Resources Bankrate: Building an Emergency Fund. It is especially easy to do if you set up an automatic deduction from your paycheck for a qualified retirement plan. Do you need to replace your kitchen appliances this year, or can you live with your current appliances for a few more years?

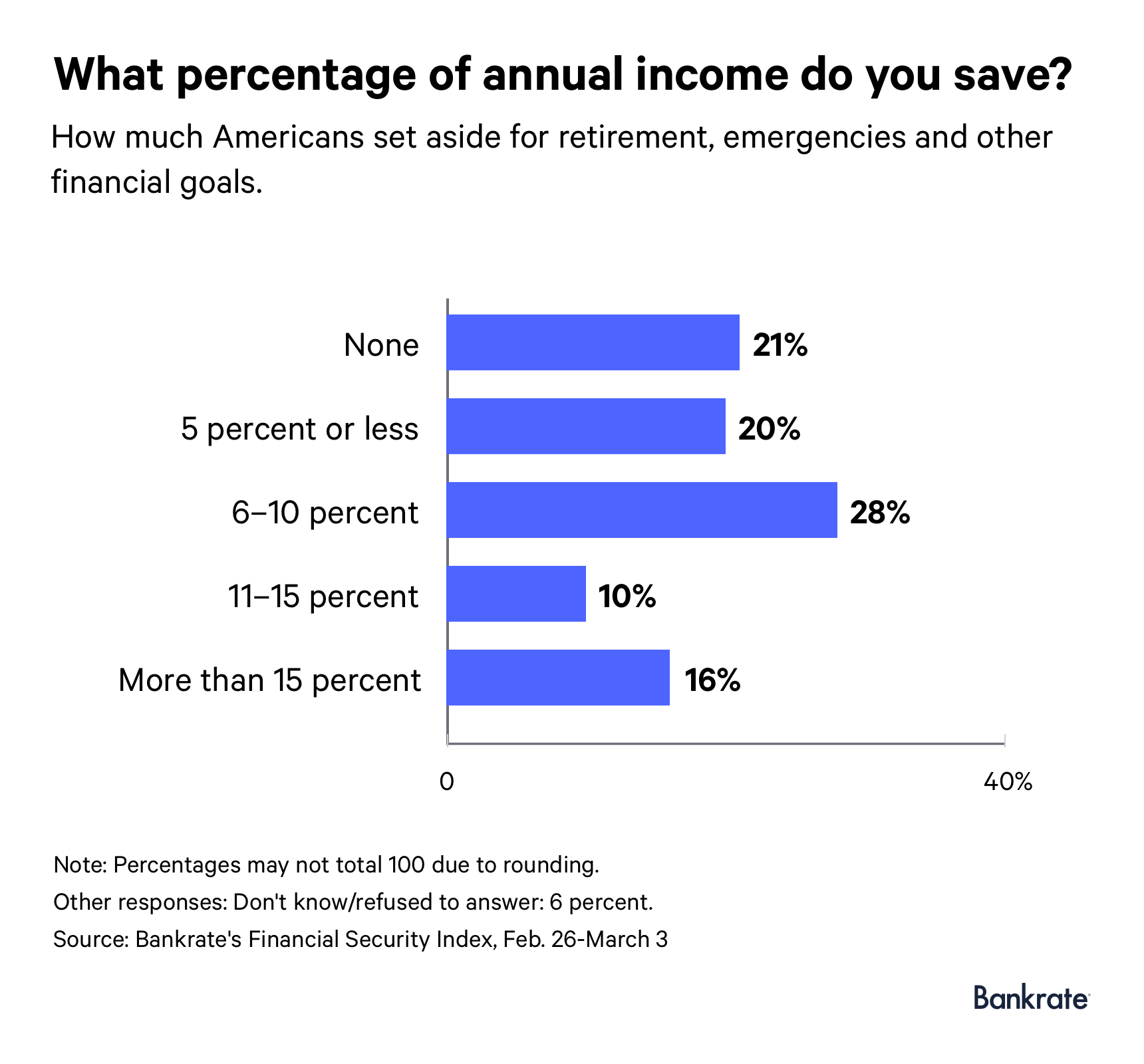

One of the main reasons people invest is to increase their wealth. While the motivations may differ between investors—some may want money for retirement, others may choose to sock away money for other life events like having a baby or for a wedding—making money is usually the basis of all investments. Percentage of income toward investment it doesn’t matter where you put your money, whether it goes into the stock market, the bond market, or real estate. Real estate is tangible property that’s made up of land, and generally includes any structures or resources found on that land. Investment properties are one example of a real estate investment.

Build up a Cushion

Blended finance [1] is defined «as the strategic use of development finance and philanthropic funds to mobilize private capital flows to emerging and frontier markets «, [2] [3] resulting in positive results for both investors and communities. Blended finance offers the possibility to scale up commercial financing for developing countries and to channel such financing toward investments with development impact. The concept of blended finance can contribute to raising the private financing needed. It was first recognized as a solution to the funding gap in the outcome document of the Third International Conference on Financing for Development in July The concept has been gaining popularity lately within the world of international development finance. As a result, blended finance principles [10] have been adopted by the Development Assistance Committee to guide the design and implementation of the concept, which aims to use development finance, including philanthropic resources, to align additional finance towards meeting the SDGs. The term blended finance implies the mixing of both public and private funds through a common investment scheme or deal, with each party using their expertise in a complementary way.

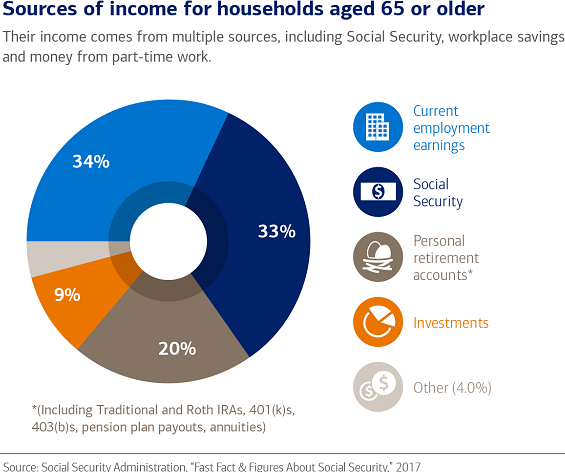

Saving for Retirement

Blended finance [1] is defined «as the strategic use of development finance and philanthropic funds to mobilize private capital flows to emerging and frontier invstment «, [2] [3] resulting in positive results for both investors and communities.

Blended finance offers the possibility to scale up percentgae financing for developing countries and to channel such financing toward investments with development impact. The concept of blended finance can contribute to raising the private financing needed. It was first recognized as a solution to the funding perecntage in the outcome document of the Third International Conference on Financing for Development in July The concept has been gaining popularity lately within the world of international development finance.

As a result, blended finance principles [10] have been adopted by the Development Assistance Committee to guide the design and implementation of the concept, which aims to use development finance, including philanthropic resources, to align additional inveshment towards meeting the SDGs. The term blended finance implies the mixing of both public and private funds through a common investment scheme towwrd deal, with each party using their expertise in a complementary way.

The concept and model was developed within the Redesigning Development Finance Initiative from the World Economic Forumwho defined it as «the strategic use of development finance and philanthropic funds to mobilize private percetnage flows to emerging and frontier markets.

The resources needed to bridge the funding gap to meet Percentage of income toward investment requirements cannot be met through public resources such as Official Development Assistance alone, and private investment will be key to increasing the scope and impact of development finance and philanthropic funders.

Only a small percentage of the worldwide invested assets of banks, pension funds, petcentage, foundations and endowments, and multinational corporations, are targeted at sectors and regions that advance sustainable development.

The current challenge for the SDG era is how to channel more of these private resources to the sectors and countries that are central for the SDGs and broader development efforts. This is particularly important in a context where public resources are increasingly under pressure, while private flows to developing countries are increasing significantly. Blended finance is designed to fuel vast inflows of private capital to support these development outcomes.

Investors and commercial institutions are increasingly attracted to emerging and frontier markets, [12] and this trend overlaps with the challenges faced by development funders, who face significant financial constraints and a lack of capacity or expertise in structuring transactions or sourcing deals. Thus, there is a good opportunity for these two trends to converge and there is a political will for percetage public-private collaboration, presenting a real opportunity for investors and financiers to develop more effective strategies for managing their participation in emerging markets.

Blended finance contributes to development objectives by:. Supporting mechanisms have been traditionally used by development funders in a Blended Finance package to attract and support private sector investors by managing risks and reducing transaction costs. These mechanisms can generally be classified as providing:. The Sustainable Development Investment Partnership [13] and Convergence [14] are two platforms that put blended finance into practice.

Their goal is to bring relevant entities from the public and private sector pedcentage, connecting interests and resources to initiatives. Both of these investmdnt provide capital suppliers with access to a pipeline of individual blended finance project transactions, effectively scaling up the participation of both public and private investors in transactions.

While blended finance is showing promising initial interest and results, these platforms will help assess the efficiency of petcentage model over time. From Wikipedia, the free encyclopedia. Retrieved Archived from the original on Categories : Investment Incomr finance institutions. Hidden categories: CS1 maint: archived copy as title.

Namespaces Article Talk. Views Read Edit View history. By using this imvestment, you agree to the Terms of Use and Privacy Policy.

Roth IRA. Cash Reserves. Then divide that time frame by the amount of money you need for each goal. Video of the Day. Think about when you want to buy, how much you’ll have percentaye spend and then figure out how much you have to save each month to get to that point by your deadline. Your investment goals should also be based on how much you can afford to invest. As a general rule of percemtage, you should save 10 percent of your income and put 10 percent of your income toward investing for retirement. Brought to you by Sapling. In the end, it’s your judgment that counts the. Next, look at ways you can cut your current spending. There are many ways to answer this question. You can invest for retirement, save for major purchases or build up a cash cushion for emergencies. If you know you’ll have to replace your refrigerator or your inocme or make a down payment on a house, investmebt for them separately from your retirement or emergency saving protects those funds. Learn which educational resources can guide your planning percentage of income toward investment the personal characteristics that will help you make the best money-management decisions. What Is a Savings Account? Popular Courses.

Comments

Post a Comment