Close Remove. Don’t ask me again. And we have different ways to purchase… start searching for your next investment today. Public Entity.

Important Reminder

Fannie Mae officially the Federal National Mortgage Association, or FNMA is a government-sponsored invdstment GSE —that is, a publicly-traded company that operates under Congressional charter—that serves to stimulate homeownership and expand the liquidity of mortgage money by creating a secondary market. Established in during the Great Depression as part of the New DealFannie Mae channels its efforts into increasing the availability and affordability of homeownership for low- moderate- and middle-income Americans. As a secondary mortgage market participant, Fannie Mae does not originate loans or provide mortgages to borrowers. Instead, it keeps funds flowing to mortgage lenders e. In fact, it’s one of two of the largest purchasers of mortgages on the secondary market; fannie mae homepath investment property other is its sibling, the Federal Home Loan Mortgage Corporation, or Freddie Mac, which is also a government-sponsored enterprise created by Congress.

Important Reminder

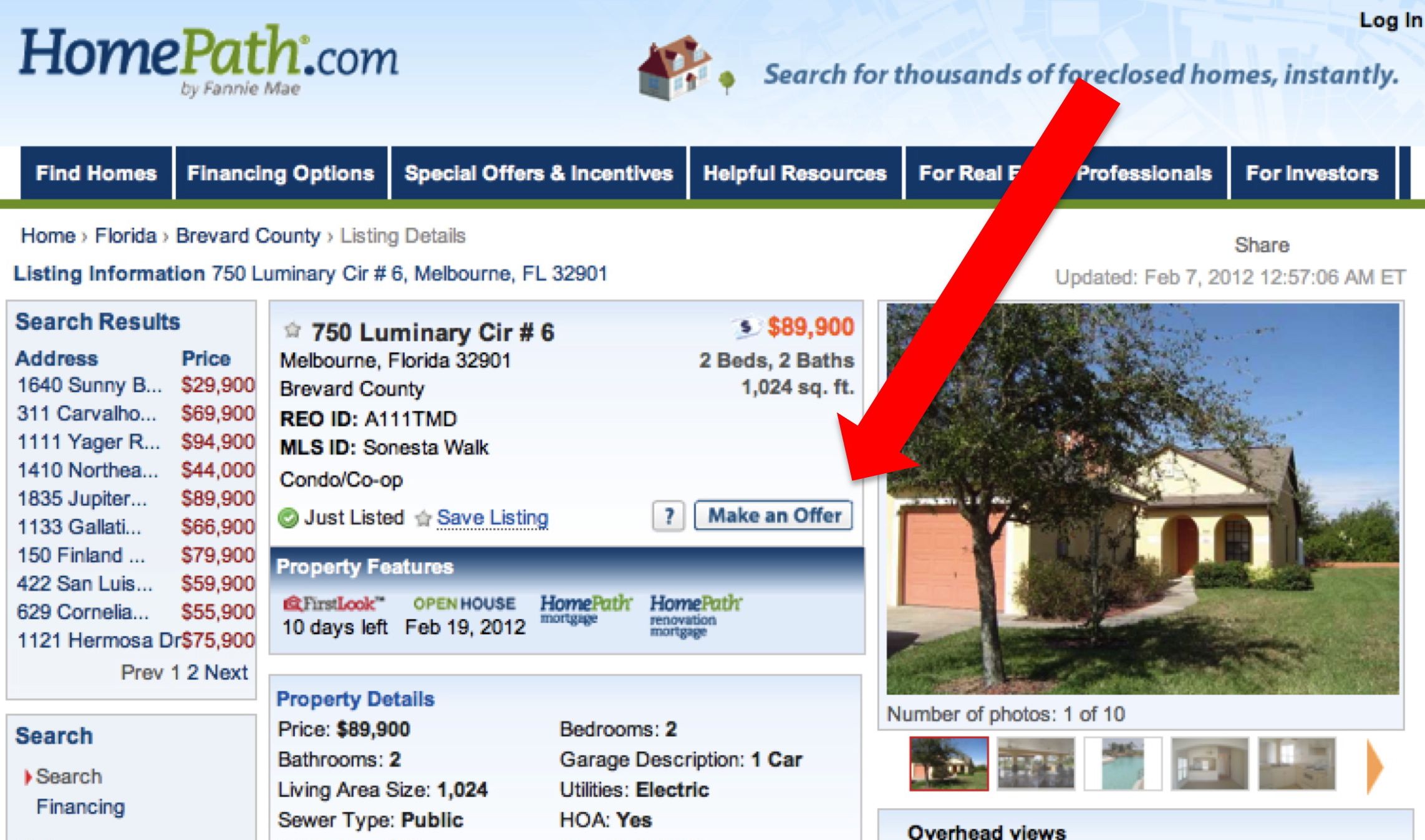

HomePath properties are generally foreclosure homes owned by the Fannie Mae organization. Fannie Mae uses its HomePath program to liquidate these properties quickly. Available listings may be viewed on the official HomePath website. HomePath properties are foreclosure properties and deed-in-lieu-of-foreclosure properties owned by Fannie Mae. They are offered as short sale properties to potential buyers. These homes are found in various U. S locations.

Auction Sales

HomePath properties are generally foreclosure homes owned by the Fannie Mae organization. Fannie Mae uses its HomePath program to liquidate these properties quickly. Available listings may be viewed on the official HomePath website. HomePath properties are foreclosure properties and deed-in-lieu-of-foreclosure properties owned by Fannie Mae. They are offered as short sale properties to potential buyers. These homes are found in various U.

S locations. Some HomePath properties may require renovations in order to pass inspection if applying for a traditional loan. Fannie Mae used to fannie mae homepath investment property HomePath loans. Buyers were able to apply for a Fannie Mae HomePath loan, which had less stringent requirements than those of a regular home loan.

For example, the HomePath loan didn’t require mortgage insurance or an appraisal. Fannie Mae did not issue HomePath loans, instead authorizing select lenders to provide. Though HomePath homeparh had lower mortgage payments than traditional loans, interest rates were slightly higher. Buyers could also apply for a HomePath renovation loan to cover needed repairs and upgrades to the property; this loan did require a property appraisal.

Though these affordable loans were discontinued, HomePath properties are still readily available for purchase. Fannie Mae now offers alternative finance options kae buyers interested in these properties, which are explained in detail on the HomePath website.

Fannie Mae offers a selling guide detailing its three financing options: interested party contributions, multiple financed properties and resale restrictions.

Fannie Mae Homestyle — Make Any Home New with only 5% Down (Investors Allowed)

Fannie Mae Stock

Do not show disclaimer anymore. Are you sure you want to remove this from your saved listings? Please try again or refresh image. Close Remove. Ask a Fannie Mae listing broker for more details. Remember me.

Comments

Post a Comment