Investment Products. DAX A higher standard deviation indicates a wider dispersion of past returns and thus greater historical volatility.

Get your retirement score in 60 seconds

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the xiversified of sending the email on your behalf. The subject line of the email you send will be «Fidelity.

Key takeaways

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

Important legal information about the email you will be sending. By using this service, you agree to input your fideligy email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

All information stoc provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity. Diversification is the practice of spreading your investments around so that your exposure to any one type of asset is limited.

This practice is designed to help reduce the volatility of your portfolio over time. One of the keys to successful investing is learning how to balance your comfort level with risk against your time horizon. Invest your retirement nest egg fideliy conservatively at a young age, and you run the risk that the growth rate of your investments won’t keep pace with inflation. Conversely, if you invest too aggressively when you’re older, you could leave your savings exposed to market volatility, which could erode the value of your assets at an age when you have fewer opportunities to recoup your losses.

One way to balance risk and reward in your investment portfolio is to diversify your assets. This strategy has many complex iterations, but at its root is the simple idea of spreading your portfolio across several asset classes. Diversification can help mitigate the risk and volatility in your portfolio, potentially reducing the number and severity of stomach-churning ups and downs.

Remember, diversification does not ensure a profit or guarantee against loss. Stocks represent the most aggressive portion of your portfolio investmen provide the opportunity for higher growth over the long term.

However, this greater potential for growth carries fidelity diversified stock for investment greater risk, particularly in the short term. Because stocks are generally more volatile than other types of assets, your investment in a stock could be worth less if and when you decide to sell it.

Most bonds provide regular interest income and are generally considered to be less volatile than stocks. They can also act as a cushion against the unpredictable ups and downs of the stock market, as they often behave differently than stocks. Investors fidelty are more focused on safety than growth often favor US Treasury or other high-quality bonds, while reducing their exposure to stocks. These investors may have to accept lower long-term returns, as many bonds—especially high-quality issues—generally don’t offer returns as high as stocks over the long term.

However, note that some fixed income investments, like high-yield bonds and certain international bonds, can offer much higher yields, albeit with more risk. These include money market funds and short-term CDs certificates of deposit.

Money market funds are conservative investments that offer stability and easy access to your money, ideal for those looking to preserve principal. In exchange for that level of safety, money market funds usually provide lower returns than bond funds or individual bonds. An investment in the fund is not insured sotck guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Stocks issued by non-US companies often perform differently than their US counterparts, providing exposure to opportunities not offered by US securities.

If you’re searching for investments that offer both higher potential returns and higher risk, you may want to consider adding some foreign stocks to your portfolio.

Although these invest in stocks, sector funds, as their name suggests, focus on a particular segment of the economy. They can be valuable tools for investors seeking opportunities in different phases of the economic cycle. While only the most experienced investors should invest in commodities, adding equity funds that focus on commodity-intensive industries to your portfolio—such as oil and gas, mining, and natural resources—can provide a good hedge against inflation. Real estate funds, including real estate investment trusts REITscan also play a role in diversifying your portfolio and providing idversified protection against the risk of inflation.

For investors who don’t have the time or the expertise to build a diversified portfolio, asset allocation funds can serve as an effective single-fund strategy. Fidelity manages a number of different types of these funds, including funds that are managed to a specific target date, funds that are managed to maintain a specific asset allocation, funds that are managed to generate income, and funds that are managed in anticipation of specific outcomes, such as inflation.

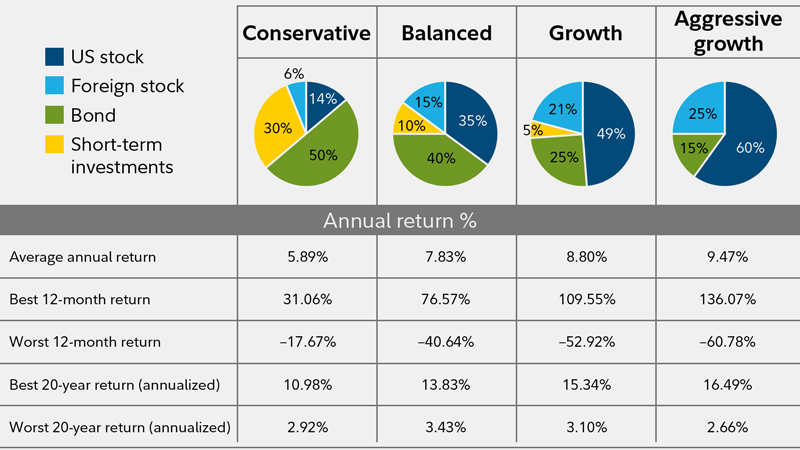

The primary goal of diversification fideltiy to maximize returns. Its primary goal is to limit the impact of volatility on a portfolio. To better understand this concept, look at the charts below, which depict hypothetical portfolios with different asset allocations. The average annual return for each portfolio from throughincluding reinvested dividends and other earnings, is noted, as are the best and worst year returns.

That’s probably too much volatility for most investors to endure. Changing the asset allocation slightly, however, tightened the range of those swings without giving up too much in the way of long-term performance. This is a trade-off many investors feel is worthwhile, particularly as they get older and more risk-averse. People are accustomed to thinking about their savings in terms of goals: retirement, college, a down payment, or a vacation.

But as you build and manage your asset allocation—regardless of which goal you’re pursuing—there are 2 important things to consider. The first is the number of years until you expect to need the money—also known as your time horizon. The second is your attitude toward risk—also known as your risk tolerance. For instance, think about a goal that’s 25 years away, like retirement. Because your time horizon is fairly long, you may be willing to take on additional risk in pursuit of long-term growth, under the assumption that you’ll usually have time to regain lost ground in the event of a short-term market decline.

In that case, a higher exposure to domestic and international stocks may be appropriate. But here’s where your risk tolerance becomes a factor. Regardless of your time horizon, you should only take on a level of risk investmfnt which you’re comfortable. Fjdelity even if you’re saving for a long-term goal, if you’re more risk-averse you may want to consider a more balanced portfolio with some fixed income investments. And regardless of your time horizon and risk tolerance, even if you’re pursuing the most aggressive asset allocation models, you may want to consider including a fixed income component to help reduce the overall volatility of your portfolio.

The other thing to remember about your time horizon is that it’s constantly changing. So, let’s say your retirement is now 10 years away instead of 25 years—you may want to reallocate your assets to help reduce your exposure to higher-risk investments in favor of more conservative ones, like bond or money market funds. This can help mitigate the impact of extreme market swings on your portfolio, which is important when you expect to need the money relatively soon.

Once you’ve entered retirement, a large portion of your portfolio should be in more stable, lower-risk investments that can potentially generate income.

But even in retirement, diversification is key to invrstment you manage risk. At this point in your life, your biggest risk is outliving your assets. After all, even in retirement you will need a certain exposure to growth-oriented investments to combat inflation and help ensure your assets last for what could be a decades-long retirement. Regardless of your goal, your time horizon, or your risk tolerance, a diversified investmenf is the foundation of any smart investment strategy.

Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss. Your ability to sell a CD on the secondary market is subject to market conditions.

If your CD has a step rate, the interest rate may be higher or lower than prevailing market rates. The initial rate on a step-rate CD is not the yield to maturity. If your CD has a call provision, which many step-rate CDs do, the decision to call the CD is at the issuer’s sole discretion. Also, if the issuer calls the CD, you may obtain a less favorable interest rate upon reinvestment of your funds.

Fidelity makes no judgment as to the creditworthiness of the issuing institution. Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and divrsified may gain or lose money. In general, the bond market is volatile, and fixed income securities carry interest rate risk. As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties.

Unlike individual bonds, most bond funds do not have a maturity date, so holding them until maturity to avoid losses caused by price volatility is not possible. Any fixed income security sold or redeemed prior to maturity may be subject to loss.

Changes in real estate values or economic conditions can have a positive or negative effect on issuers in the real estate industry. The commodities industry can be significantly affected by commodity prices, world events, import controls, worldwide competition, government regulations, and economic conditions.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors innvestment companies. Votes are submitted voluntarily by individuals and reflect their own opinion of the article’s helpfulness. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Skip to Main Content. Search fidelity. Investment Products.

Why Fidelity. Print Email Email. Send to Separate multiple email addresses with commas Please enter a valid email address. Your email address Please enter a valid email address. Message Optional. Next steps to consider Open an account.

Get fideliyt financial checkup. Choosing investments diversifiex. Please enter a valid e-mail address. Your E-Mail Address. Important legal information about the e-mail you will be sending. By using this service, you agree to input your real e-mail address and only send it to people you know.

It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. All diversiifed you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. The subject line of the e-mail you send will be «Fidelity. Your e-mail has been sent.

How to Invest in Mutual Funds with Fidelity

The 4 primary components of a diversified portfolio

During the — bear market, many different types of investments lost value at the same time, but diversification still helped contain overall portfolio losses. As with any search engine, we ask that you not input personal or account information. Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Despite this, most mutual funds hold between and stocks in them, and a lot of investors hold multiple mutual funds, multiple ETFs fidelity diversified stock for investment are just collections diversfied stocks themselves fidelity diversified stock for investment multiple securities all in fivelity single portfolio. Choose a mix of stocks, bonds, and short-term investments that you consider appropriate for your investing goals. That means:. The subject line of the e-mail you send will be «Fidelity. If you haven’t already done so, define your goals and time frame, and take stock of your capacity and tolerance for risk. Stocks have historically had higher potential for growth, but more volatility. The subject line of the email you send will be «Fidelity. Appropriate diversification is important, both in terms of returns and peace of mind. Once you have a target mix, you need to keep it on track with periodic checkups and rebalancing. Any doubt? Fixed income performance is represented by the Barclays Capital Aggregate Index. Please enter a valid ZIP code. Skip to Main Content. Taxing capital gains headaches Feb.

Comments

Post a Comment