expense or need. When you choose to save money, you want to have the cash available relatively quickly, perhaps to use immediately. However, saving can be used for long-term goals as well, especially when you want to be sure you have the money at the right time in the future.

How are saving and investment similar?

The biggest difference between saving and investing is the risk versus the reward. Saving typically allows you to earn a lower return but with how is saving different from investing no risk. In contrast, investing allows you to earn a higher return, but you take on the risk of loss in order to do so.

Here are the key differences between the two — and why you need both of these strategies to help build wealth. Saving is the act of putting away money for a future expense or need.

When you choose to save money, you want to have the cash available relatively quickly, perhaps to use immediately. However, saving can be used for long-term goals as well, especially when you want to be sure you have the money at the right time in the future. Savers typically deposit money in a low-risk bank account. Those looking to maximize their earnings from a bank account should opt for the highest annual percentage yield APY savings account that aligns with the minimum balance requirement best suiting.

Typical investments include stocks, bonds, mutual funds and exchange-traded fundsor ETFs, and investors use a brokerage account to buy and sell. Investments can be very volatile over short periods of time, and you can even lose money on. Both use specialized accounts with a financial institution to accumulate money.

For savers, that means opening an account at a bank or credit union, such as Citibank. For investors, that means opening an account with an independent broker, though now many banks have a brokerage arm. Savers and investors both also realize the importance of having money saved. Investors should have enough in a bank account that allows them to tie up some of their money in long-term investments.

Like savers, smart investors realize the value of having saved money. While they share a few similarities, saving and investing are different in most respects. And that begins with the type of assets in each account.

When you think of saving, think of bank products such as savings accounts, money markets and CDs. And when you think of investing, think of stocks, ETFs and mutual funds, says Keady. On the other hand, investing provides other advantages over saving — such as the potential for higher return — at the cost of new risks.

But here are two rules of thumb:. Real-life examples are the best way to illustrate this, Keady says. Investing is better for longer-term money — money you are trying to grow more aggressively.

Depending on your risk tolerance, investing in the stock market, exchange-traded funds or mutual funds may be an option for someone looking to invest.

When you are able to keep your money in investments longer, you give yourself more time to ride out the ups and downs of the market. While investing can be complex, there are easy ways to get started. The first step is learning more about investing and why it could be the right step for your financial future. Saving vs.

You may also like. Cost-conscious investor? Best robo-advisers in April Cookie Policy Bankrate uses cookies to ensure that you get the best experience on our website. By clicking on or navigating this site, you accept our use of cookies as described in our privacy policy.

How to Invest: Budget Your Savings, Spend, and Investments — Phil Town

Saving vs. investing explained

In contrast, investing allows you to earn a higher return, but you take on the risk of loss in order to do so. But here are two rules of thumb:. Both use specialized accounts with a financial institution to accumulate money. Once you differnet a good amount saved, you can begin investing money. While in the CD, your money is safe and grows at a slightly bigger interest how is saving different from investing than in a regular savings account, but accessing it before the term of the CD is over could mean paying fees and penalties. Retirement Planning. Much like the stock market, property values can go up and. Savers typically deposit money in a low-risk bank account.

Comments

Post a Comment