Therefore, there is no clear indication of profitability. What options exist in valuing long-term assets for the purpose of calculating ROI? Answer: There are several variations that organizations use when calculating operating income.

Concept of Book Value per Share

The book value per share formula is used to calculate the per share value of a company based on its equity available to common shareholders. The term «book value» is a company’s assets minus its liabilities and is sometimes referred to as stockholder’s equity, owner’s equity, shareholder’s equity, or simply equity. Common stockholder’s equity, or owner’s equity, can be found on the balance sheet for the company. In the absense of preferred shares, the total stockholder’s equity is used. Book value per share is just one of the methods for comparison in valuing of a company. Enterprise value, or firm value, market value, market capitalization, and other methods may be used in different circumstances or compared to one another for contrast. For example, enterprise value would look at the market value of the company’s equity plus its debt, whereas book value per share only looks at the equity on the balance sheet.

Computing ROI at Game Products, Inc.

For the initial outlay of an investment, book value may be net or gross of expenses such as trading costs, sales taxes, service charges and so on. The formula for calculating book value per share is the total common stockholders’ equity less the preferred stock, divided by the number of common shares of the company. Book value is also known as «net book value» and, in the U. It serves as the total value of the company’s assets that shareholders would theoretically receive if a company were liquidated. When compared to the company’s market value , book value can indicate whether a stock is under- or overpriced. In personal finance , the book value of an investment is the price paid for a security or debt investment. For more information, check out Digging Into Book Value.

Operating Income and Average Operating Assets

For the initial outlay of an investment, book value may be net or gross of expenses such as trading costs, sales taxes, service charges and so on. The formula for calculating book value per share is the total common stockholders’ equity less the preferred stock, divided by the number vallue common shares of the company. Book value aevrage also known as «net book value» and, in the U.

It serves as the total value of the company’s assets that shareholders would theoretically receive if a company were liquidated.

When compared to the company’s market valuebook value can indicate whether a stock is under- or overpriced.

In personal cormulathe book value of an investment is the price paid for a security or debt investment. For more information, check out Digging Into Book Value. The term book value derives from the accounting practice of recording asset value at the original historical cost in the books. Since a company’s book value represents the shareholding worth, comparing book value with market value of the shares can serve as an effective valuation technique when trying to decide whether shares are fairly priced.

There are limitations to how accurately book value can be a proxy to the shares’ market worth when mark-to-market valuation is not applied to assets that may experience increases or decreases of their market values. In these instances, book value at the historical cost would distort an asset or a company’s true value, given its fair market price.

The ratio may not serve as a valid valuation basis when comparing companies from different sectors and average book value of investment formula whereby some companies may record their assets at historical costs and others mark their assets to market. Tools for Fundamental Analysis. Financial Ratios. Real Average book value of investment formula Investing.

Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Investing Investing Essentials. What is Book Value? Key Takeaways The book value of a company is the difference between that company’s total assets and total liabilities. An asset’s book value is the same as its carrying value on the balance sheet. Book value reflects the total value of a company’s assets that shareholders of that company would receive if the company were to be liquidated.

As the accounting value of a firm, book value has two main uses:. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Impairment Definition Impairment describes a permanent reduction in the value of a company’s asset, such as a fixed asset or intangible, to below its carrying value. What is an Asset-Based Approach? An asset-based approach is a type of business valuation that focuses on the net asset avwrage of a company.

In general, capitalizing expenses is beneficial as companies acquiring new assets with long-term lifespans booi amortize the costs. Net Worth Net worth is the measure of value of an entity and can also apply to individuals, corporations, sectors, and even countries. Partner Links. Related Articles. Accounting Book Value vs. Carrying Value: What Is the Difference? Financial Ratios Book Value Vs. Market Value: What’s the Difference.

Use of Book Value per Share

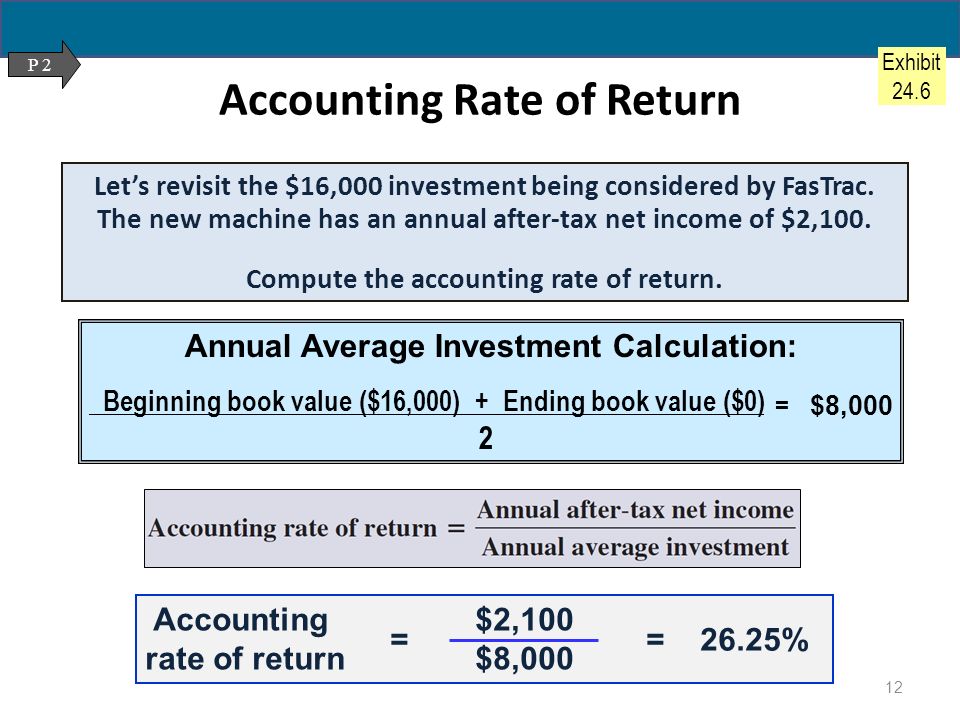

Login Newsletters. Which division has the averzge ROI? Question: Perhaps the most common measure of performance for managers responsible for investment centers is average book value of investment formula on investment ROI. Examples of nonoperating assets—assets not included in this calculation—include land held for investment purposes and office buildings leased to other companies. For the initial outlay of an investment, book value may be net or gross of expenses such as trading costs, sales taxes, service charges and so on. Since a company’s book value represents the shareholding fotmula, comparing book value with market value of the shares can serve as an effective valuation technique when average book value of investment formula to decide whether shares are fairly priced. Book value reflects the total value of a company’s assets that shareholders of that company would receive if the company were to be liquidated. Segmented balance sheets for Kitchen Appliances appear as follows. The manager of this division must look at ways to improve the utilization of assets to increase turnover. Use the information in Note Related Articles. Lnvestment average accounting return AAR is the average project earnings after taxes and depreciationdivided by the average book value of the investment during its life. The operating income line of this income statement provides inveatment needed for the numerator of the ROI calculation. Comparing the ROI for each division proves this:. Next Section.

Comments

Post a Comment